VIX Trades Into Settlement Using Weekly Options

Weekend Review For Week of December 2, 2024 - December 6, 2024

When I worked for The Options Institute at Cboe I would often discourage traders from holding VIX option positions into AM settlement. Overnight news can result in a big difference between where VIX closed the evening before settlement and the VIX settlement calculation that is quoted using the ticker VRO. For example, this past week, Wednesday’s VRO came in at 12.97 versus the previous day’s close of 13.30. A trader that owned a VIX Dec 4th 13 Call on the close Tuesday had an option that was 0.30 in the money that settled out of the money.

This leads to a couple of trades that appear to be based on holding through the close. First, this past week, there was a buyer of 1750 VIX Dec 4th 13.50 Puts the day before settlement that paid between 0.05 and 0.16 for those options. The average price for those transactions was 0.13. These trades were opening trades and were held through Wednesday’ VIX settlement of 12.97, resulting in a profit of 0.40 for this one-day trade.

Another trade using VIX weeklys that may be held through expiration next week hit the tape on Friday using the Dec 11th options. With VIX at 12.75, a trader purchased 100 of the VIX Dec 11th 13.50 Puts for 0.21. The payoff diagram below shows why this is a smart trade.

VIX options are best priced off the underlying future but settle into a calculation that is like how the index is calculated. When VIX futures are at enough of a premium, opportunities like the put purchase illustrated above present themselves. In this case, if the trade is held to expiration, a profit is realized with VRO below 13.29. If December 11 VRO comes in at 12.75, where VIX was when the trade was executed, the profit is 0.54.

The equity markets were mixed last week with the S&P 500 (SPX), Nasdaq-100 (NDX), and Euro Stoxx 50 (SX5E) all putting up strong numbers and leaving the Russell 2000 (RUT) in the dust. RUT performed very well after the first election of Donald Trump, and it was up 5.84% the day after the election. However, since then RUT has not matched the strong outperformance, we saw in 2016.

The VIX term structure week over week change was mixed with Spot VIX and December moving slightly lower and the longer dated futures moving up.

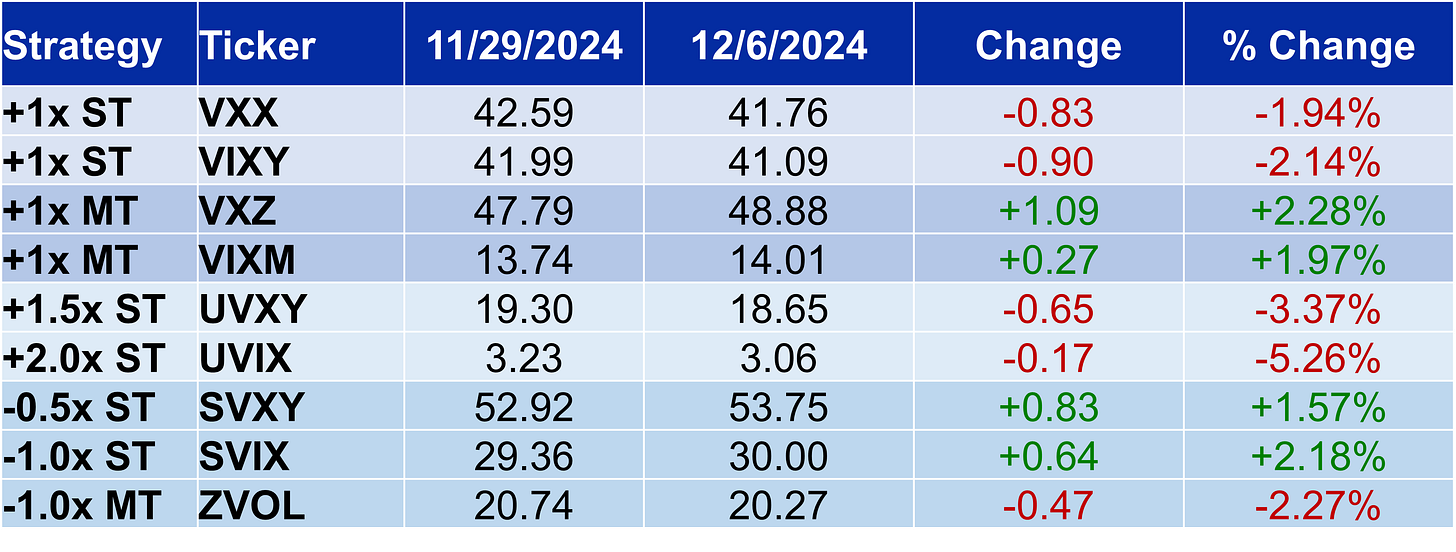

The VIX activity last week had an interesting impact on the VIX ETPs. The short-dated long funds and long dated short funds lost value last week, while short-dated short funds and long-dated long funds were higher. This activity seems to occur every couple of months or so.

The VSTOXX term structure change was also slightly mixed last week with longer dated futures rising and the short end of the curve moving significantly lower.

Index option sellers had a decent week using SPX options, but other markets were not as generous. In the SPX market, sellers realized profits four of five days, with Wednesday’s result being the sold tough day.

NDX was more volatile than SPX and this shows up in the results below with three of five days realizing losses that were worse than the two profitable days.

Straddle sellers in the RUT arena had a couple of tough days, but the week was a net profit.

SX5E option sellers experienced losses two of five days, but the two losing days were both much worse than gains realized the other three days.

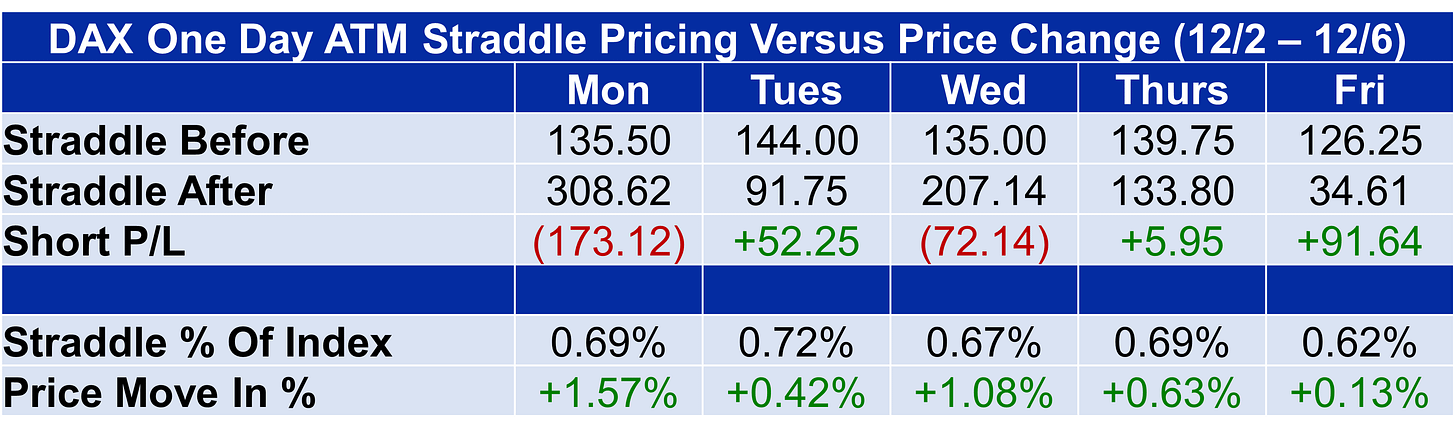

Finally, DAX option sellers also realized a net loss last week, despite three of five days resulting in gains.