Update on UVIX Weekend System, VIX Term Structure Indicating More Volatility Ahead

Weekend Review For Week Of May 19, 2025 - May 23, 2025

In June last year we ran a quick back test to determine if a long volatility position, just held over weekends, would make sense as a consistent strategy. The approach to determine this was buying the Volatility Shares 2x Long VIX Futures ETF (UVIX) on the close each Friday, exiting the trade on the open the following Monday. If there is a holiday weekend (like this weekend), then the trade would buy before the long weekend and sell on the open after our 3-day holiday.

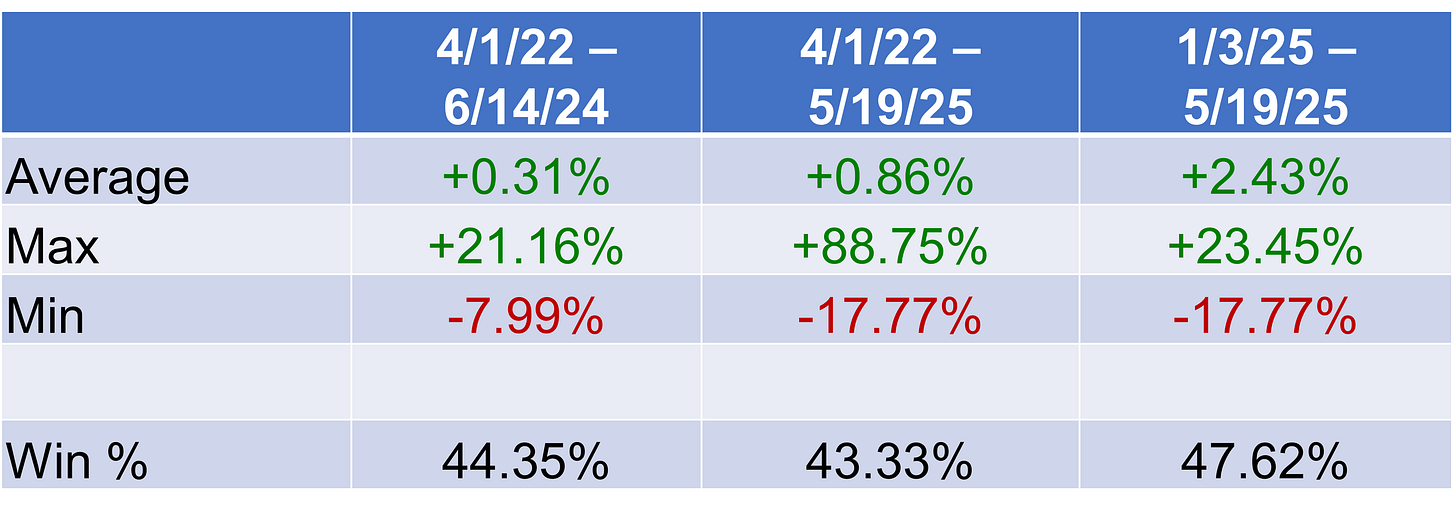

What we found, using data from April 2022 (when UVIX was launched) through June 2024, was that just under half of weekends UVIX was higher from close to open. Despite the win rate falling under 50%, the average trade was a gain of 0.31%. The table below breaks out performance of this basic strategy over three different time periods.

Note the biggest winner for the period ending in June 2024 was +21.16%. After running that test, we started trading it and the timing could not have been better as the first weekend in August had UVIX up over 88% from close to open, this improved the average trade performance to +0.86% over the full period from April 2022 through this past week. Finally, the column on the far right shows the performance in 2025, which has resulted in an average gain of +2.43%, again with a win percentage below 50%.

