SPX And NDX Option Market And The CPI Plus Earnings For DIS And PARA On Tap

Sunday Preview For Week Of August 7 - 11

Next week brings use a lighter earnings calendar than the past couple of weeks with only two of our stocks reporting earnings. The firms reporting earnings are competitors in the entertainment space with Paramount Global (PARA) reporting Monday after the market close and The Walt Disney Company (DIS) releasing numbers Wednesday after the market close. The table below is a summary based on the last 12 quarterly reports.

***This table was upated on 8/7 after a reader pointed out an error in the DIS straddle data***

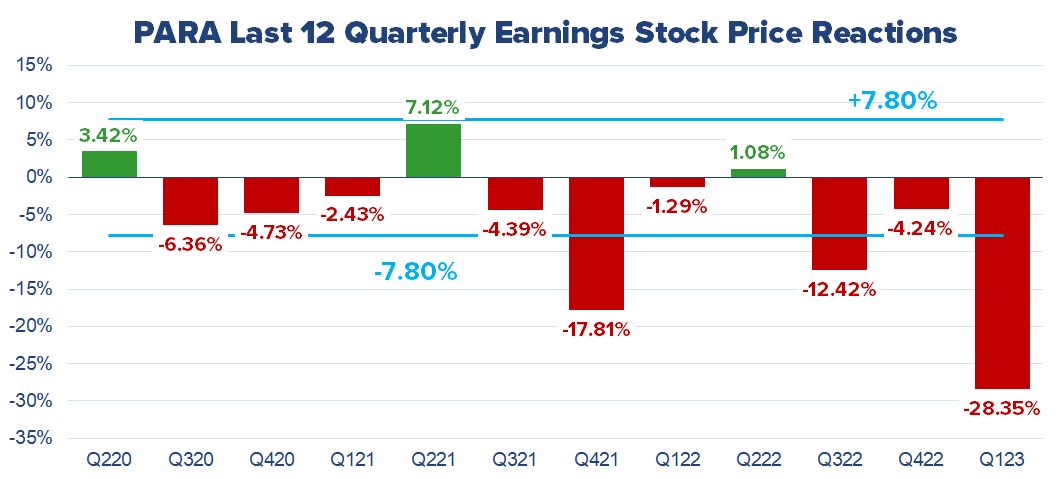

Paramount Global (PARA)

The graphic below shows the price reactions for the trading session following an earnings announcement. Note PARA experienced a significant drop in response to Q123 earnings. This is one of three double digit losses for PARA in response to earnings over the past three years.

The second figure shows the at-the-money (ATM) straddle pricing before and after earnings announcements.

There are two dramatic occurrences of underpricing. For Q421 the straddle lost almost 4.00 points and the most recent announcement was almost a 5-point loser. However, notice Q122, where the ATM straddle premiums were elevated with a small reaction resulting in the straddle overpricing the move by about 1.50. We expect after the 28% drop for PARA last quarter that the ATM straddle will be priced at a premium relative history.

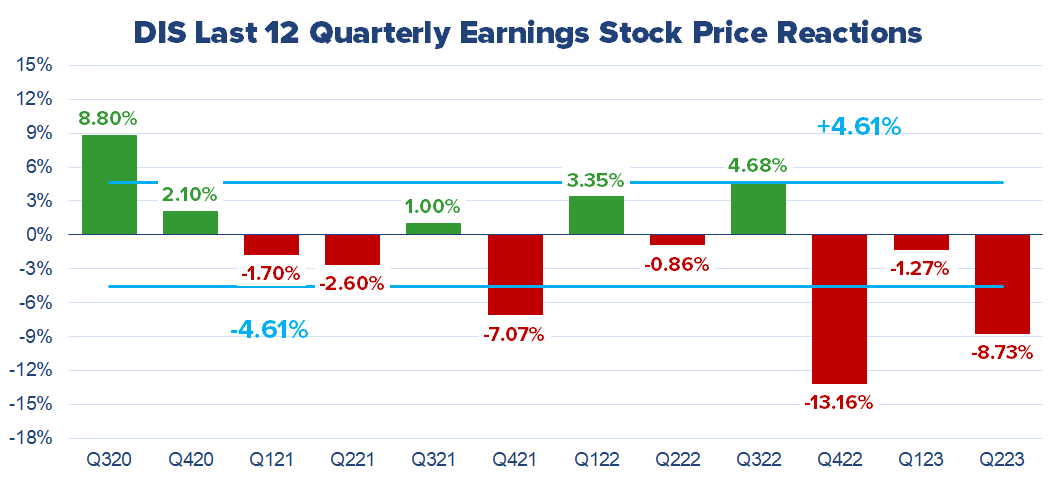

The Walt Disney Company (DIS)

DIS earnings will be widely watched as the firm has undergone some dramatic cost cutting at ESPN. The stock is also near 2023 lows, so expectations should be bearish.

