S&P 500, Nasdaq-100, And EURO STOXX 50 Numbers To Know Before Friday's Payroll Report.

NFP reactions have been lower than average trading days for most markets in 2023.

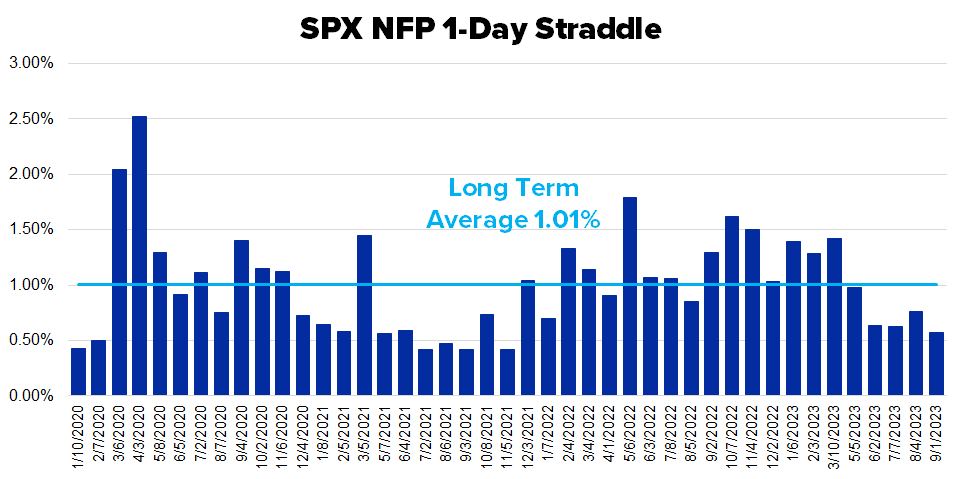

First, apologies for not having a Sunday market preview, but family time is important, and I was at my daughter’s college parent’s weekend. Also, none of the firms we track report earnings this week, but we do get the Non-Farm Payroll figure Friday before the market opens. Since short-dated index options are all the rage, we focus on the pricing of options on the close the day before an announcement that will expire on the close the day of the announcement. The first chart for the S&P (SPX) below shows the one-day price change for each NFP day going back to January 2020.

The average price change over this period is +/-0.87%, slightly lower than the average one-day price change for SPX of +/-0.97% over the same period. The past three SPX reactions to NFP reports have been small and so have the more recent straddle prices. The long-term average for the straddle pricing as a percentage of the underlying is 1.01%. However, note on the chart below, the last couple of NFP days saw the SPX straddle priced at about half that amount.

Finally, we track the SPX straddle pricing relative to the price move on the chart below. The past three announcements turned out well for option sellers, despite the straddles pricing in a lower projection the day before.

The Nasdaq-100 (NDX) is a more volatile index than the S&P 500 due to more economically sensitive names in the index. The average move for NDX on payroll Friday is +/-1.17%, which is slightly lower than the price change for all days over the same period which is +/-1.27%. Of course, there are some large moves in both directions on the chart below, with NDX dropping as much as 4% and gaining almost 3% on NFP days. Like SPX, NDX reactions have been below the long-term average for the last few reports.

The NDX straddle pricing has averaged 1.28% over the past three plus years. Note the last few announcements the straddle was priced below the long term average, but not to the extent of the SPX option market.

The last four NFP announcements resulted in profits for NDX straddle sellers. The August figure is interesting when comparing the previous chart and the chart below. Note the profit for both August and September announcements was similar, but the straddle prices differed greatly.

Traders around the world pay attention to the NFP report and now that there are short-dated index options now available for the EURO STOXX 50 we are keeping an eye on that market. The chart below shows the price change on NFP days for the EURO STOXX 50.

For US traders unfamiliar with EURO STOXX 50 options, they close at 11:30 eastern time, which gives a trader plenty of time to trading around the employment number which is released at 8:30 eastern.