VIX Weekly Trade Hits The Settlement Bullseye

Weekend Review For Week Of March 3, 2025 - March 7, 2025

One of my weekly duties involves appearing on Vol Views on the Options Insider Network where I review trades using non-standard or weekly VIX options. Each week there are usually a handful of trades that appear to be targeting expiration, specifically that the settlement level will be lower than where the future is quoted. However, late Tuesday with VIX at 22.08 and the March 5th VIX future at 22.00 a trader sold 200 of the VIX Mar 5th 24 Puts @ 2.57 each.

VIX futures and options are AM settled and March 5th VIX settlement came in at exactly 24.00. The outcome for the seller of the 24 puts was a profit equal to the credit received when selling the options. Note, this trade would profit with VIX settlement anywhere above 21.43.

Last week was a tough one for US stocks with the Russell 2000 (RUT) leading to the downside giving up more than 4%. Both the S&P 500 (SPX) and Nasdaq-100 (NDX) were down a bit more than 3%. Volatility expectations were higher in both the US and Europe with all volatility indices rising more than 10%.

The VIX term structure shifted higher across the board moving from backwardation on the very short end to backwardation across the the whole curve.

The VIX-related ETPs performed as expected with UVIX moving higher by almost 24%. SVIX was the laggard for the week, dropping almost 14%.

VSTOXX was in slight contango a week ago, moving to backwardation last week, despite the Euro Stoxx 50 moving slightly higher on the week.

Straddle sellers suffered from high volatility last week. Starting with SPX straddles, there were substantial losses on Monday and Thursday. Some of that loss was made up due to the relatively high price of the straddle that expired on the close Friday.

NDX straddle pricing was higher than the resulting move three of five days last week, but the cumulative result was a loss of around 20 points for straddle sellers.

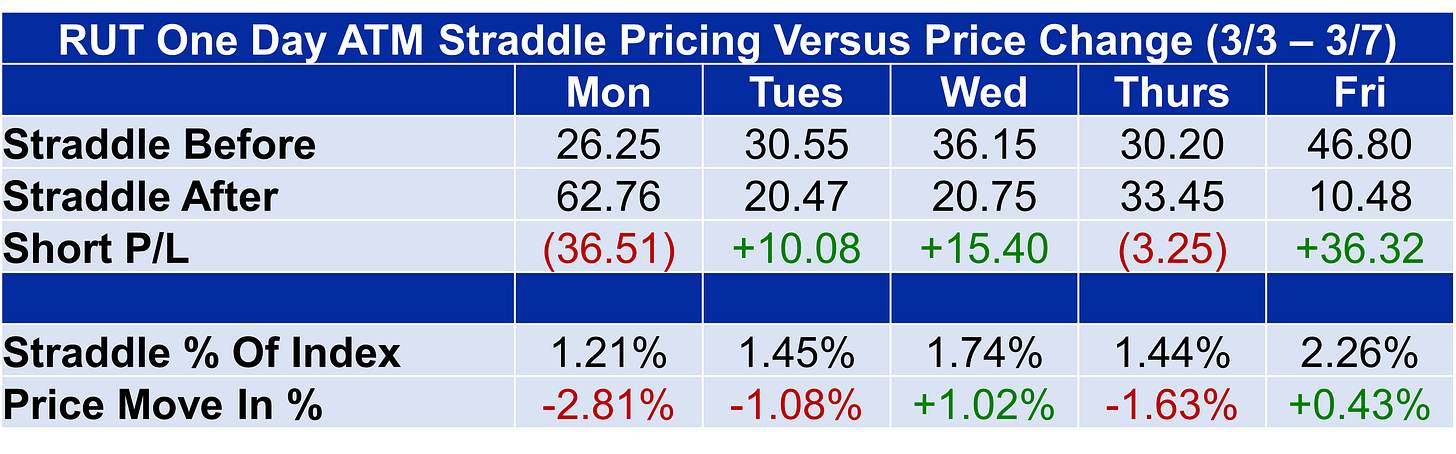

RUT straddles were the only market that overpriced resulting moves enough to provide a net profit to sellers.

Euro Stoxx 50 sellers netted losses of over 100 points last week, mostly due to an almost 3% drop on Tuesday.

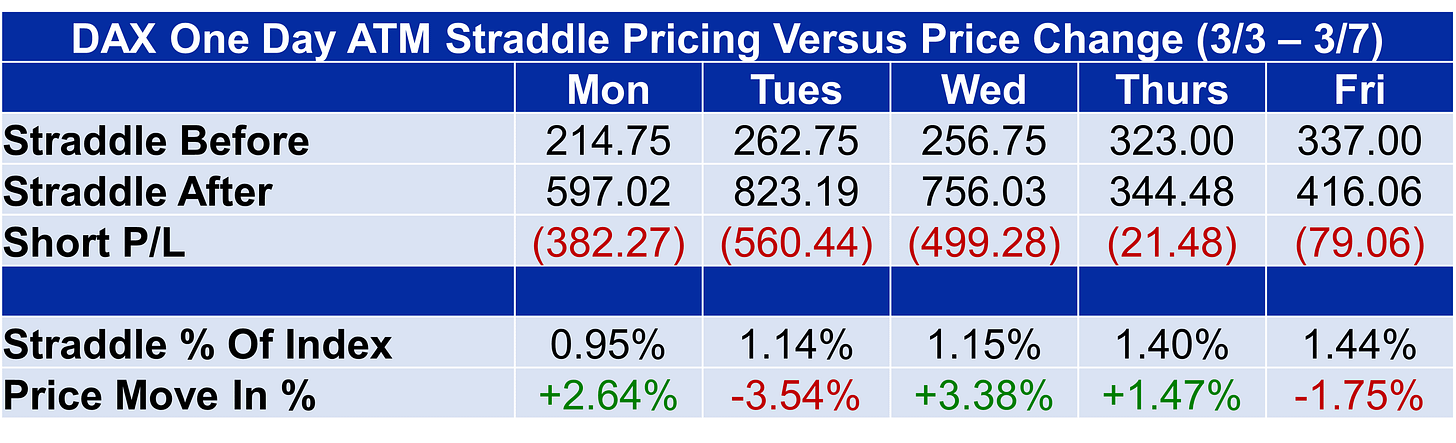

Finally, the worst is saved for last with DAX straddles underpricing all five days last week.