Long Dated AMZN Option Trade Based On Bullish Outlook

Barron's Option Trading Series Week Of December 18

Something I have done for decades since getting a subscription to Barron’s for Christmas when I was 16 (I’m 56 now) is use recommendations from Barron’s to explore option strategies. This normally involves an investment idea I like from that weekend’s issue but applying option strategies based on the timing and price target associated with any recommendation. As part of my new consulting efforts, I plan on sharing this exercise on Monday’s when appropriate.

With all that, there was nice article in Barron’s laying out a bull case for Amazon (AMZN) in 2024. The article is found on page 11 with a price target of 190 noted over the next 12 months. With those two pieces of information, I searched for expirations about 12 months out with January 17, 2025, being the best expiration series available right now.

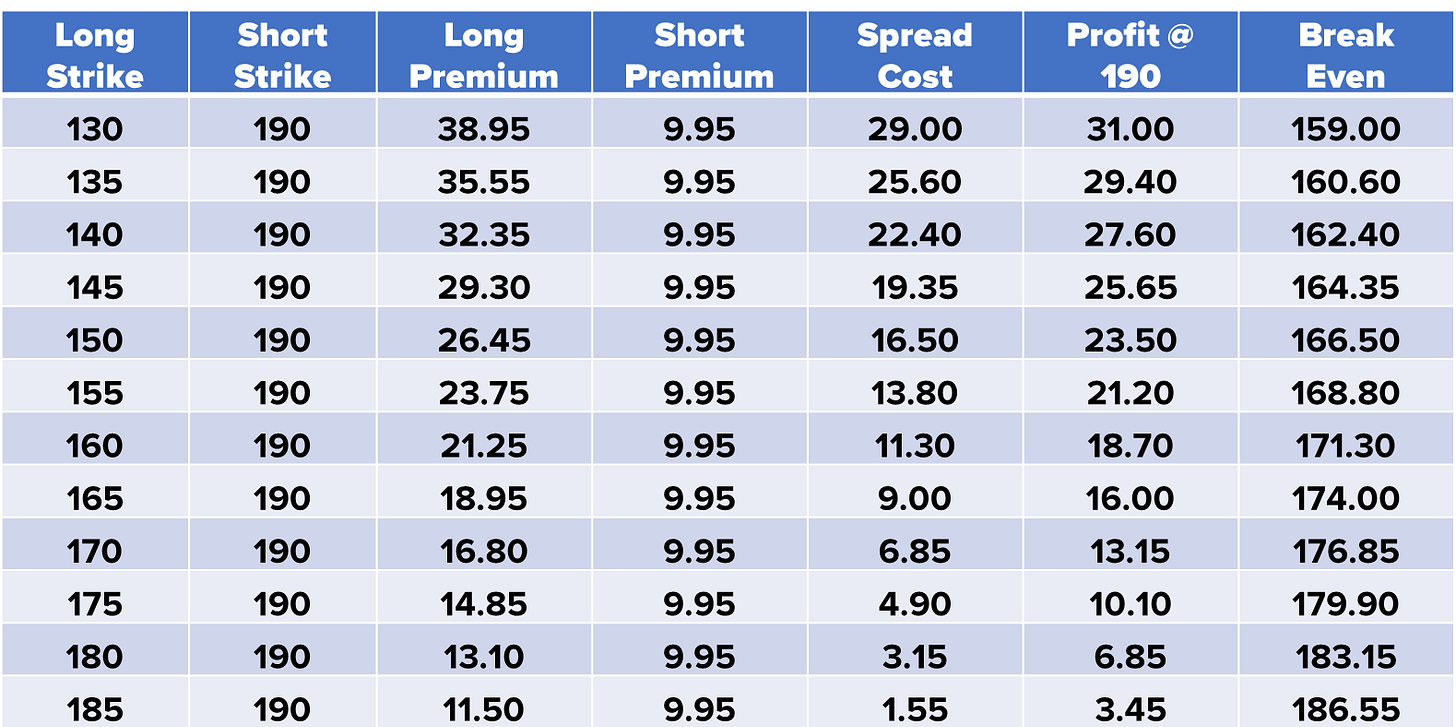

Often the trade will be a vertical spread selling the strike that coincides with the price target and buying another option based on the risk / reward and break-even levels of the trade. The table below shows the price paid combining a long Jan 2025 call with a short position in the 190 call.

