Market Adjusts For Elevated Rates Plus An SVIX Strategy Using A Basic Option Strategy

Saturday Review For September 23, 2023

My Saturday ritual begins with a ‘Tony Soprano like’ stroll to the end of my drive to pick up Barron’s. The top line this week reads, “A Brutal Week For Stocks – What’s Next”. It was the second worst weekly performance for stocks in 2023 as the Silicon Valley Bank debacle put more pressure on the S&P 500 (SPX) and Russell 2000 (RUT) with RUT losing over 8% in a single week back in March.

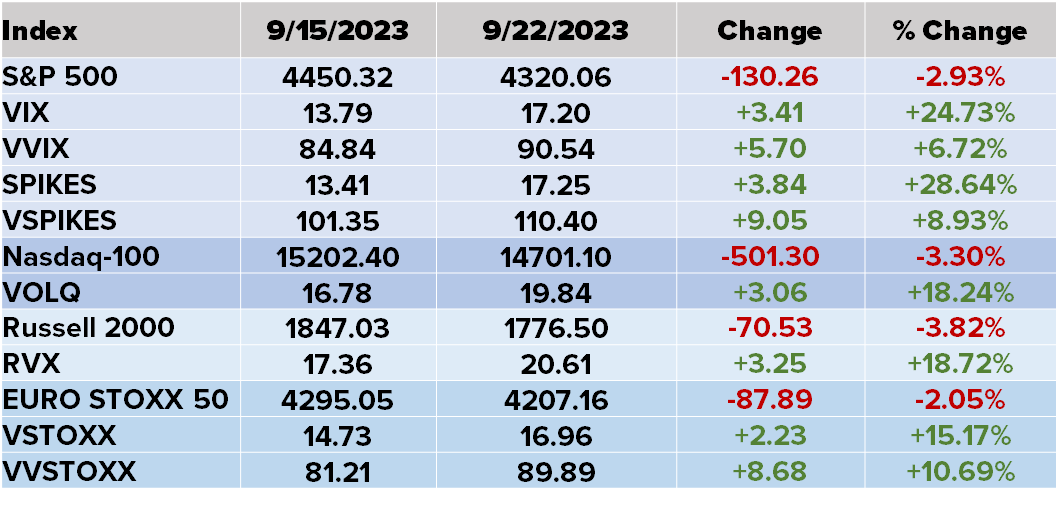

The volatility indexes adjusted higher, based on the FOMC announcement on Wednesday. When I say ‘adjusted’ I mean the whole VIX curve moved higher. VIX rallies come in two varieties. One is when VIX runs up and the futures have a muted response with the curve flattening or moving into backwardation. The other is when VIX moves higher, and the futures shift higher as well. The second one is what we got last week with most of the move happening on Thursday. Come Friday the new front month October contract was up slightly closing in line with spot VIX.

The long ETPs shined with the move higher in VIX futures. UVIX (which will reverse split 1:10 next month) was the big winner, while SVIX lost over 10%. A little lower in this space is a discussion of an SVIX strategy that makes sense in the current environment.

The VSTOXX term structure remains choppy, but did move higher across the board this past week. The December seasonal dip in the curve is a function of the extra days off in December / January so do not read too much in that outlier.

The 1-day ATM straddles for SPX, Nasdaq-100 (NDX), and the EURO STOXX 50 (SX5E) were all impacted by excess volatility last week. Starting with SPX, which was priced below 0.50% of the index on Monday and Tuesday, levels usually showing up on holidays. Likely the market felt we would be in a wait and see mode until Wednesday’s FOMC. After two outlier moves on Wednesday and Thursday, the premium for Friday’s ATM straddle was at 0.81%, higher than FOMC day and higher than the price move that day.

NDX ATM straddles followed the same pattern as SPX, with lower than average pricing Monday and Tuesday, slightly higher pricing on FOMC Wednesday and after the big drop on Thursday, an expensive straddle on Friday.