Last quarter DIS shares dropped 8.73% in reaction to earnings and of the last three announcements, DIS shares have dropped more than the average move off earnings. It is doubtful many traders will have bullish set ups going into Wednesday’s report.

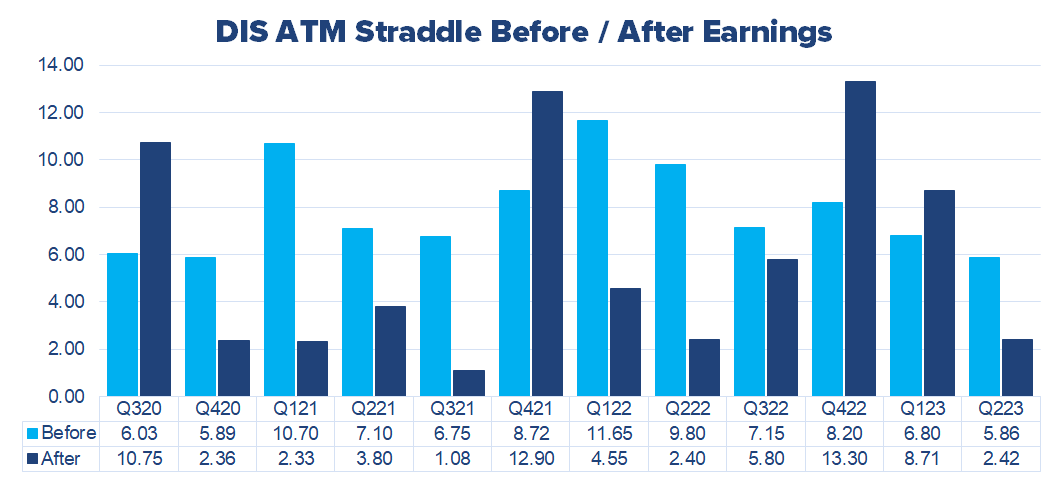

Note below, that despite shares dropping dramatically, the ATM straddle did not experience a significant loss. We expect the ATM straddle to price in a larger than expected move.

***This gragh was upated on 8/7 after a reader pointed out an error in the DIS straddle data for the last two earnings reactions***

CPI

Daily index options offer a pure method of trading the reaction to major economic numbers. Since there is debate around how well the Fed is managing inflation, CPI continues to be a significant figure for the financial markets. We track S&P 500 (SPX) and Nasdaq-100 (NDX) one-day straddle pricing around major economic events.

Starting with SPX, the figure below shows the one-day price change on CPI days going back 12 months.

The average price change on CPI day is +/-1.63%. For perspective, the average daily price change for SPX over the same period is +/-0.89%. Do note the last four reactions to CPI have been less than the 1.63% average move, but also lower than the average daily move over the last 12 months.

The graphic below shows the ATM straddle price action. The last time the ATM SPX straddle dramatically underpriced the subsequent move was in November 2022.

The tech heavy Nasdaq-100 (NDX) reactions to the CPI report average over 2% for the last 12 months, but the average (not on the chart) for the last 2 months is a much tamer +/-1.05% as inflation concerns have subsided.

The NDX ATM straddle pricing is lower than in late 2022 as well with the last five CPI day reactions resulting the straddle closely pricing the reaction.

Analysts expect CPI to move slightly higher with this report, which may be taken in stride or could result in fears of a second bout with inflation. If the premium is low relative to history, we may be calling for buying NDX options in anticipation of an outlier move.

I have some questions about data on DIS ATM Straddle Before / After Earnings.

I use ToS thinkBack feature to collect data and I see on 05/10/2023 the DIS 101 straddle is priced at 5.86, but on 05/11/2023 that same DIS 101 straddle is priced at 8.71. Likewise on 02/08/2023 DIS 112 straddle is priced as 6.80 and the next day after earnings I see DIS 112 straddle priced at 2.42.

Am I doing this right? Or is there some other method you use to collect this information?