UVIX Weekend Approach Performance Update And Mixed Signals From The Volatility Markets

Weekend Review For The Week Of December 30, 2024 - January 3, 2025

Back in the summer I was playing with some numbers and found that a buyer of UVIX on the Friday close who sells on the open Monday (or for holidays buy before the weekend and sell when we get back to work) resulted in a return of about +0.31% per trade. The data for that result included all weekends between April 1, 2022, when UVIX was launched, and June 14, 2024. The win rate at that time was around 44%, which is impressive and honestly higher than I guessed it would be before running the numbers. UVIX offers leveraged long exposure to the front month VIX futures and over a long period of time performance is negative, for example UVIX is down about 45% over the past 3 months.

Since running those numbers last summer, being long UVIX over the weekend offered some nice returns. The average return between June 14, 2024, and December 27, 2024 was +2.30%, this is due to an 88% gain over the first weekend in August. In fact, missing that weekend takes the results from positive to negative over this later period and the win percent dropped into the 20’s. However, that’s the nature of long volatility approaches, more losses than wins, but big wins more than make up for those small losses. The table below breaks out this approach’s performance over the two time periods as well as cumulative performance.

The Russell 2000 (RUT) was the big winner last week gaining just over 1%, while the S&P 500 (SPX) lost 0.48% and Nasdaq-100 (NDX) was 0.68% lower. This was despite a nice rally on Friday. Expected volatility for RUT dropped while VXN and VIX were higher. The Euro Stoxx 50 (SX5E) performance was slightly lower and VSTOXX moved higher, approaching the 17.00 level.

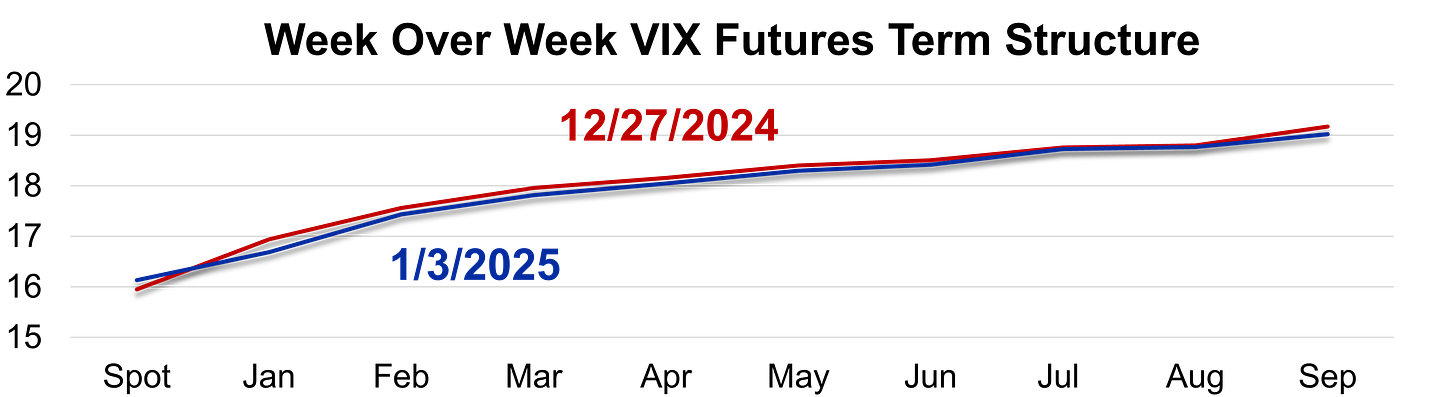

The VIX term structure was little changed last week, but there is an interesting tidbit from the curve. Note, VIX futures were higher, despite spot VIX moving up. This is mostly a function of getting past the holiday week.

VIX ETP price action was mixed with all but one long fund losing value. On the short side SVIX was lower while the other two funds were slightly higher for the week.

The VSTOXX term structure also had mixed results with the index and shorter dated futures moving higher and the long end of the curve lower by a tick. Note the elevated March premium below. This is a function of a pending election in Germany in late February as March expiration is the first contract to expire after that potential volatility inducing event.

Shameless plug – I will be conducing a webcast this coming Thursday with Interactive Brokers to discuss VSTOXX and specifically talk about trading ideas leading up to the German election – registration is here - https://www.interactivebrokers.com/campus/webinars/review-and-preview-of-vstoxx-index-futures-and-options/

Finally, in the short-dated index option space we are only going to talk about US price action as Europe took several days off last week. SPX option sellers went two for four last week with Tuesday and Thursday offering profits, bookended by losses on Monday and Friday. Those that can do quick math can see the net result was a small profit.

NDX sellers were also two for four, but unlike SPX, the losses outpaced the gains.

The best market for sellers last week was RUT, where profits occurred all days but Friday and those winners overwhelmed the one losing day.