Straddle Pricing Adjusts To Higher Volatility Last Week

Weekend Review For Week Of March 10, 2025 - March 14, 2025

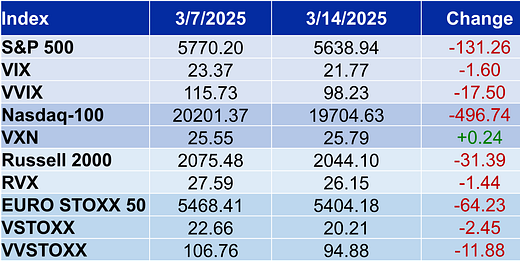

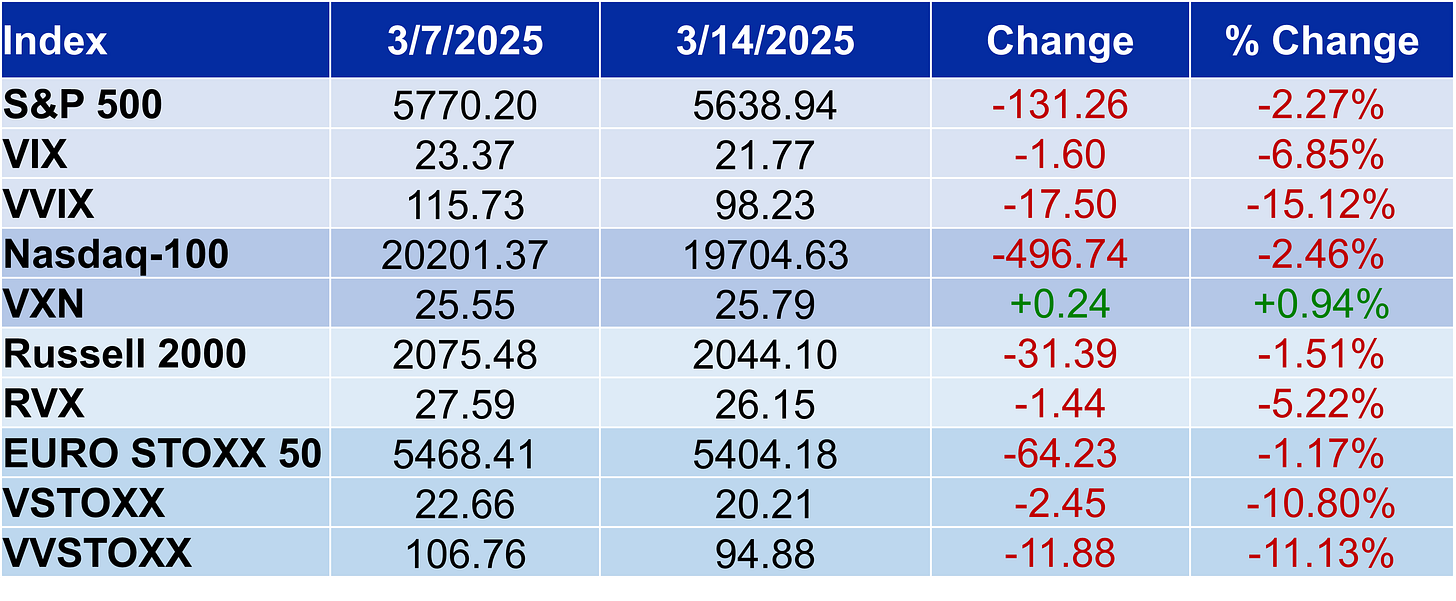

In the two or so years I have been reviewing index and volatility markets each weekend. I do not recall a market table that had so much red. The previous week was a brutal one, pushing VIX to the mid-20’s, a level that would be difficult to maintain without significant S&P 500 (SPX) follow through. Friday’s SPX rebound pushed VIX lower by almost 3 points, resulting in the monotone nature of the table.

