In early December I was a guest on the Options Insider https://theoptionsinsider.com/ Pro Q&A show when I got a question about positioning for a volatility spike over the following six months. The specific question was, “If you think there is going to be a spike in volatility over the next six months, how would you position for it?” The trade structure I chose was to sell a put spread and use the proceeds to buy an out of the money call option using the front month contract and periodically rolling the position forward. The roll date is always the Friday before standard expiration.

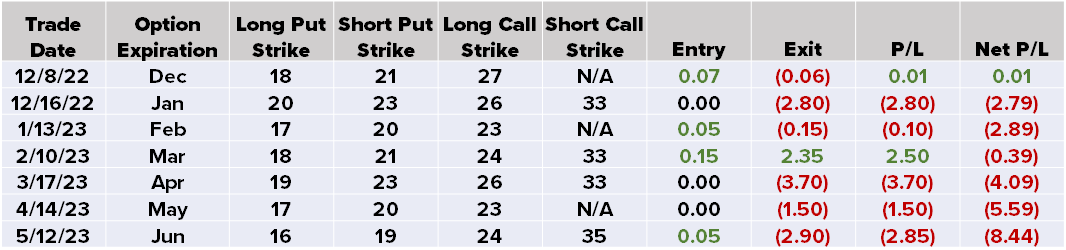

The idea behind this trade is to have an inexpensive method of preparing for a spike in volatility. Our plan was if the front month future tops 30.00 we would monetize (exit) the trade. We came close, as spot VIX topped 30.00 a couple of times back in March, but the future did not reach that level. The table below summarizes the trades including the final leg using June VIX futures that expire this week.

VIX and the June future are at such low levels that the call legs of the final trade have no value. Exiting the VIX Jun 16/19 Bull Put spread cost 2.90 which resulted in a loss of 2.85. Netting out the various losses along with the only profit (thank you March) results in a loss of 8.44 per spread. It is rare that someone would discuss a losing trade like this, but we promised to see this through to June expiration. Also, there is always something to learn from bad trades, possibly more than from winners.

The put spread plus long call or bull call spread has been one of our favorite trade structures. Since it did not work, we decided to check in on a couple of more basic trades that offer bullish exposure to VIX. First, we explored buying the 50-delta call and holding it to the roll date. Those results show up below.

The benefit behind just buying the call is unlimited upside. However, that comes at a cost and since VIX has mostly trended lower call buying did not work so well. Note, even in March, with VIX at a bit of an elevated level, the original complex spread structure was up 2.35, while the long call gained only 0.95.

Our other choice was again buying the 50-delta call and shorting the 25-delta call. Those results show up below.

The call spread structure lost just under 4.00 points over the last 6 months. This is an improvement versus the structure that shorted puts and purchased calls. The original structure that shorted puts took a good portion of losses due to short puts being in the money on roll dates. Lowering the cost by selling out of the money calls, none of which were ever in the money over the past six months improved the outcome, but if we had experienced a volatility spike the long call structure would likely have prevailed as the best choice.

Thanks for taking us through this journey--it was educative and I certainly added a powerful weapon to my hedging arsenal.

I noticed that as VX futures dropped, implied volatility for puts dropped while that of calls remained elevated. For example, the 15 strike put's IV is 1/7th (21.7%) that of the corresponding call (146.57%) expiring on July 19th 2023.

This skew means that were I to extend the trade to July, I would collect a lot less premium from selling the put spread, therefore requiring a much further out of the money call to establish a costless (or small credit) combination. What accounts for the skew, and how would you adjust your trade structure to deal with diminished IV and therefore credit from selling the put spread?