Index Option Trading Around Non-Farm Payroll Reports

We Look At How SPX, NDX, RUT, and SX5E Behaved In 2023

Friday January 5 brings us the first big economic number of 2024 with the release of the December Nonfarm Payrolls (NFP) report. This monthly employment situation report is a first look at economic activity during the previous month. With daily index options available in a variety of markets we track the at-the-money (ATM) straddle pricing on the close before and on the report day to gauge the mind of the market around this important number.

The data for each index covers 2023 or eleven NFP reports from last year. Note the March report, released on April 7, 2023, occurred on a market holiday.

S&P 500

Starting with the S&P 500 (SPX) we note the average move on NFP day in 2023 was +/-1.05% is 40 basis points higher than the average daily change for SPX in 2023 (0.65%). Note on the graph below that the average move has only been exceeded once since June 2023.

The next graphic shows the 1-day ATM straddle pricing the day before and at settlement on NFP day. SPX options overpriced five and underpriced six NFP moves last year. Despite the magnitude of the moves shrinking as the year progressed, two of those underpricing scenarios occurred in the fourth quarter last year.

Nasdaq-100

The average Nasdaq-100 (NDX) price reaction to the payroll report in 2023 was +/-1.28%. This figure is higher than the average NDX change on all days of +/-0.91% last year. Note on the price change graphic below that the average has been exceeded in the second half of 2023, although only once. Also, the 0.39% price change in December is interesting as it is the lowest of the three major US indices with daily index options.

NDX straddles underpriced the subsequent move four of the eleven observations last year. Two of those instances where market reaction exceeded the straddle premium showed up in the last three months of 2023.

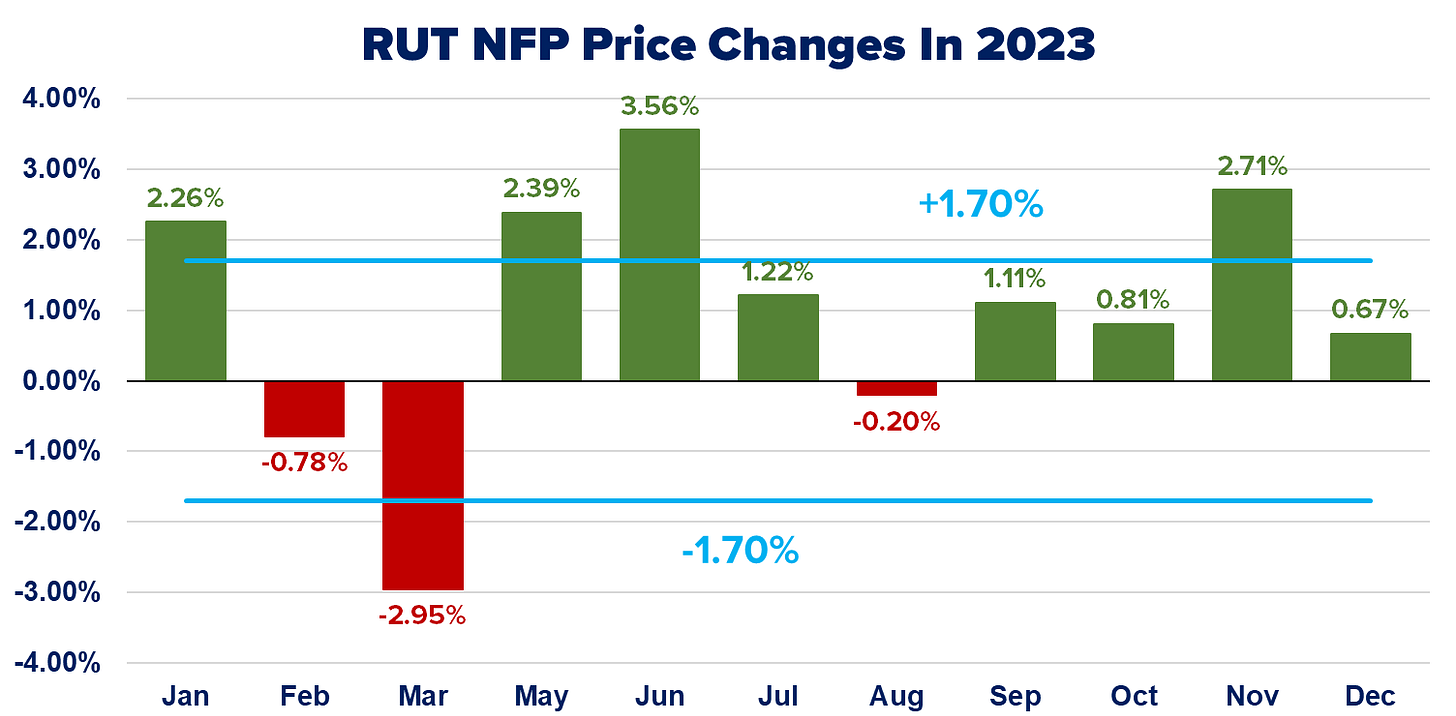

Russell 2000

First, we are aware that daily expirations for the Russell 2000 (RUT) are not available. However, there are Friday PM expirations on NFP day, so we have relevant data. Also, this will not be the case as the RUT complex will have daily index options starting next week.

The Russell 2000 is more volatile than SPX and NDX and 2023 was a tough year for small cap stocks, at least until December rolled around. The average NFP move for RUT is +/-1.70% which is 69 basis points higher than the average daily move last year (+/-1.01%).

RUT options underpriced the NFP move seven of eleven observations last year. This is a contrast to the SPX and NDX. It does reflect the struggle for small caps last year, but the last four reports, which all resulted in a higher RUT may be an indication of more small cap strength in 2024.

Euro Stoxx 50

EUREX introduced Euro Stoxx 50 (SX5E) daily expirations in late August 2023. This market mirrors US market reactions to NFP, with an average change of +/-0.87% which is a bit higher than the average of +/-0.65% on all days last year.

The price change chart below shows the reactions in 2023 to the employment number were mostly positive with only two losing days. Also, the reaction was more volatile for SX5E than US indexes in the fourth quarter.

Finally, we only have four NFP reports with daily SX5E expirations. The data below shows two instances of overpricing and two of underpricing, although the October report is close to a tie.