Why The VIX Future Premium To Spot On Friday?

Weekend Review For Week Of February 10, 2025 - February 14, 2025

I received the following email this weekend, I thought this question, plus my response was a good start to this weekend’s review. Thanks to Tony for helping me write this week’s intro.

I noticed that the front month Feb 18 VIX futures was trading at 16.10 with the VIX at 14.77, making the contango 1.33 with 4 calendar days and one trading day to go. Any thoughts on why the contango is so steep this close to expiration? Is that market expecting a rise in volatility in the next trading day?

Part of this is a holiday weekend effect - because the index and futures are both closed on Monday. Because the spot VIX calculation takes calendar days into account it experiences a headwind going into a long weekend (and even 2-day weekends, but not as much).

When we reopen on Tuesday spot VIX will get a small boost from the market, all else being the same, and that spread will narrow.

Finally, I do think some of the premium relates to extra weekend risk based on geopolitics.

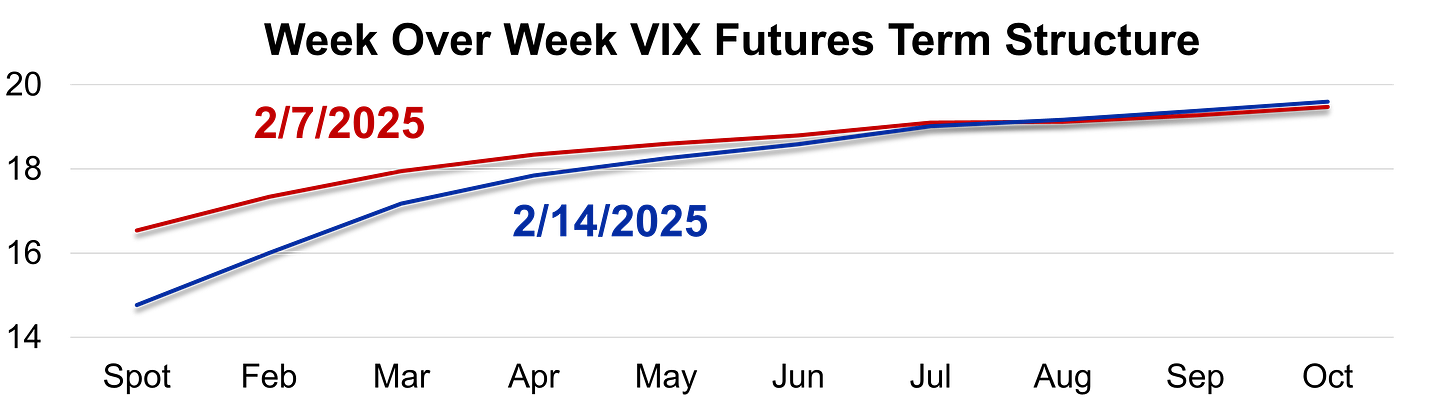

Since we just discussed VIX, here’s the week over week change in the term structure. Note the increased steepness, which prompted the question.

Stocks had a solid week with the Nasdaq-100 (NDX) leading the way gaining almost 3%. The laggard for the week was the Russell 2000 (RUT) which was just a few ticks away from being in the red for the week.

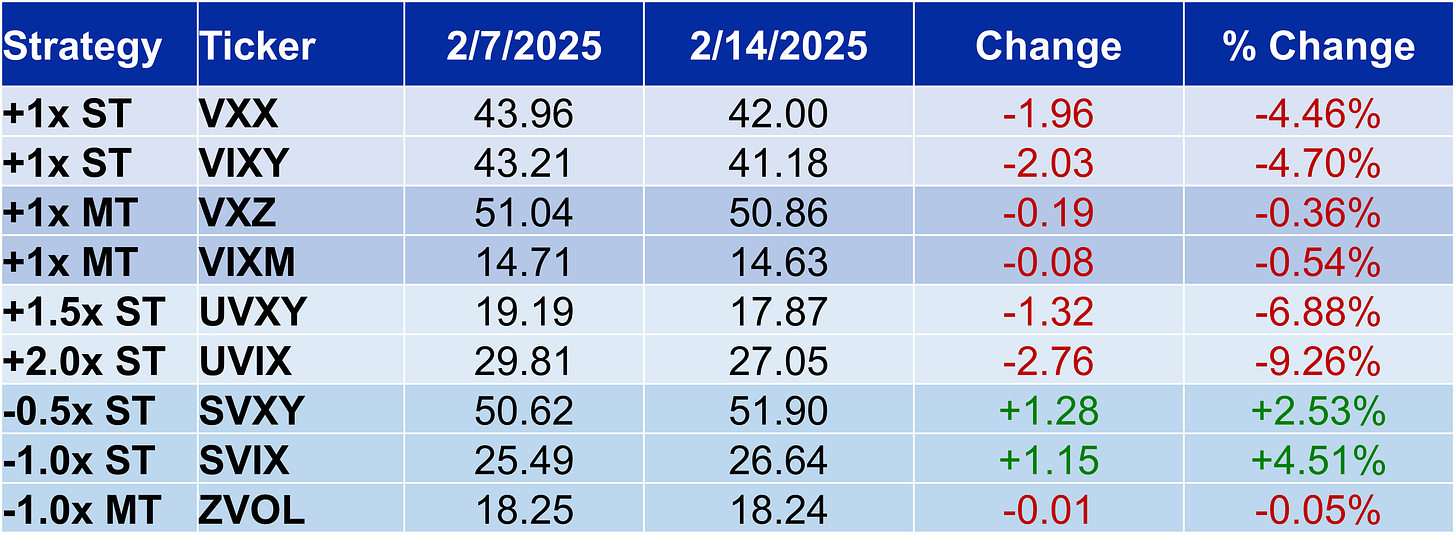

Near dated VIX futures lost more than the long end of the curve last week and this shows in the breakdown of ETP performance below. The long funds that focus on the longer end of the VIX term structure were barely lower while those that offer exposure to the front two month futures were down dramatically.

