New Short VIX ETP Launched Friday With Less Volatility Due To Unique Structure

Weekend Review For Week Of March 17, 2025 - March 21, 2025

A new product was added to the VIX ecosystem on Friday as JP Morgan rolled out the Inverse VIX Short-Term Futures ETN using the ticker VYLD. This is an exchange-traded note (ETN) which means the issuer is not required to hold a position in the underlying securities on behalf of the shareholders, which means we do not get a report on holdings to analyze.

The big question is why we need this, but the structure is unique enough to be additive to the VIX liquidity pool if it picks up assets. A one-point price change in VYLD would be the equivalent of a 1% change in holding the relevant short positions in the front two monthly VIX futures contracts. This results in a much less volatile method of shorting volatility than the other short VIX-related ETPs. This also results in long-term underperformance relative to show VIX ETPs like SVIX.

For a historical of VYLD versus other VIX related ETPs we used a short position in the index VXX is based on (S&P 500 VIX Short-Term Futures Index). To demonstrate the lower volatility associated with the VYLD methodology we look at the ten best and ten worst days for VXX and highlight how VYLD would perform on those days based on the index.

The worst and best days for VXX are both associated with Volamageddon. The worst performance was on February 5, 2018, and the best the following day. Note that a short VXX position was down by over 49% while owning VYLD would result in a loss of 14.60%. The following day a short VXX position gained 35% while VYLD was only 7.67% higher. Time will tell if this method catches on, but it contrasts enough with the other VIX related ETPs to be additive to volatility focused trading books.

It was a calm market on a week-over-week basis with all the equity indices we follow in the green, but in the green by less than 1%. Except for VSTOXX the volatility indices were hit hard last week, although the US focused volatility indices were coming off elevated levels.

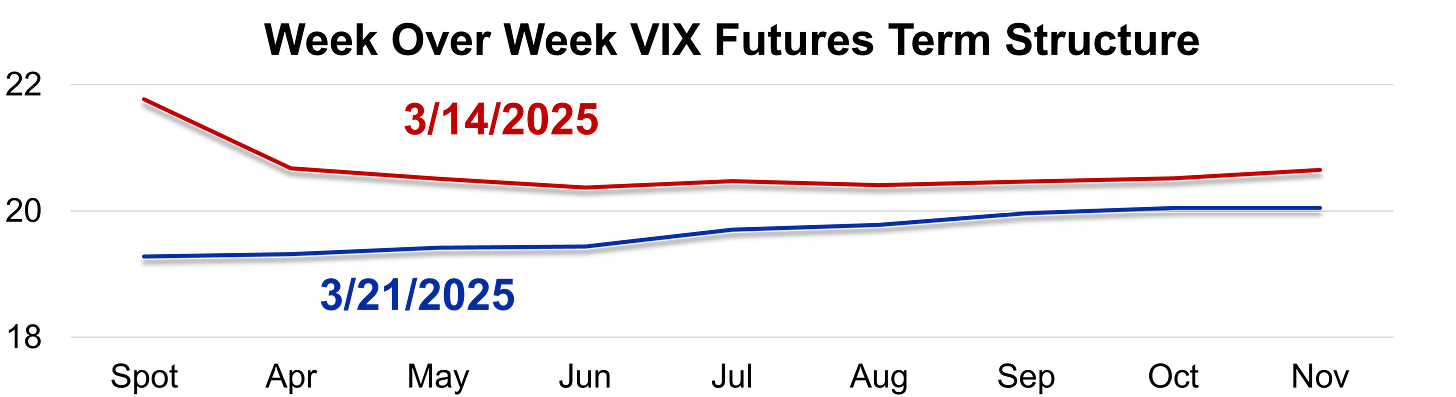

The VIX term structure shifted from backwardation to very slight contango last week. The current structure is flat with the spread between the spot index and the highest priced future at just under 0.80. Historically this is associated with market uncertainty, which is a good description of the current market environment.

VYLD will be added to the table below next week, however the index was 1.32% higher for the week, a bit lower than the 6.08% return for SVIX. On the long side, UVIX is holding on to the 30’s, despite losing 13% on the week.