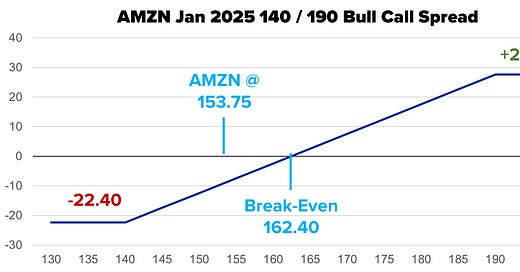

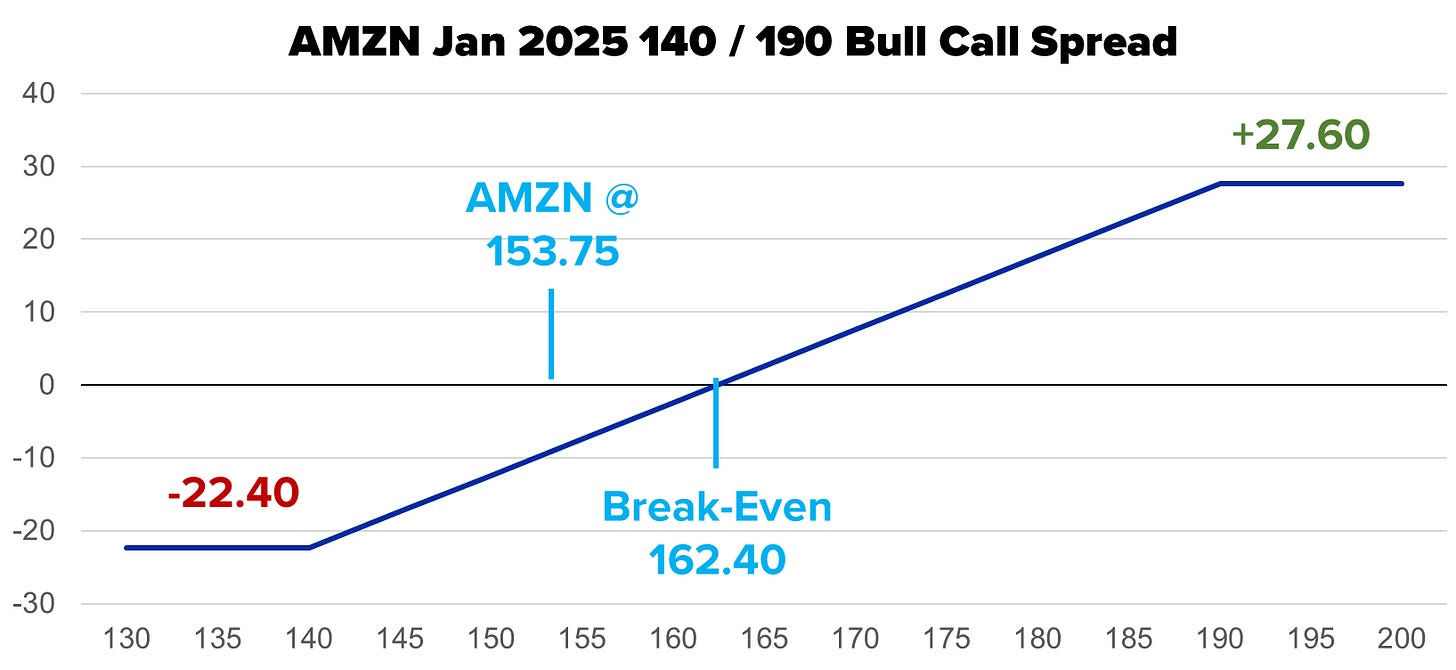

This part of the exercise is subjective and based on my own risk / reward rules as well as how strongly I agree with Barron’s recommendation that prompted the option trade. I do like to have a bigger reward than dollar risk, especially for trades using options (LEAPs technically) that have several months to expiration. For this outlook we like buying the AMZN Jan 2025 140 Call For 32.35 and selling the AMZN Jan 2025 190 Call for 9.95 resulting in a net cost of 22.40. The payoff below is based on holding the trade through expiration.

Recall, AMZN was trading at 153.75, when the data above was captured for this exercise. The break-even level on this trade is less than ten points higher at 162.40. Finally, the reward is higher than the risk or cost of the trade at 27.60 versus 22.40.

So now we watch and if AMZN quickly runs to the target price of 190, there may be a managing trade, otherwise this may be on our radar through early 2025.

Finally, 2023 has been a transition year for me as I wrap up my time at EQDerivatives. The best email for me going forward is russell@listder.com - feel free to shoot me any questions or suggestions about what you would like to see more of in this space.