VIX Term Structure Starting To Exhibit Historical Normalcy

Weekend Review for Week of May 26, 2025 to May 30, 2025

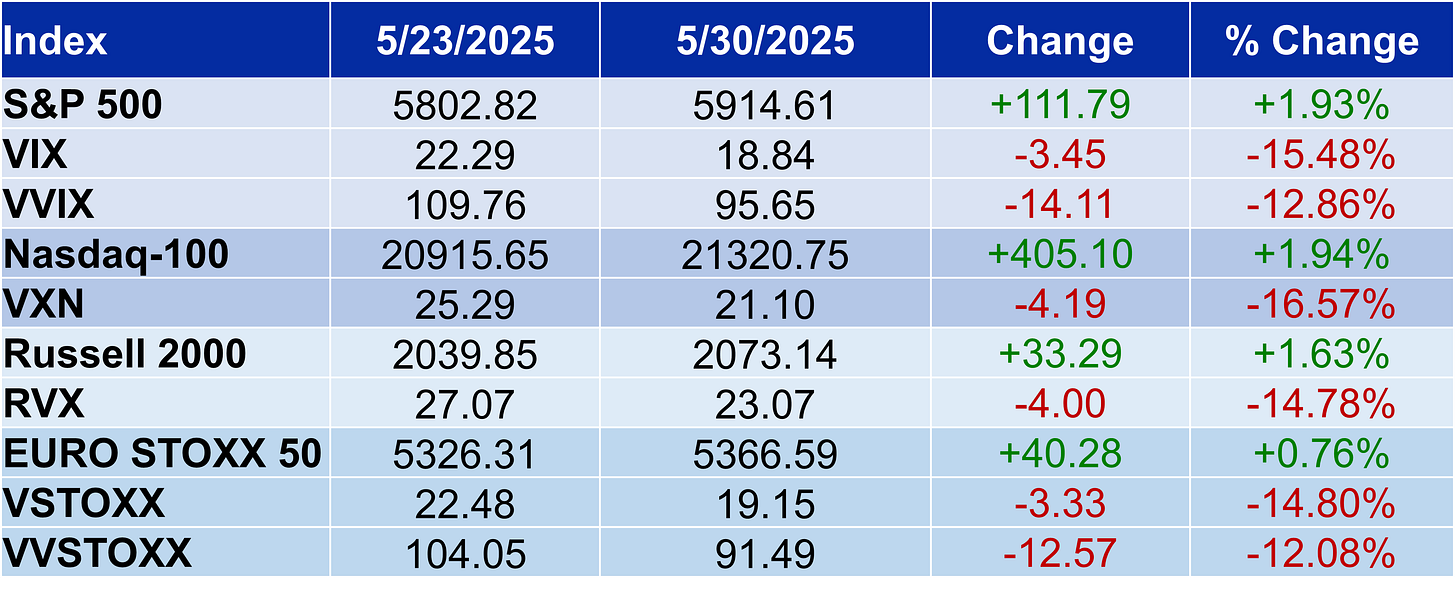

Stocks rebounded last week with all three US indices higher. In a photo finish, the Nasdaq-100 (NDX) led the way gaining 1.94% followed by the S&P 500 (SPX) which was up by 1.93%. The Russell 2000 (RUT) lagged slightly, rising 1.63%. VIX closed at the low of the day Friday, giving up almost three and a half points last week.

