Review Of SPX And NDX 1-Day Straddles And Why We Are Staying Short (For Now)

Saturday Review For August 26, 2023

We have been very vocal about turning bearish on the markets with two major factors contributing to this outlook. The first is the recent relative performance of the Nasdaq-100 (NDX) versus S&P 500 (SPX). Last week NDX was up just over twice the move from SPX, which shakes our confidence a bit. However, for August NDX is down over 5% while SPX is 3.99% lower. We may be letting human behavior get in the way, but if that gap flips with SPX relative performance consistently underperforming NDX, we are cautiously staying short. The other data point that keeps us bearish is VIX which has not made a new 2023 low since late June despite SPX putting up 2023 highs a few times.

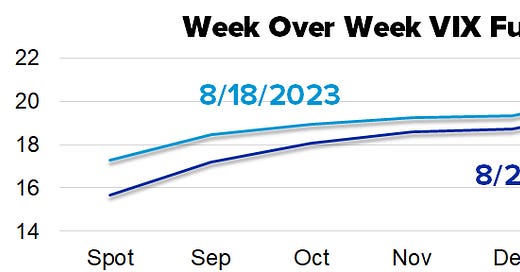

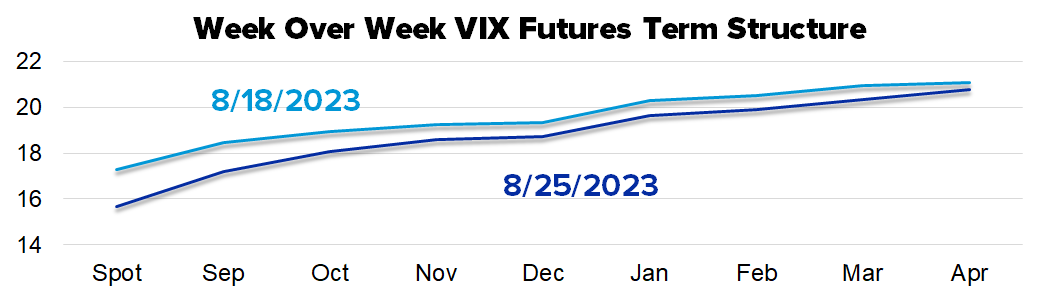

The VIX term structure shifted lower in sync with the spot index dropping 1.62. Note despite some scary looking days for equities as of last that the curve remains in contango. Also, do not try to read too much into the dip indicating the December future pricing. This seasonality comes around every year due to the number of market holidays between standard December VIX expiration and the SPX option expiration used to determine December VIX settlement.

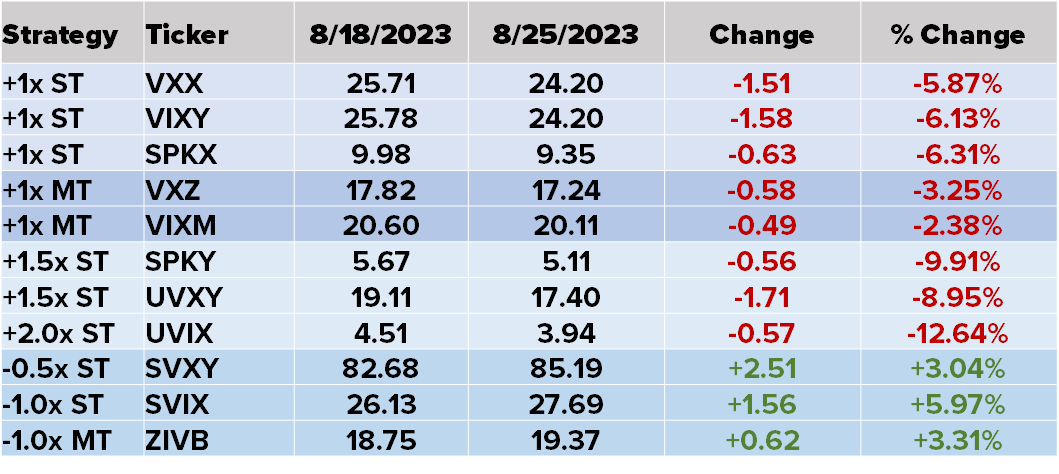

The volatility related ETPs behaved as expected with SVIX gaining almost 6%. The long funds drifted lower as would be expected. Do note the steepening of the curve in the chart above, this bigger the premium of the second month versus the front month, the more of a headwind for long funds and tailwind for short funds.

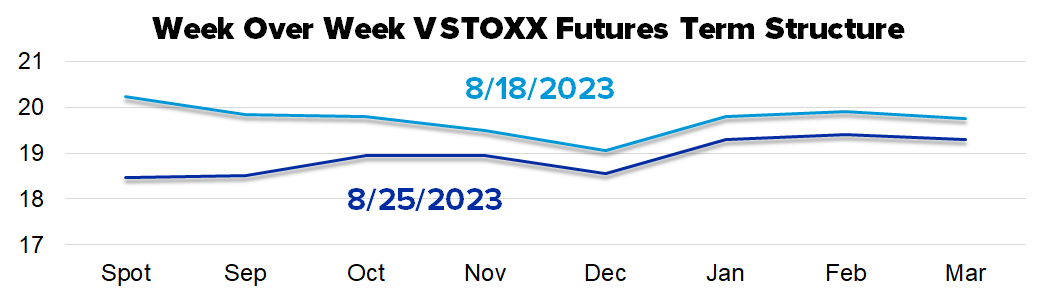

The VSTOXX curve is a contrast to the VIX term structure. The prior week ended with the VSTOXX curve in backwardation going out to December. This reversed itself last week with the spot index and September future basically in line with each other. The curve is closer in description to being flat than anything else. We always associate a flat curve with elevated uncertainty for the underlying market.

We had two firms report earnings last week and if we had to guess which of the two would put up the big earnings move, we would have been dead wrong. Macy’s (M) dropped over 14% in response to earnings. However, the option market priced in a large move, so the at-the-money (ATM) straddle went from 1.66 to 1.90, despite the big move from the underlying. NVIDIA (NVDA) was practically unchanged with the dust settled after reporting earnings, despite the stock rising as much as 6% earlier in the day.

Finally, when checking on 1-day ATM straddles for SPX and NDX, the results from last week tell two different stories. First, SPX

SPX overpriced the subsequent move three out of five days last week which is within expectations, with the two outlier days coming Wednesday and Thursday. Note the Thursday straddle was more expensive than the other straddles as the market braced for the first day of the KC Fed’s Jackson Hole meeting.

NDX straddle sellers fared poorly last week with three days where the straddle settled more than 100 points higher than the straddle premium. Note Thursday, like SPX, the pricing is elevated relative to the other days, but not elevated enough to offset the subsequent move in NDX.