VIX has been stubborn, not breaking below the 2023 closing low of 12.07 on December 12, 2023. Since that day in mid-December the S&P 500 (SPX) has reached 32 new all-time highs with the most recent being this past Wednesday. VVIX rebounded a bit as volatility traders took advantage of the low VIX and VIX futures pricing to purchase VIX call options just in case of a volatility event in the near future.

VIX and all VIX futures contracts moved lower in a very paralell fashion last week. Note the May contract finished at a 0.65 premium to spot VIX versus 1.00 premium a week ago. this is a function of May futures expiring this coming Wednesday on the open.

SVIX was the top performing VIX ETP, gaining 6% last week. Friday’s close was the 18th all-time high for SVIX in 2024. The short VIX ETP is also up over 23% in 2024.

The VSTOXX term structure shifted lower as well, however the May premium is a bit higher than that of VIX. On a week over week basis, the May VSTOXX future moved from a 0.55 premium to over 1.20 this past week, even though May VSTOXX expires this coming week.

Short-dated index straddle sellers have had a tough time over the past few weeks, however, last week was a good one for all five markets we follow. One day at-the-money (ATM) SPX straddles overpriced the following day’s move four out of five trading days last week. Consistent straddle sellers (not a recommendation) would have pocketed about 21.00 points in profits.

This past Friday was standard May option expiration so there are only four trading days on the Nasdaq-100 (NDX) table below. The ATM straddle overpriced the NDX move three days resulting in short profits of about 40.00 points.

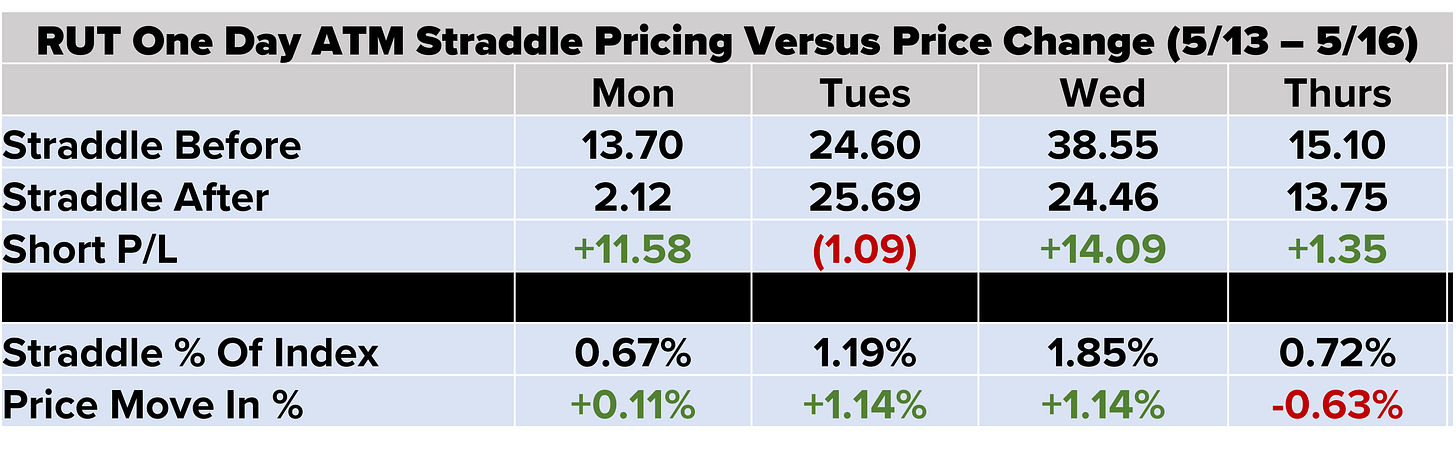

The Russell 2000 (RUT) complex also does not have PM settled contracts on the third Friday of the month so we have four observations below. RUT straddle sellers did quite well netting about 25.00 points with only one small loss last week.

Euro Stoxx 50 (SX5E) staddle sellers were less than a point from going five for five last week. Note how low the premiums are for Friday at 0.42% of the index, despite this ‘cheap’ straddle, it still overpriced a tame move on Friday.

DAX straddles were also mostly overpriced with Thursday being the exception and like SX5E the Friday pricing was lower than average, but not overpriced.