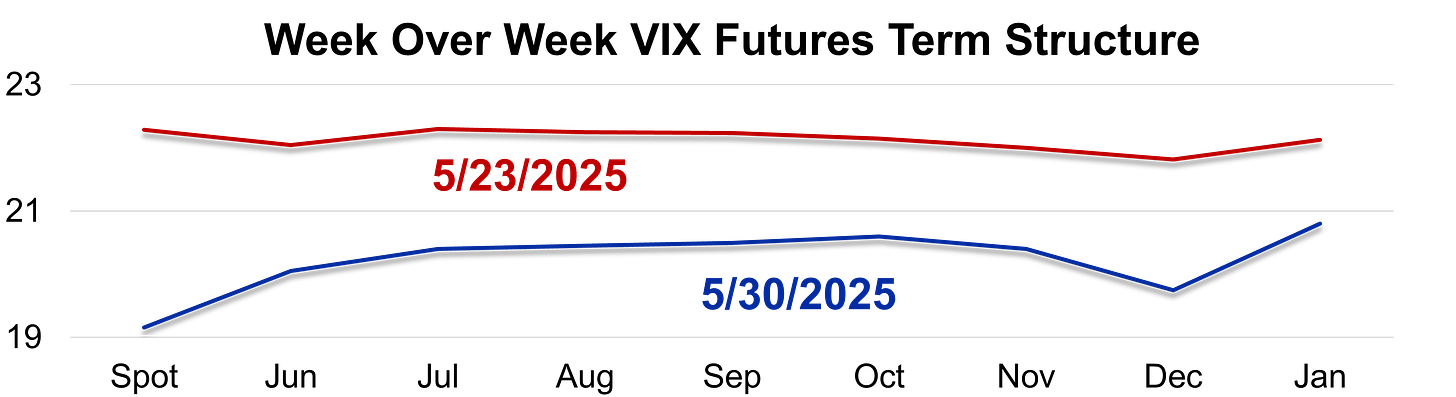

The VIX term structure finished the week in contango (when considering spot through the October contract) from flat a week ago. Higher volatility, like we are experiencing in 2025, usually leads to inverted or flat term structures for VIX. However, as market uncertainty has started to subside, the curve has been finishing the day in contango a bit more often.

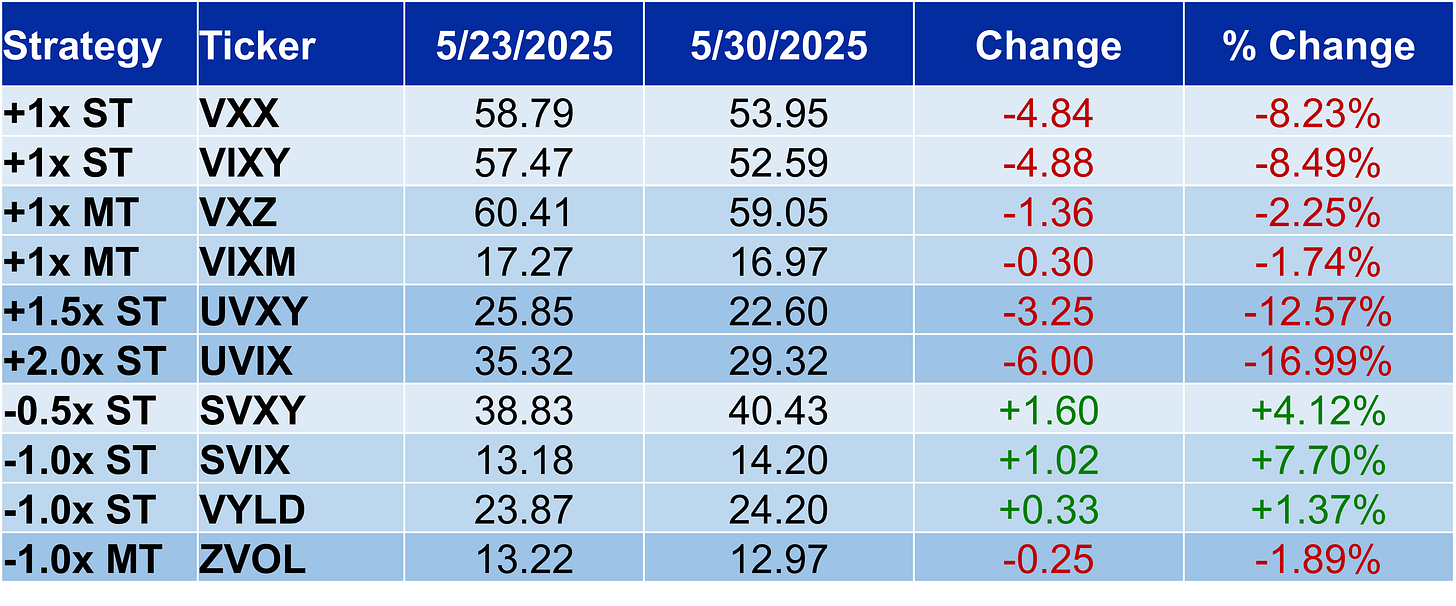

All the long-focused VIX-related ETPs lost value last week with UVIX leading the way lower by 16.99%. As would be expected during a parallel shift lower in the curve, SVIX was the big winner for the week.

