It is another week without stocks with heavily traded option markets reporting earnings. This leaves us with FOMC and how the S&P 500 (SPX) and Nasdaq-100 (NDX) have reacted around FOMC announcements. Before getting to that, we want to look at the market’s prediction for the next FOMC move (spoiler, it’s not a hike).

As of last Friday, the derivative markets priced in a 0.8% chance of a hike. That’s not 100%, but that projection is likely dead on. The chart below shows the market’s odds of a hike starting with the last FOMC meeting (July 26, 2023) through Friday Sep 15, 2023. With one brief exception, the odds basically trended lower.

The projection for other FOMC announcement dates experienced a bit more volatility. The next meeting, on November 1, is forecasted at 31.0%, but rose to a tad over 69% over the past few weeks before moving to lower levels.

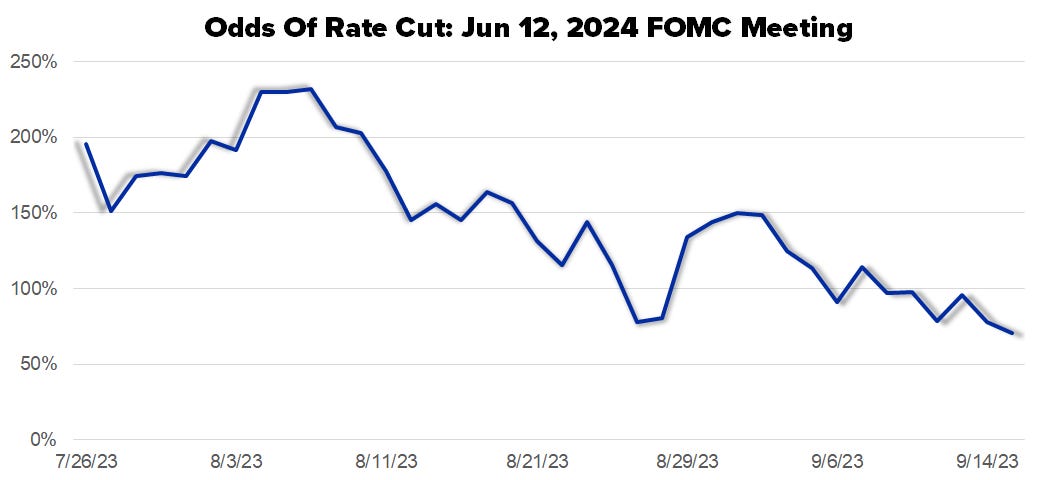

We are not going to show all the meeting odds, but we do want to highlight a couple of 2024 meetings and when the first cut may be coming. The chart below shows the odds of a cut, which was well over 100% after the last FOMC meeting. Note the odds may be over 100% as the hike is based on the market’s projection of a rate change. So, 120% means certainty of a 25bp cut and 20% chance of the FOMC hiking by 50bp.

Since the last FOMC meeting the odds of a cut in March 2024 have worked down to only 20%. So when does the market (not economists, the market) think the next FOMC move will be? Currently the meeting with more than a 50% chance of a change is Jun 12, 2024. You can see on the chart below the odds at just over 70%.

The June FOMC prediction, at 200% on the earlier part of the chart above indicates an expectation of total hikes of 50bp by that meeting. Note the odds are now 70%, but much lower than the peak in early August.

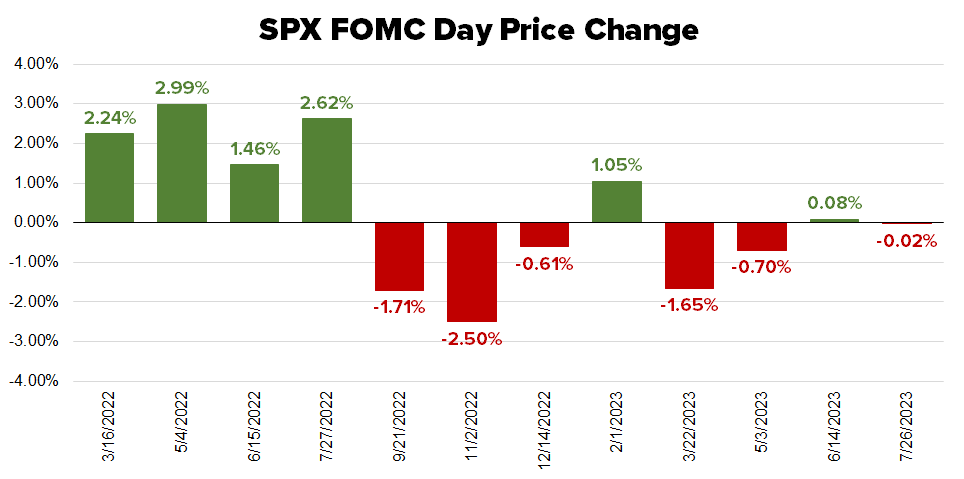

We like to track the performance of 1-day at-the-money (ATM) straddles the day before and the day after (expiration day). The first chart shows the price changes for SPX on the last twelve FOMC announcement days.

Words are not really needed here, as the volatility around FOMC announcements has fallen to a level where the last three announcements experienced price changes that are less than an average day, not just an average FOMC day.

The ATM straddle pricing has also trended lower and we would not be surprised to see a cheap straddle, based on history, due to the small price changes at the last three meetings.

The most recent NDX price changes on FOMC have all fallen under the average price change on all days in 2023 (+/-0.95%). It appears as there is more certainty around the end of rate hikes, the market reacts a bit less to announcements.

Finally, the straddle pricing on the chart below has trended lower since the December 2023 announcement. This is a function of tamer moves, more market certainty, and a lack of an outlier move like the price action for most announcements in 2022.

As always, it is anyone’s guess as to what the market reaction will be to this week’s FOMC announcement. We will be watching the straddle pricing late Tuesday and subsequent reaction as well as checking the tape for any good or bad trades into the announcement.