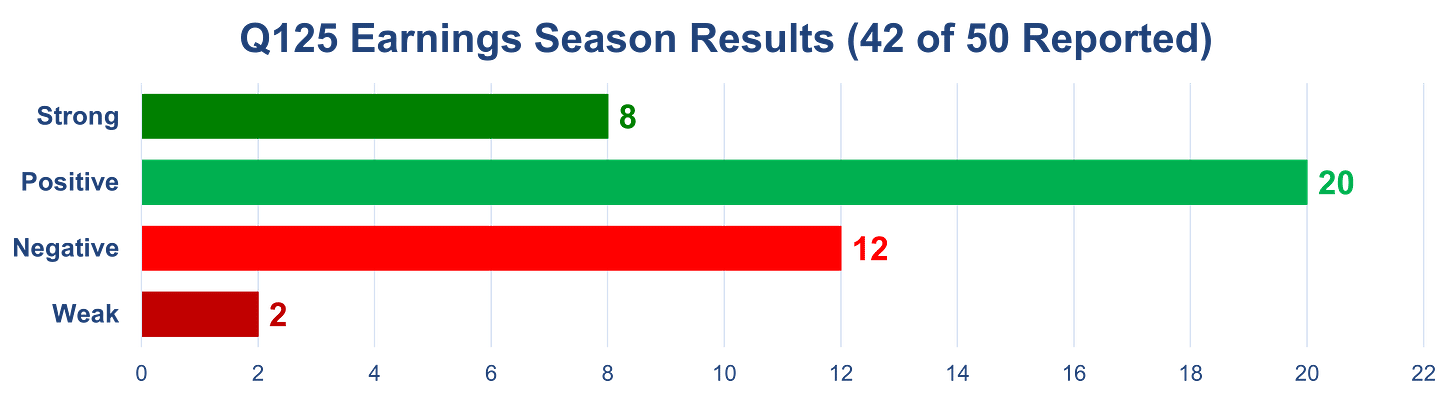

Only one of the fifty firms we follow reported earnings last week. Target (TGT) shares dropped just over 5% in response to earnings, less than the average move of +/-10.04% from the previous twelve reports. This places TGT’s result in the negative category for earnings tracking purposes.