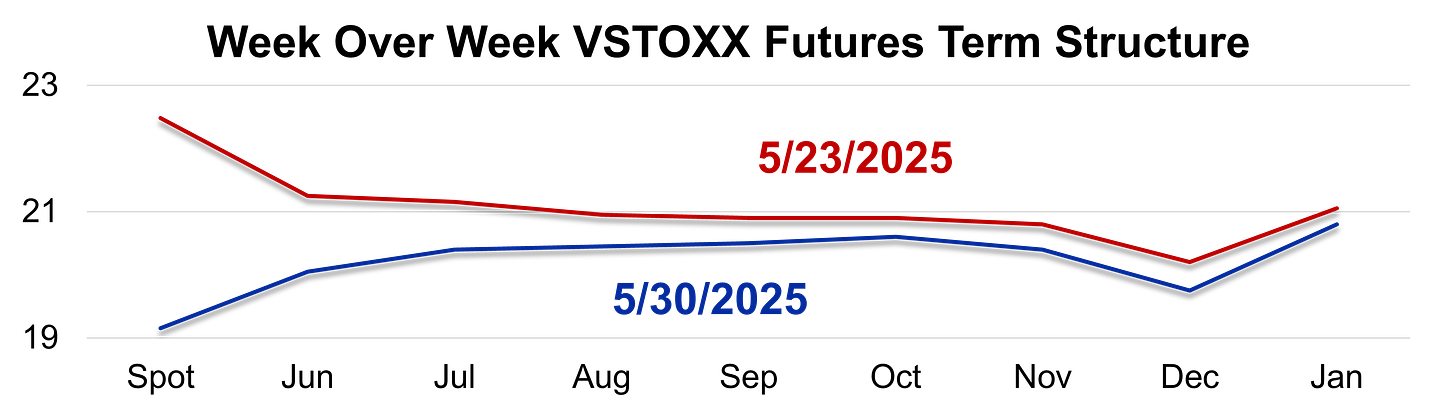

VSTOXX finished the week at a slight premium to VIX, but the VSTOXX term structure followed VIX’s lead returning to contango after finishing the prior week in backwardation.