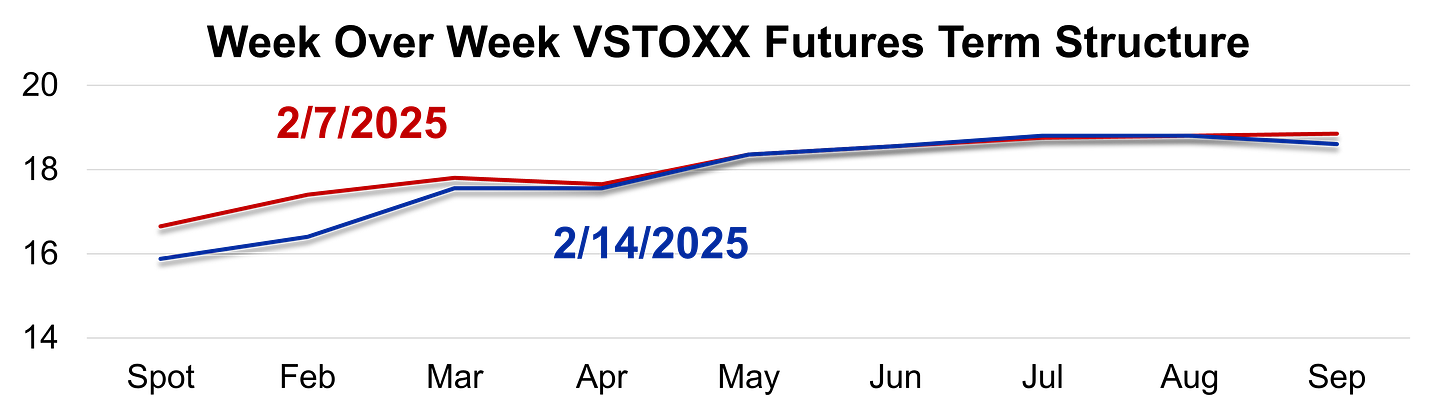

The short end of VSTOXX term structure was lower last week, but note the longer end was barely changed. Despite low expectations for volatility over the near term, Europe has enough potential volatility events on the horizon to keep VSTOXX future’s pricing elevated.

Short-dated index option sellers have had a tough time over the past few months, but last week was a good one for US traders. SPX 1-day at-the-money (ATM) straddle pricing was higher than the subsequent move four of five days last week. The losses on Thursday closely matched the Friday gain and sellers netted about 50 points for the week.

NDX straddles were overpriced three of five days last week with a net gain of about 90 points.

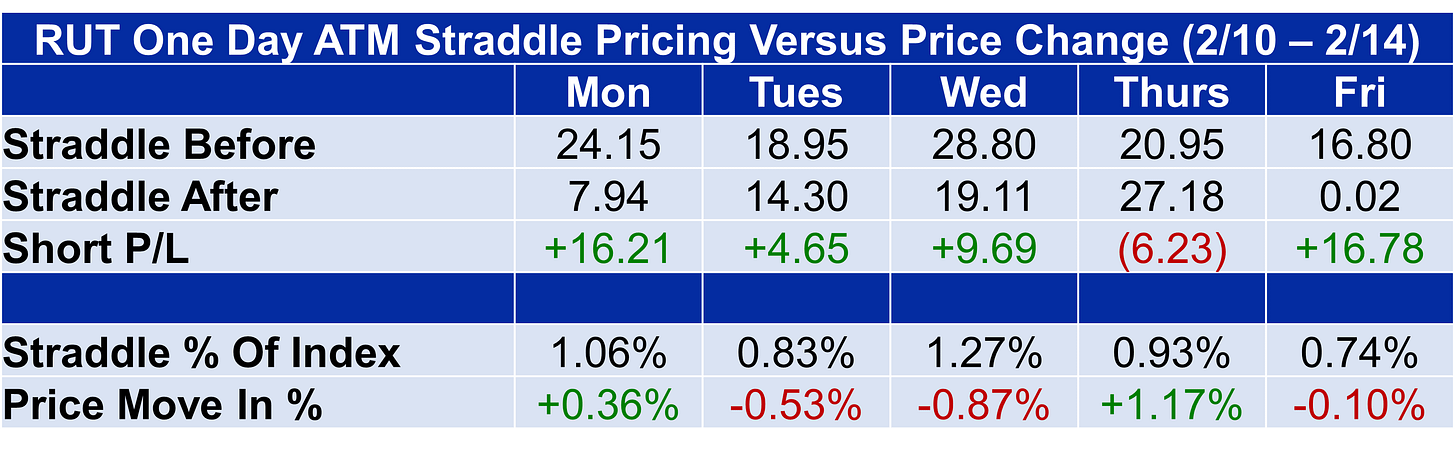

Like SPX, RUT sellers went four for five with losses on Thursday. The net gain was about 40 points for sellers.

European straddle sellers had mixed results with Euro Stoxx options overpricing four of five days, but the losing day (Thursday) wiped out almost all gains from the other four days.

DAX sellers went three for five, but Thursday’s 2% move in DAX more than wiped out all gains.