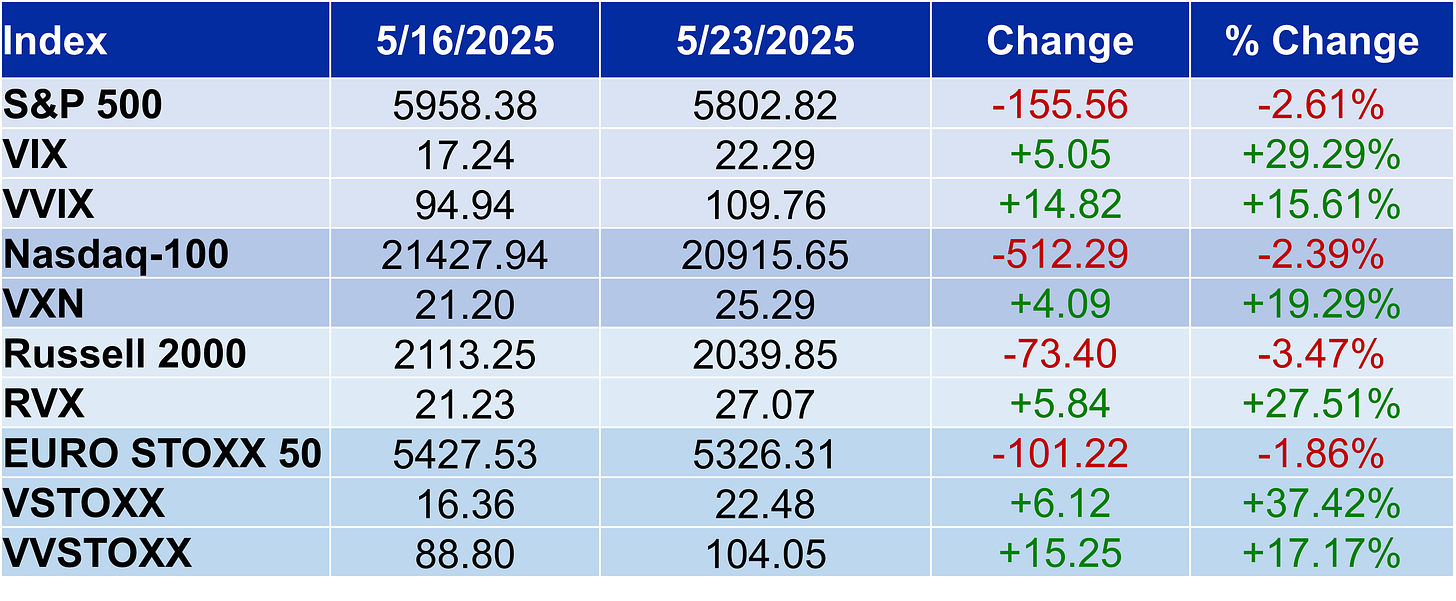

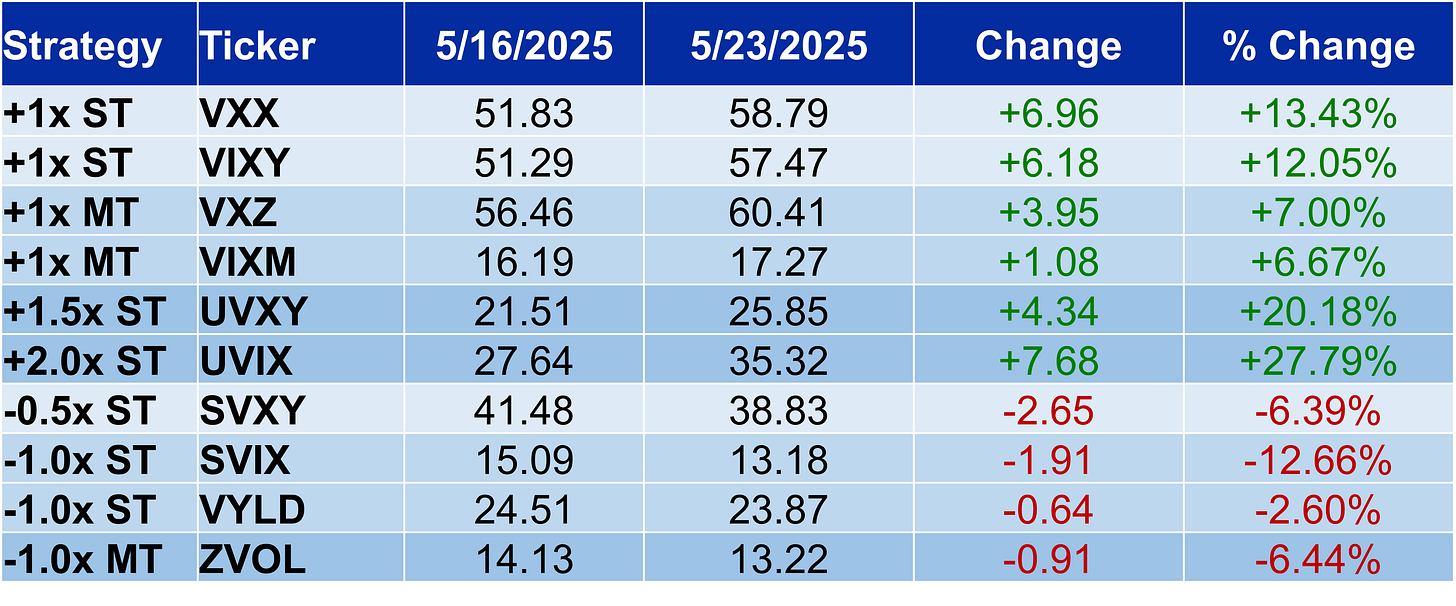

Stocks were lower last week with the Russell 2000 (RUT) leading the way lower, giving up 3.47% for the week. Both the S&P 500 (SPX) and Nasdaq-100 (NDX) gave up over 3%, while the Euro Stoxx 50 (SX5E) lost a little less than 2%. Volatility indices reacted as one would expect with both VIX and VSTOXX moving back to the low 20’s.