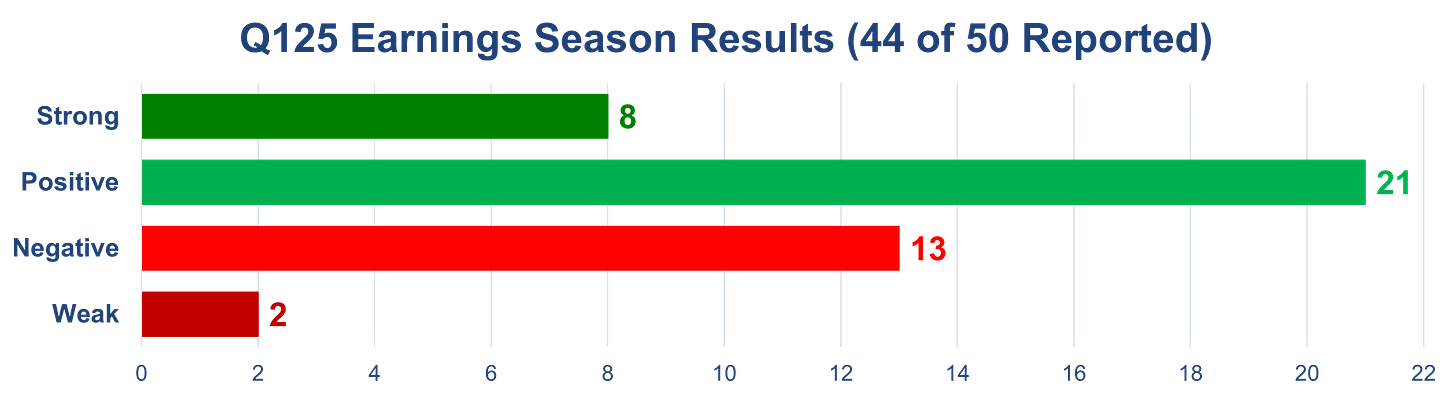

NVIDIA (NVDA) and Salesforce (CRM) reported earnings last week with NVDA up 3.25%, less than the average move of +/-7.72% classifying the report as positive, while CRM dropped 3.30% which falls into the negative grouping. Net results for this earnings season have been mostly positive as indicated in the graphic below.

