SPX, NDX ATM Implied Vol Finally Reflecting Election Risk

Weekend Review For Week Of October 28, 2024 - November 1, 2024

One of the benefits of having index options expiring every day of the week is the ability to pinpoint risk events. Another is to gain insight into the magnitude of the potential market reaction to specific events, such as the upcoming presidential election. S&P 500 (SPX) and Nadaq-100 (NDX) options expiring the day of and the day after the election have been available for trading since mid-October and the behavior was a bit perplexing. Specifically, the spread between November 5 and November 6 at-the-money (ATM) straddle implied volatility at what we considered too narrow considering the importance of the election. However, after Friday’s employment report, this spread widened dramatically for both SPX and NDX markets.

Starting with SPX, the spread was slightly under 3% in mid-October, but started to slowly widen, reaching just over 3% toward the end of last week. Finally, the spread was around 5%, Wednesday and Thursday of this past week before finishing Friday just over 9%. The jump from 5% to 9% was partially a function of the November 5 options pricing higher volatility in front of Friday’s employment number. Now that the next risk event will not impact the markets until November 6, November 5 volatility expectations dropped Friday. All of this shows up on the graphic below.

NDX volatility followed the same trend as SPX with the spread remaining around 2.5% to 3.0% though last week. That spread widened to over 10% as of the close on Friday. For a better perspective on just how high ATM implied volatility is in the NDX complex, the average NDX 3-Day ATM straddle has been 1.90% of the index in 2024, as of Friday this figure stood at 2.37%, still relatively low, but likely to increase between now and the market close on Tuesday.

Checking on the markets last week, small caps did their seasonal thing, and the Russell 2000 (RUT) held up better than the other US indices, gaining 0.10%. By seasonal thing, we mean RUT typically outperforms toward the end of the year. Both SPX and NDX were down more than 1% on the week as was the Euro Stoxx 50 (SX5E).

VIX rose last week, mostly reflecting expectations around this coming week’s market activity. Note the futures were higher, but not nearly to the extent of the spot index. We are keeping a close eye on the November versus spot relationship this coming week as that can be an indication whether traders believe VIX will move post the election.

VIX ETP behavior has been sluggish for both the long and short funds as the futures have not been nearly as volatile as the spot index. The long funds did well last week with UVIX leading the way higher. The worst performer was ZIVB, which offers short exposure farther out on the VIX term structure.

The VSTOXX term structure reflects election risk, but there is a difference when comparing the December VSTOXX and December VIX contract. We always highlight the December discount, which is a function of the number of holidays between expiration of the respective December volatility futures and the index options used to calculate the settlement value. This seasonality is showing up in the VSTOXX complex, but not VIX. There may be a spread opportunity here, either shorting Dec VIX and buying Dec VSTOXX or for those that like to make things more complex short Dec VIX / long Jan VIX combined with long Dec VSTOXX / short Jan VSTOXX.

Finally, checking in on short-dated straddles pricing, this approach has not worked particularly well in 2024 and this past week that held true for all but those who focus on RUT.

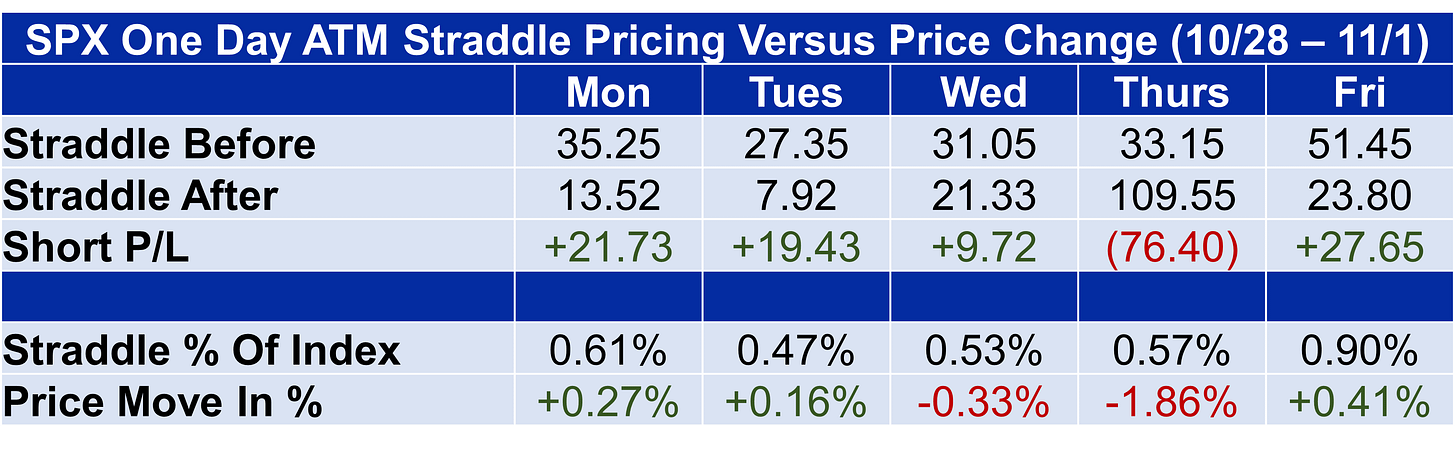

SPX straddles overpriced the following day’s move all but one day last week. However, the loss from Thursday was more than gains from the other four trading days.

After a great start on Monday, with NDX almost unchanged on the day, option sellers had a go of it the following three days before seeing a small recovery on Friday.

RUT straddle sellers had a slightly profitable week after losing almost 20 points on Monday.

Euro Stoxx 50 straddle sellers went two for five, with cumulative losses of about 27 points.

Finally, DAX straddle sellers managed profits three days last week, but the large loss on Wednesday plus a difficult day on Thursday wiped out those gains and more.