VIX Finishes Week In Slight Backwardation

Weekend Review For Week Of January 6, 2025 - January 10, 2025

What would normally be the first full trading week of the year was interrupted by Thursday’s holiday. I am not quite sure what the plan would have been if they had chosen Friday for the day off as the first piece of significant market news, Non-Farm Payrolls, was released Friday. For the bears, the market being open was a blessing as stocks did not like this figure. Stocks were higher in Europe, driven by strong performance on Monday and managed to put up a gain in excess of 2% on the week.

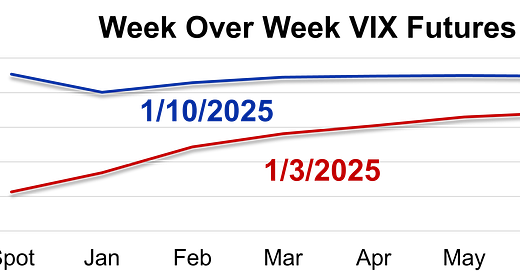

VIX was higher by over 20% last week and the result was slight backwardation at the short end of the curve. The January contract closed at 19.54 and the first three monthly futures were at a small discount to spot.

The VIX ETP space behaved as expected with UVIX leading the way higher and SVIX coming up as the big loser on the week.

VSTOXX was higher, but the term structure differs from VIX, showing a slight contango with an exception when looking at the March and April contracts. There is an election in Germany in late February that is influencing the March contract. Specifically providing a slight boost. We saw the same situation leading up to two elections last year and some calendar spread opportunities based on a near month at a premium to the next month leading up to the events. Currently, March VSTOXX is at a 0.35 premium to April. We would like to see that spread widen to the 0.50 – 0.60 range for an opportunity to sell March and buy April, taking the trade off when March moves to a discount relative to April.

It was a tough week for option sellers as the S&P 500 (SPX) with two days when the index was down over 1%. Friday was a tricky day to trade, both due to the Thursday holiday and payroll report Friday before the market opened.

Nasdaq-100 (NDX) options underpriced three of four trading days last week.

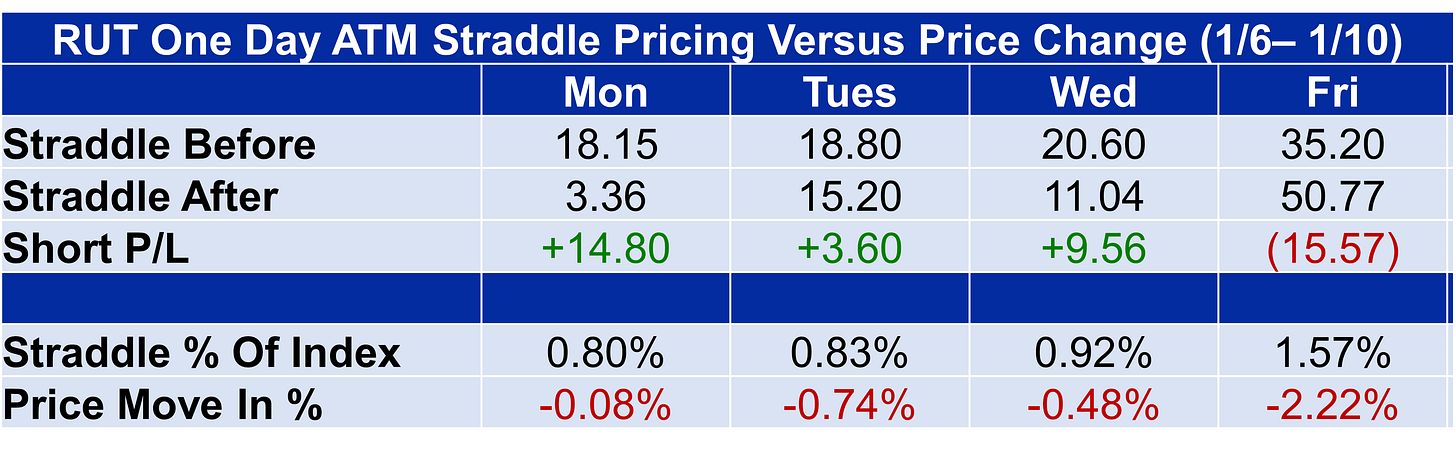

The bright spot for US index option sellers was the Russell 2000 (RUT) where only Friday resulted in a loss and the gains from the three profitable days outpaced that loss.

In Europe losing days bookended the week with Monday being nothing short of a disaster as the Euro Stoxx 50 rallied by over 2% to start the week.

The DAX mirrored the Euro Stoxx 50’s price action on Monday, but losses were made up over the balance of the week.