The Return Of Employment Induced VIX Backwardation

Saturday Review For Week Of September 2, 2024 - September 6, 2024

For many traders, or those with a trader mentality, the biggest sequel of the summer was Deadpool 3. I include myself among those that counted down to the premier. For traders with a short equity bias, Friday’s equity market reaction to the monthly employment report could be considered a sequel to the reaction in early August.

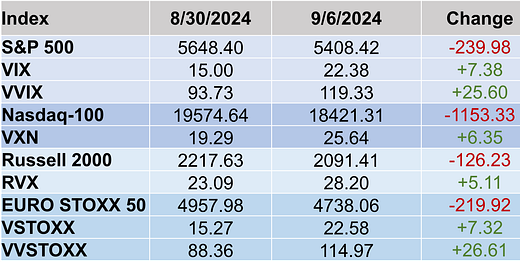

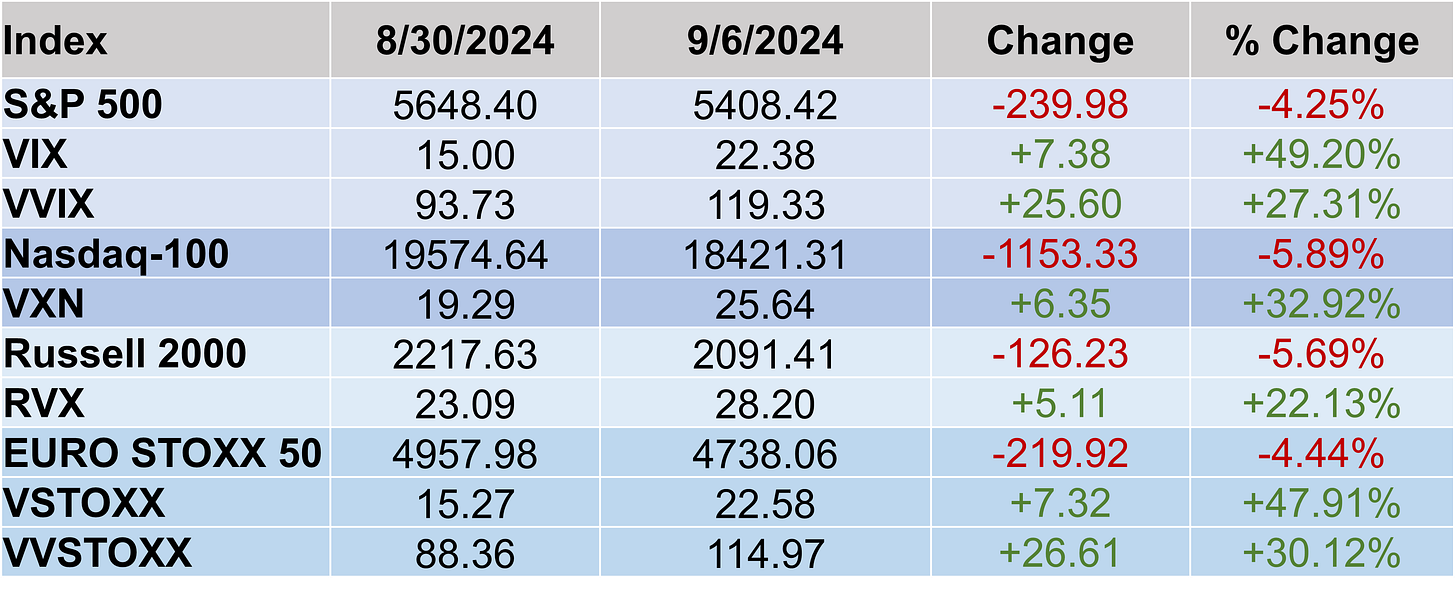

The S&P 500 (SPX) had the worst Labor Day week this century, losing 4.25%. This figure outpaced a 4.22% drop during the holiday shortened week in 2001. The Russell 2000 (RUT) managed to lose 5.69%, which is also the worst Labor Day week this century. Finally, the Nasdaq-100 (NDX) lost 5.89% which is not the worst since 2000 as NDX was down 6.97% and 7.85% Labor Day week in 2000 and 2001.

VIX managed to rise just short of 50% in reaction to the tough week for stocks which pushed the VIX term structure into backwardation. For those looking for a positive from last week’s price action, note the September VIX future discount to spot VIX. There are seven trading days and an overnight session between now and September settlement, that discount can be taken as traders expect lower VIX by September settlement which is usually accompanied by higher stock prices.

The rally in VIX pushed UVIX up by over 50% which SVIX was the big loser dropping almost 24%.

European volatility mirrored US price behavior with VSTOXX landing just 0.20 higher than VIX. The VSTOXX term structure is practically a duplicate of its American cousin.

Last week’s equity price action was tough on option sellers, even with only four trading days in the US. For example, Monday’s SPX sell off of over 2% was four times the at-the-money (ATM) straddle price. Friday’s SPX move was dramatic but note the straddle premium was elevated in anticipation of the employment number.

