SPX, NDX, And RUT 1-Day Option History Around FOMC Annoucements

The stock market has started the year on a slightly positive note with the S&P 500 (SPX) achieving an all-time high rising just over 3% with two days to go in the month. The Nasdaq-100 (NDX) is up a bit over 4% while the Russell 2000 (RUT) is the laggard down a bit more than 1%. All this can change on the last day of the month as the stock market reacts to the FOMC announcement. To prepare for the market reaction to the FOMC release we offer a look back at market reactions over last twelve dating back to July 2022.

Starting with SPX, note the average move on FOMC day is +/-1.19%. The index exceeded this move slightly at the last announcement.

The June and July 2023 reactions to FOMC annoumcements was muted, with neither day exceeding more than 10 basis points in daily price changes. The straddle chart below shows how those two small price changes influenced the underpriced September straddle. The 1-Day at-the-money (ATM) SPX straddle is on a three report underpricing streak which may boost premiums in front of the pending report.

NDX has a heavy weighting in stocks that are sensitive to the economy so the reactions can be dramatic with the average move over the last twelve FOMC days at +/-1.67%. The average move over the same period for NDX is 1.10% or 0.57% lower. The figure below shows that the more recent reactions have been tamer than those in the second half of 2022 and early 2023 when there was more uncertainty about inflation and how long the Fed would need to keep raising rates.

Like SPX, straddle pricing has adjusted lower in front of FOMC days due to fewer outlier moves in recent history. However, note on the figure below that 1-Day at-the-money (ATM) straddles have dramatically underpriced the subsequent move on the last three FOMC days. We may see elevated premiums in front of this coming announcement as option sellers have not fared well on those most recent FOMC days.

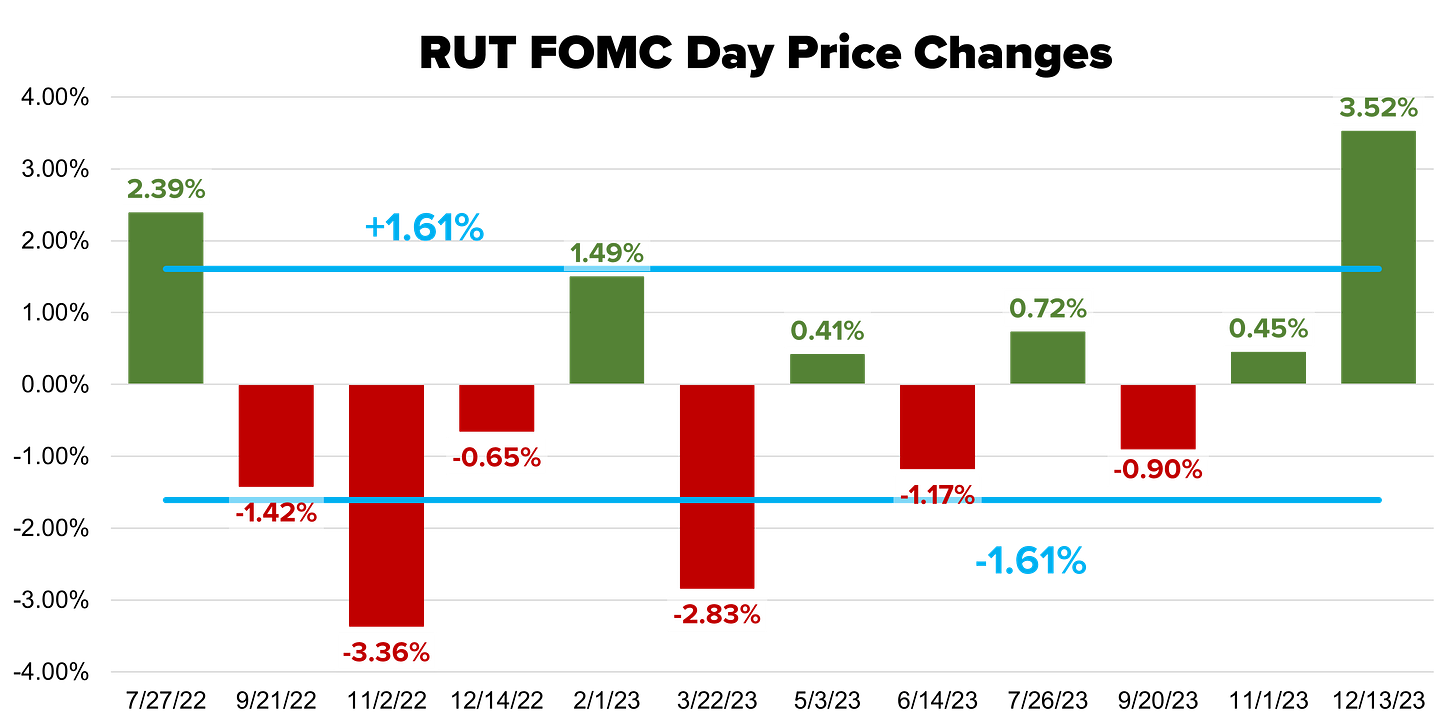

Finally, average RUT price changes are lower than the NDX average. However, the small cap benchmark rallied just over 3.5% on the last FOMC day. This big move may offer expensive options in front of the next FOMC report.

Based on the 3.52% rally in reaction to December’s FOMC announcement, the RUT ATM straddle lost over 2x the amount of premium taken in based on the closing prices of the relevant options. Note, there are couple of other outlier moves below, but the premiums following the outlier moves appear to be influenced by the most recent reaction.