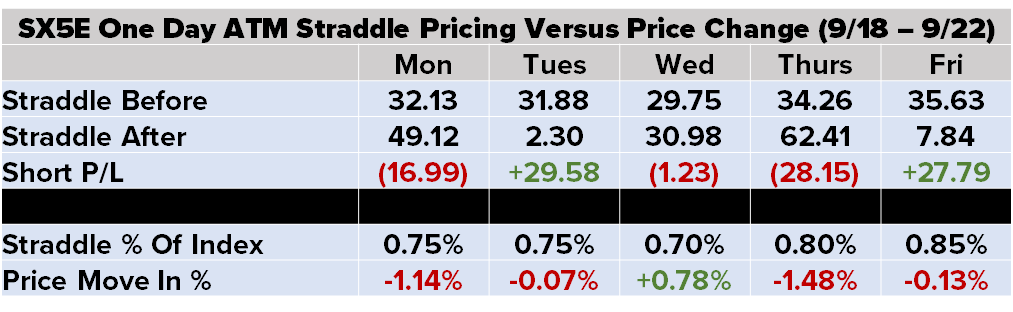

The relatively new SX5E 1-day straddles have mostly been overpriced, but last week was a tough week for option sellers as the straddle pricing underpriced the subsequent move three of five days. However, do note the two days where the move was less than the straddle, the profit for sellers more than makes up for the three underpriced days.

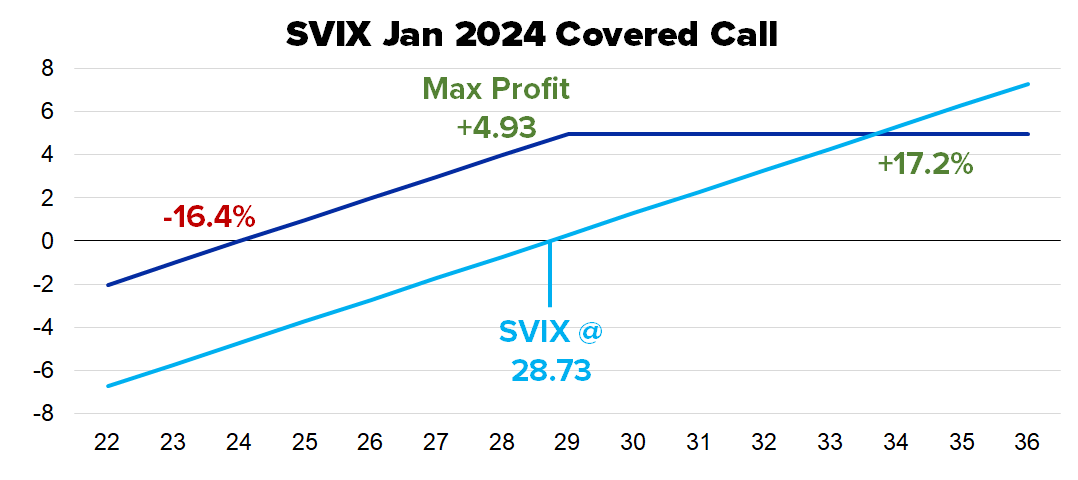

Finally, a quick trade idea. Normally I talked about big trades that are interesting, but with the drop in SVIX there is an interesting trade using a boring strategy. The spread is a covered call, which is at the low end of complexity, but based on the nature of SVIX it makes a lot of sense here.

On Friday, SVIX closed at 28.73 losing over 10% on the week. If a trader purchased SVIX and sells the Jan 2024 29 Call for 4.70 they have some downside protection equal to the 4.70 premium. In exchange for that premium, an SVIX holder is obligated to sell shares at 29.00 on the third Friday of January.

When I was at the Options Institute, we were told to never talk about a covered call being a hedge, it is an income strategy. However, selling this call guards against losses down to -16.4%. Conversely, the max profit is equivalent to SVIX moving higher by just over 17%. Finally, there is no rule stating short calls must be held to expiration. Any weakness in SVIX may create a trading opportunity to cover your short calls with a plan to sell again with an SVIX rebound.