VIX Term Structure Continues With Uncertain Outlook

Weekend Review For Week Of October 21, 2024 - October 25, 2024

It was a mixed week for equities with the S&P 500 (SPX) losing almost 1% and the small cap benchmark Russell 2000 (RUT) down by almost 3%. The sole US winner was the Nasdaq-100 (NDX) which managed to eek out a gain of 0.14%. The Euro Stoxx 50 (SX5E) was also lower on the week, giving up 0.87%.

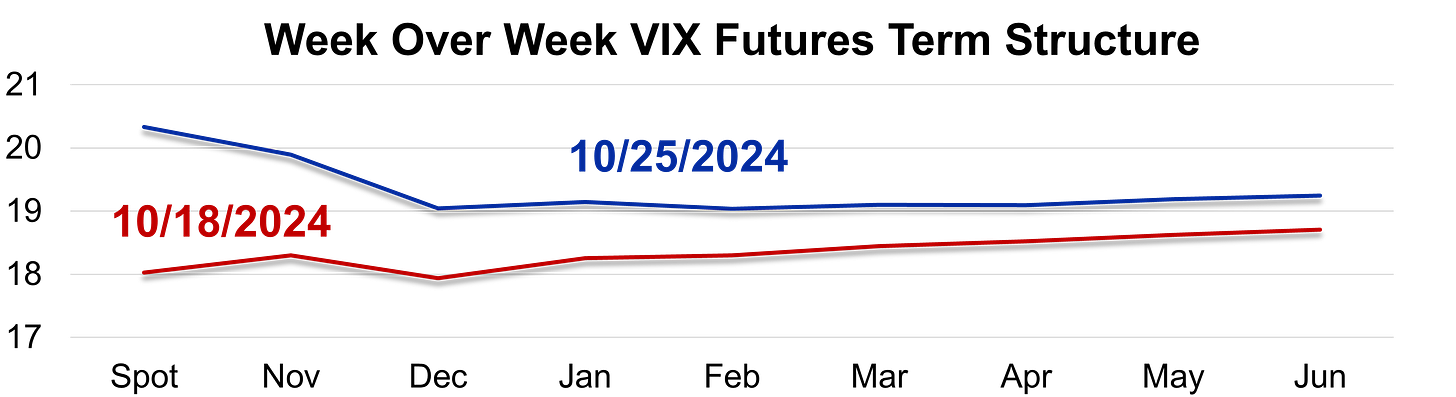

This click bait this week is about the VIX term structure being clueless. What I mean by that is just how flat it is going into 2025. The blue line on the term structure chart represents VIX and the monthly VIX futures contracts through June expiration. The highest priced future on Friday was the November contract at 19.90 and the lowest priced is December at 19.05 resulting in a low to high spread for VIX futures of 0.85.

For context the average spread between the highest and lowest priced VIX future is about 5.15 points using data starting with January 2010 through this past week. This spread has only closed under one point 150 of almost 4,000 trading days or about 3% of the time. Basically, it is rare.

VIX watchers (including me) associate a flat term structure with uncertainty as to what is next for stocks. The one thing to keep in mind is moves are usually pretty strong after a flat curve, the direction is the part that is uncertain.

The long VIX ETPs do benefit from the curve being flat or inverted as the negative roll yield that usually creates a headwind for them is not present. This, plus higher VIX futures pricing resulted in UVIX gaining 15% on the week. On the other side of the performance coin, SVIX lost just over 7.5% on the week.

Like VIX, the VSTOXX term structure is flat from January 2025 through June. However, the November future is at a decent discount to the spot index and December is displaying low pricing based on the seasonality surrounding holidays that suppresses December VSTOXX settlement slightly.

Index option sellers have had a tough time lately. Last week offered a break for that trend as 1-Day at-the-money (ATM) straddles were mostly overpriced relative to subsequent moves last week. SPX straddles were overpriced, four of five days last week, with Wednesday putting up the only outlier day.

NDX straddles went three for five overpricing the move, and once the math is done, the net result is a gain of just under 4.00 points for the week.

RUT straddles were also overpriced, three of five days, and the net result was a small gain of a little over 8.00 points.

Over the course of the past year or so, SX5E straddle sellers have fared much better than their US counterparts. This past week they once again had better results than the US markets with four winning days versus a single loser on Monday.

Finally, DAX followed the SX5E’s lead with the only losing day coming Monday last week.