NDX straddle activity reflected the SPX resulted with Tuesday and Friday resulting in substantial losses.

RUT was a slight outlier as the elevated ATM straddle pricing using Friday’s options overpriced the subsequent move. However, Tuesday was a tough way for sellers to start the week.

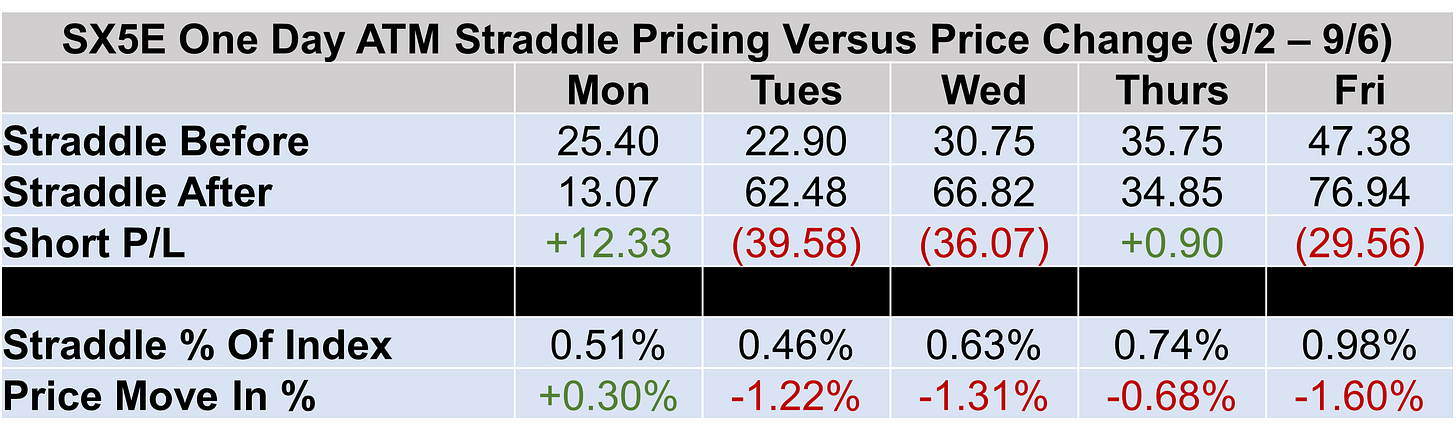

There was no holiday in Europe, so we have five straddle observations for the Euro Stoxx 50. The best day for sellers was Monday, with the balance of the week seeing outlier moves with the exception of Thursday where the straddle pricing was within a point of the resulting price move.

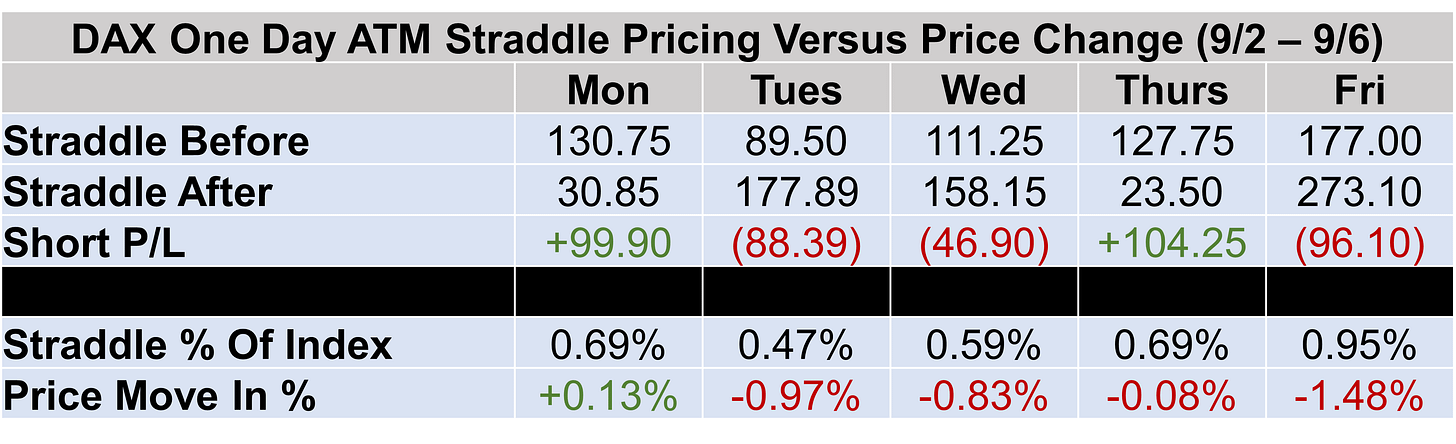

Finally, DAX straddle sellers managed a couple of good days, but not enough to overcome the losses from the three big price changes last week.