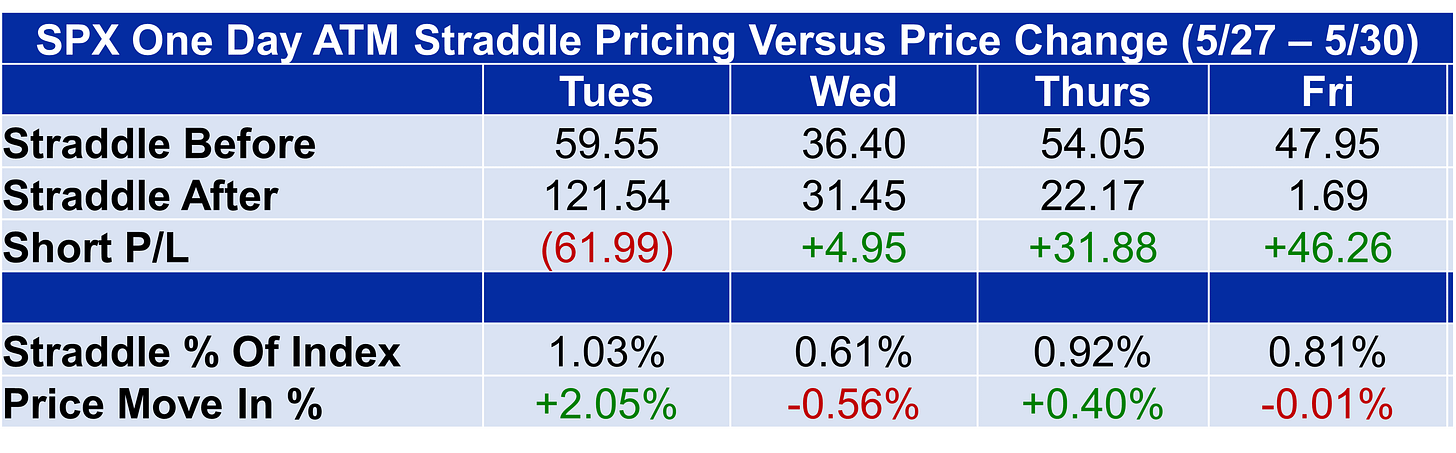

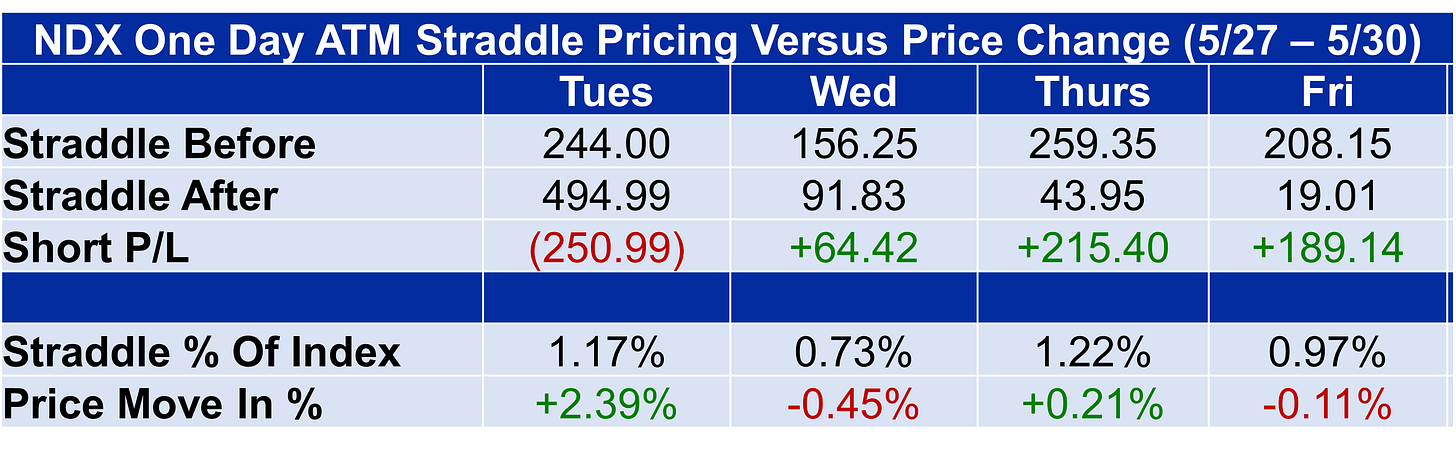

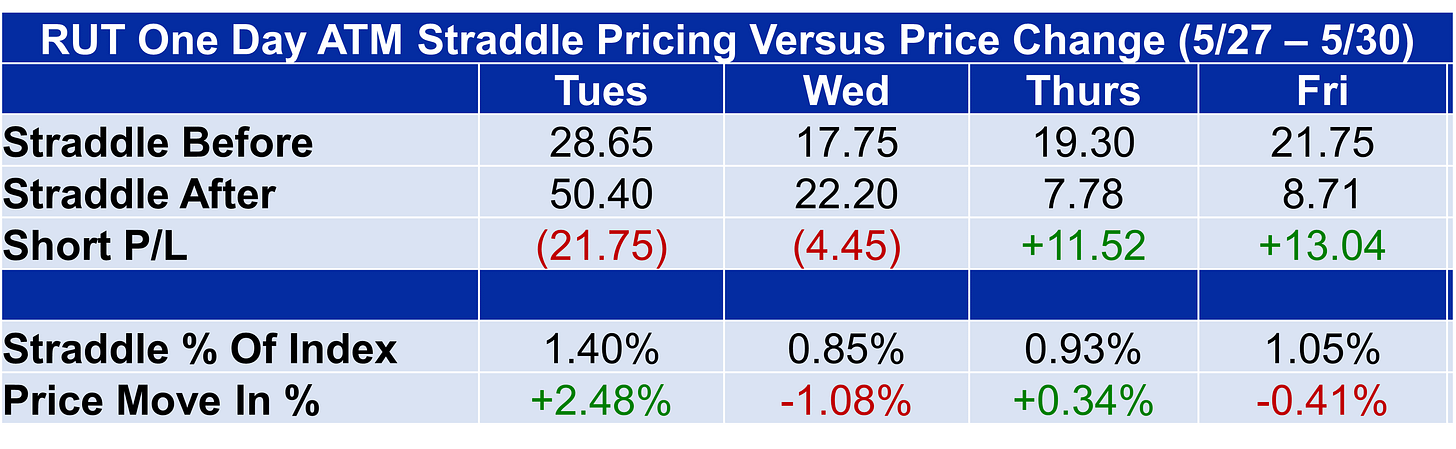

We have four daily expirations in the US indices to explore due to the Memorial Day holiday. All three US markets (SPX, NDX, RUT) underpriced Tuesday’s move by over 1%. SPX and NDX made up for those losses as the week progressed. RUT sellers also lost a bit on Wednesday with Thursday and Friday profits not making up for losses on the first two days of the week.