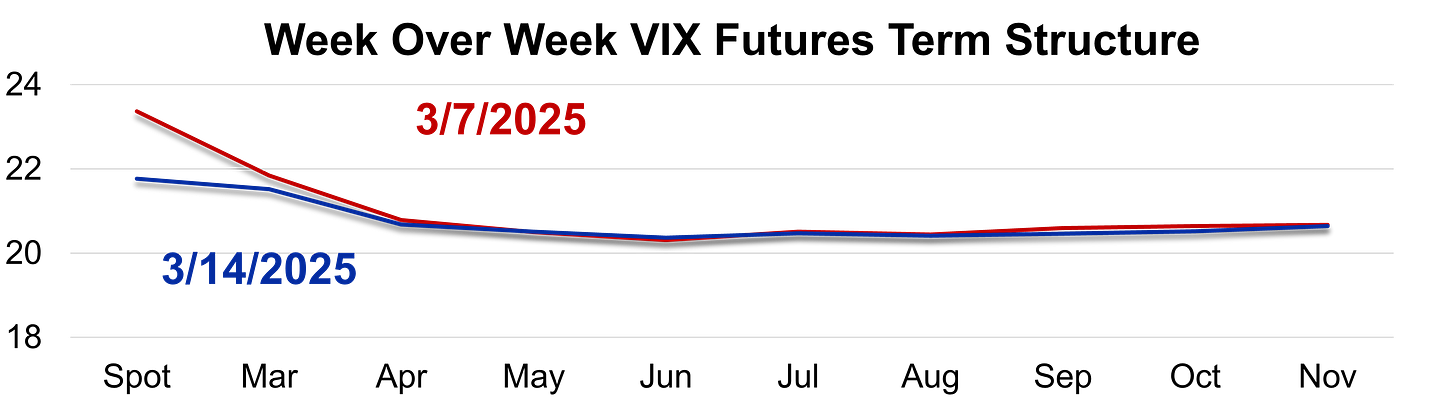

The week over week change for the VIX term structure is a bit unusual as well. The spot index moved dramatically lower, front month (March until Wednesday) was down slightly, and the balance of the curve was basically unchanged.

The week over week change for the VIX term structure is a bit unusual as well. The spot index moved dramatically lower, front-month (March until Wednesday) was down slightly, and the balance of the curve was basically unchanged. The best way to interpret this is that the market is not quite out of the woods with respect to elevated volatility.

The choppy action in VIX and VIX futures took its toll on volatility related ETPs. On the long side, only VXX and VIXY managing to gain, while ZVOL was up slightly.

The European volatility term structure was a bit weaker and remains at lower levels than their VIX counterpart. March remained at parity to April or even at a premium for a good portion of the past few weeks, but that relationship finally moved to normalcy to end this past week.

SPX straddle sellers had a tough week, starting with Monday’s 85 point loss and finishing with a 53 point loss on Friday. Do note, the straddle pricing at a % of index on this table is much higher than what is normally in that spot by an average of about 50 basis points.

Nasdaq-100 (NDX) straddle pricing was also elevated, but not enough for sellers to overcome a couple of large price changes.

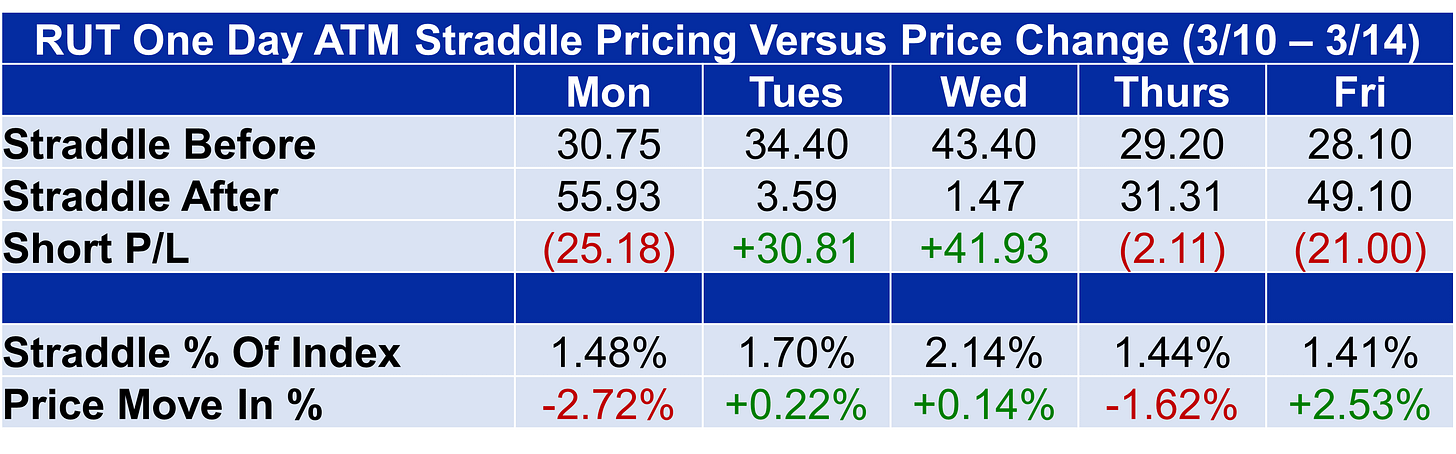

Despite only overpricing two of five days last week, 1-day Russell 2000 (RUT) straddle sellers were net profitable last week due to small index changes on Tuesday and Wednesday.

Euro Stoxx 50 (SX5E) 1-day straddle pricing was overpriced only two days last week, but that was enough for net profits.

Finally, those using DAX options for short-term volatility selling basically broke even last week.