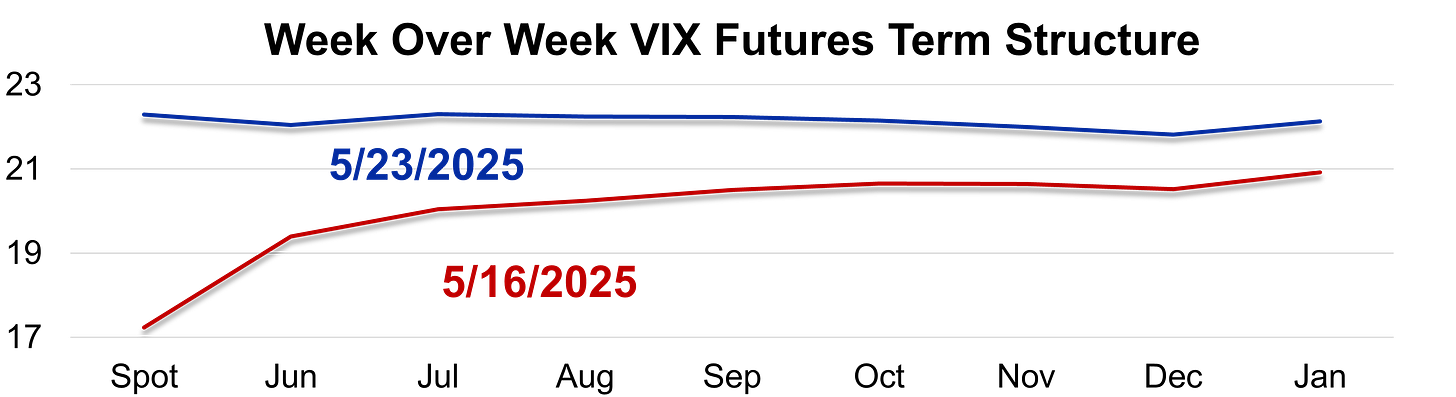

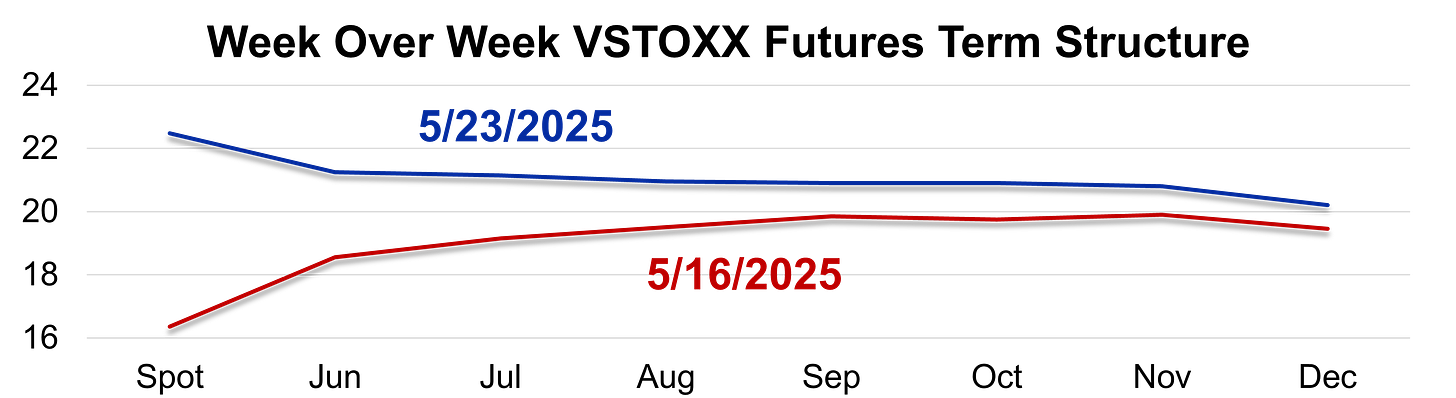

Last week’s price action took the VIX term structure from contango to flat. We discussed the flat term structure a couple of weeks ago, noting that the S&P 500 tends to be more volatile over the next week and month following instances where spot VIX and VIX futures are within a 1-point range. Stated more plainly, the flat term structure is usually followed by higher-than-average volatility, but the direction is up in the air.