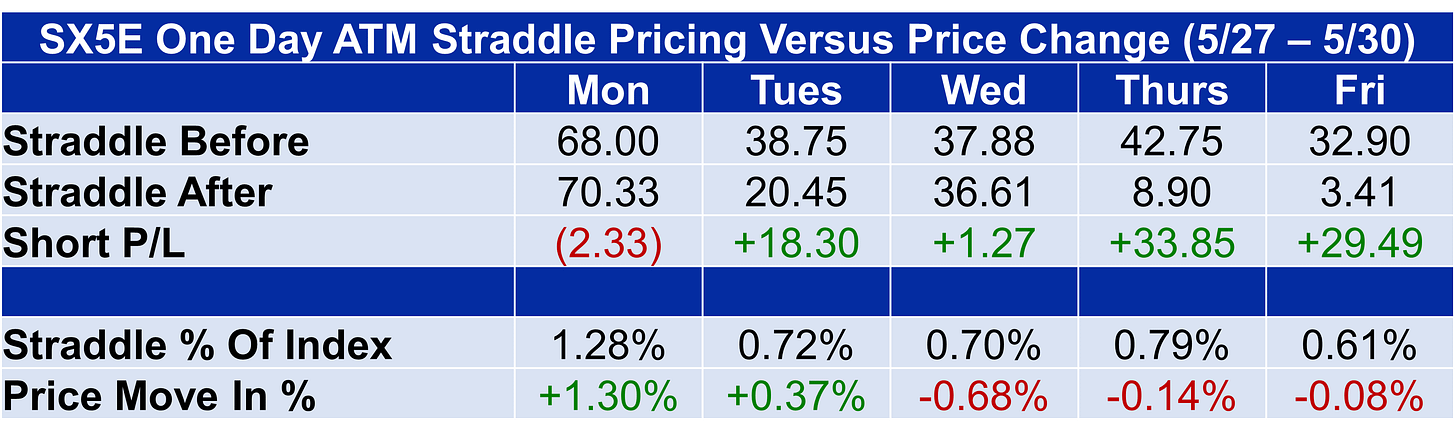

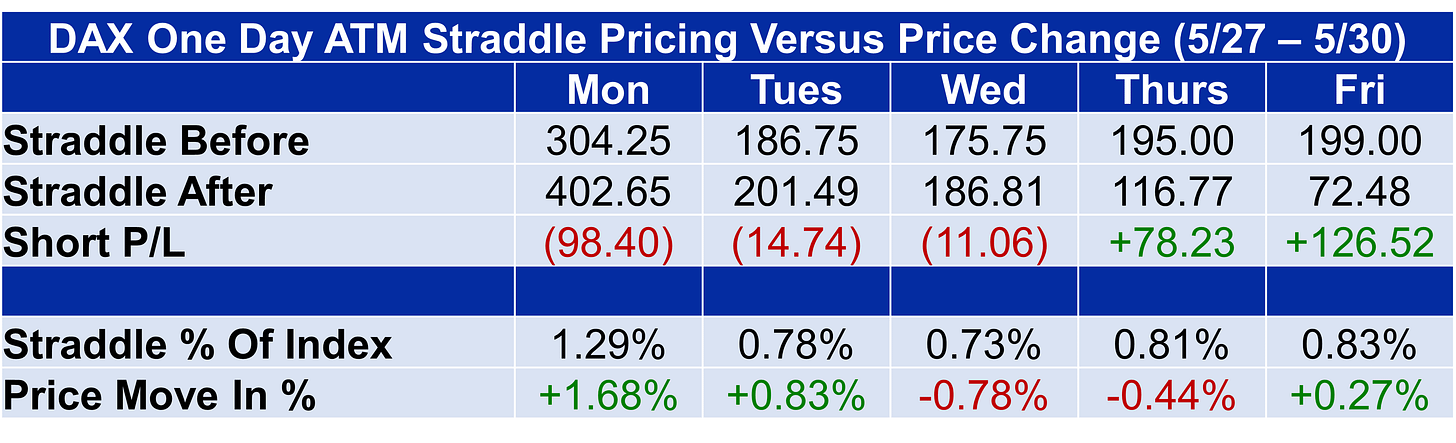

In Europe, the biggest price change for both SX5E and DAX occurred on Monday as those of us in the states were celebrating Memorial Day. That was the only day last week where SX5E options underpriced the subsequent move. DAX was a bit more volatile, with the price change magnitude greater than the ATM staddle Monday, Tuesday, and Wednesday. The overpricing on Thursday and Friday did manage to make up for the losses that occurred to start the week.