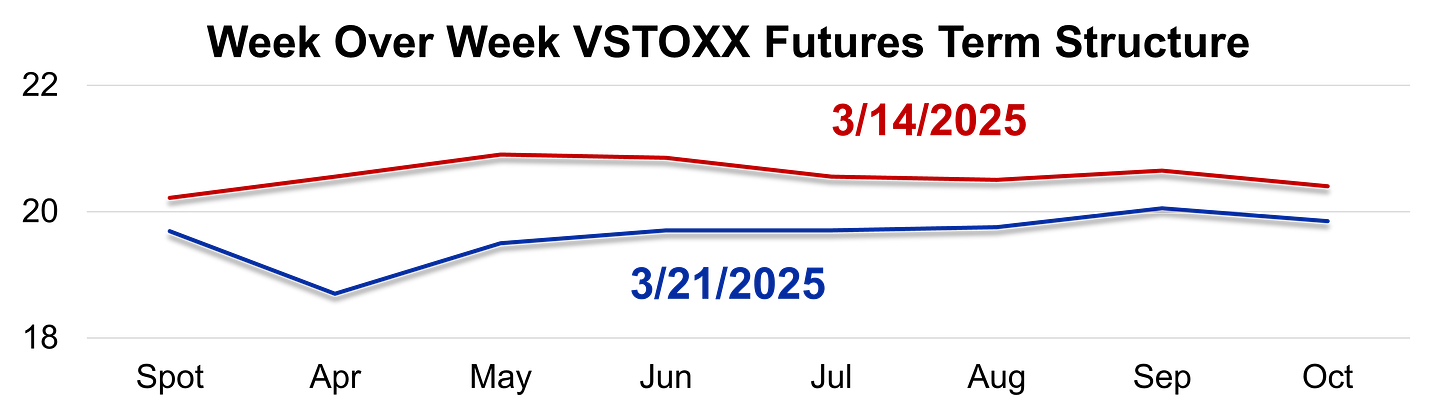

The VSTOXX term-structure is flat with an outlier in April. The future at a discount like that could be considered bullish for the Euro Stoxx 50 as lower VSTOXX is usually associated with higher equity prices.

2025 has been a tough year for option sellers, but this past week was a winner for sellers of 1-day index options. Starting with SPX, the only down day was Tuesday with a loss of 15.34. Note the Straddle % Of Index level was 0.79%, the lowest of the week.

Last week was an old school third Friday option expiration so we have four PM expirations to work with in the NDX arena. Like SPX, Tuesday was a tough day, but the rest of the week more than made up for Tuesday’s losses.

RUT straddle sellers went four for five last week with Wednesday putting up a small loss.

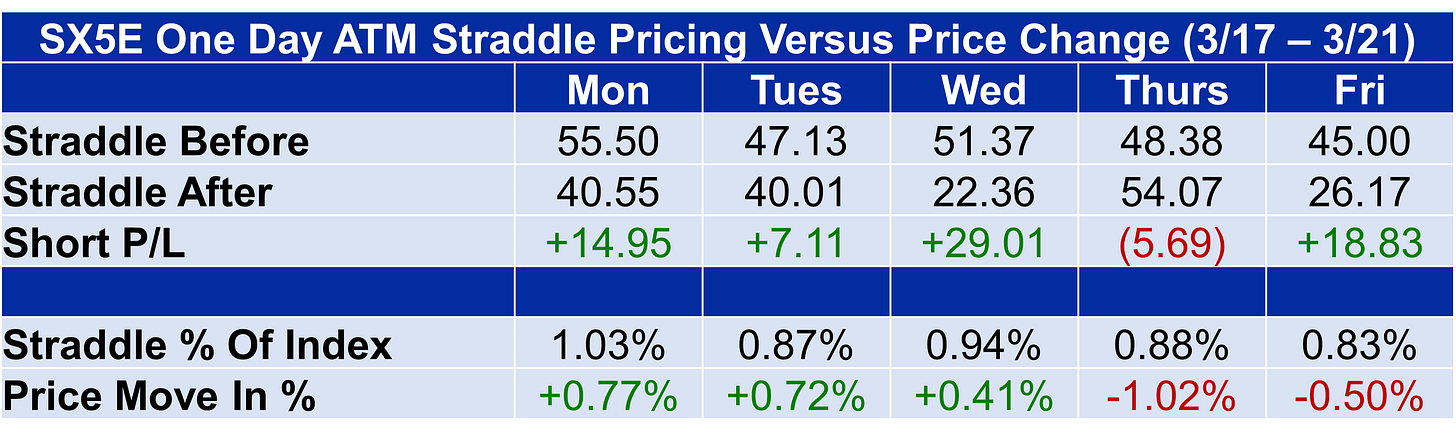

European index option traders selling ATM straddles did well last week with only a small loss on Thursday for the Euro Stoxx 50 market.

Like all other markets DAX index options overpriced four of five days last week with Thursday being the tough day in that market.