The long VIX ETPs had a great week, with our favorite long fund, UVIX leading the way higher with about a 28% move. If you were 100% long UVIX last week, take the profits and have a great summer.

VSTOXX was higher, with the spot index rising more than VIX and closing at a premium to VIX for the first time in 26 trading sessions on Friday. Typically, VSTOXX closes at a premium to VIX (like 80% of trading days) and this was the eighth longest VSTOXX closing below VIX streaks on record. We dug a bit to see if this has been a signal for either the volatility indies or their related markets in the past. Unfortunately, we found nothing but will keep trying.

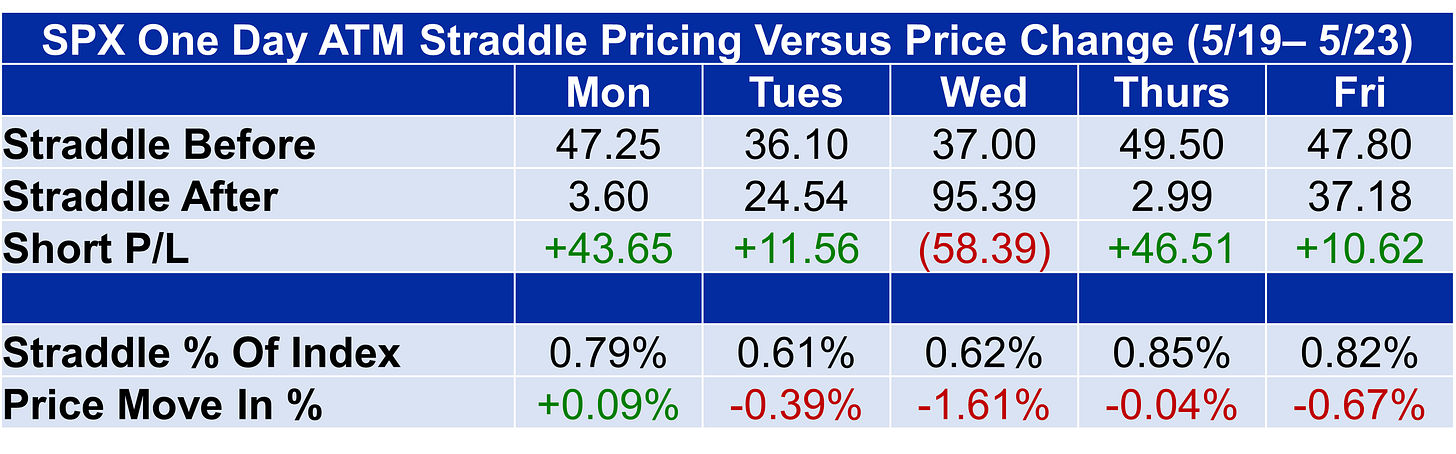

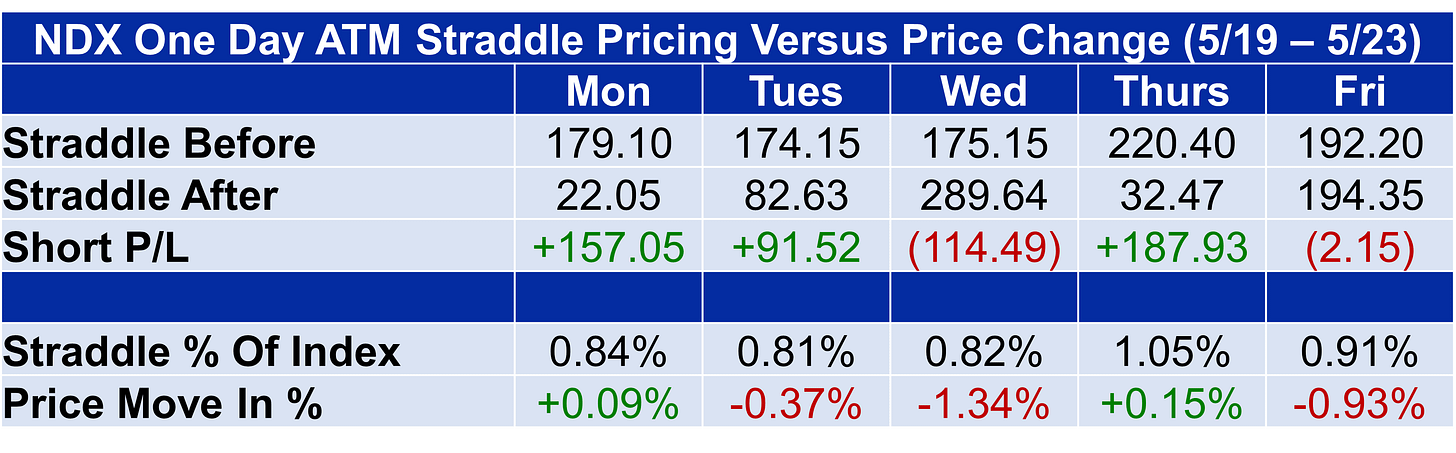

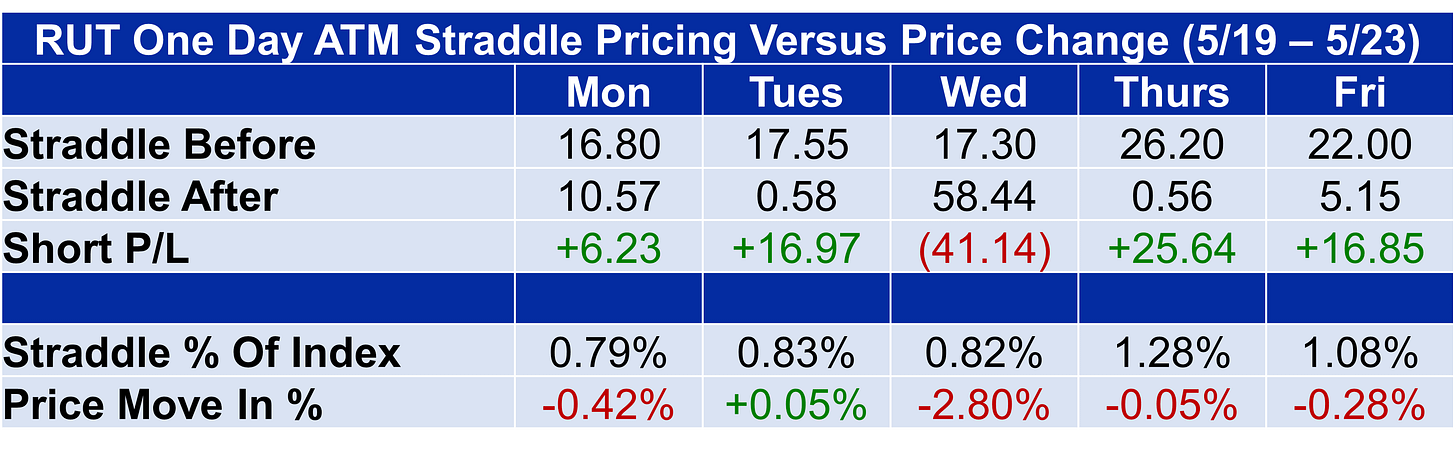

Two of the three US indices we follow with daily expirations had the options over price all but one day last week. Specifically, sellers of the 1-day at-the-money straddle profited four of five days using SPX and RUT. Friday’s price action in NDX resulted in two losing days for option sellers in that market, but Friday’s loss was just over 2 points.

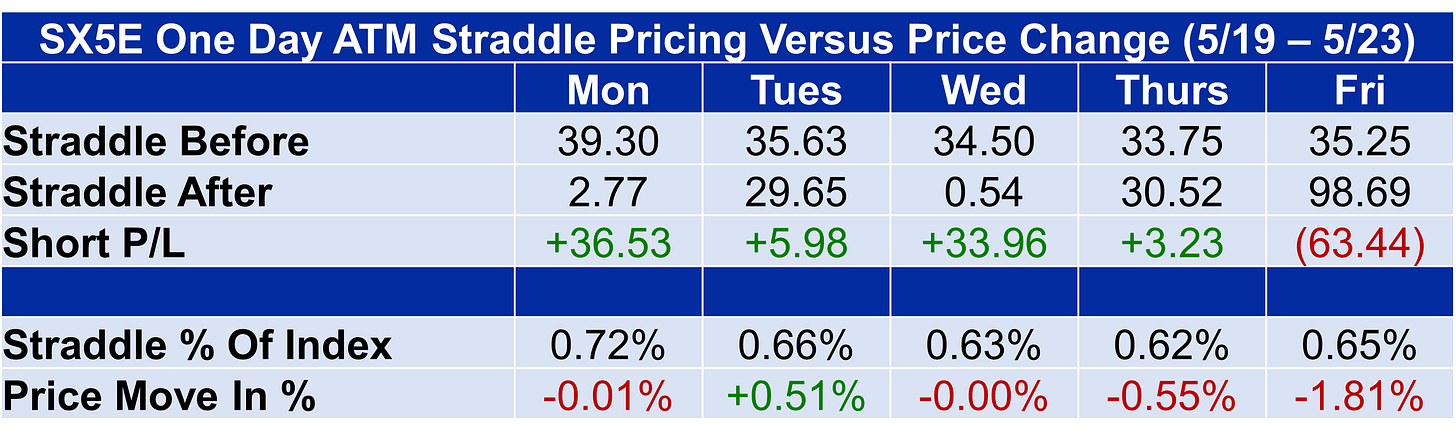

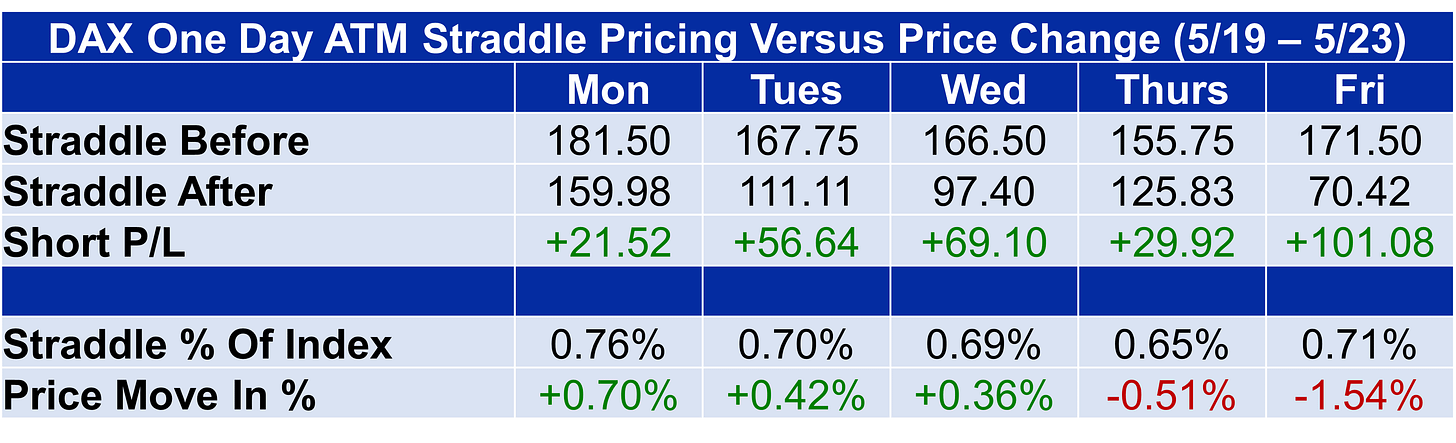

Option selling activity in Europe had similar results with SX5E straddle sellers profiting four of five days, while DAX had a second week in a row with all five days resulting in profits for option sellers.