Trading in EURO STOXX 50® End of Day (EoD) options commenced today, August 28, with a handful of trades hitting the tape and then expiring on the same day. The following trades got our attention as market participants did not waste anytime to try out the new contracts.

First, there was a seller of 50 of the 28 Aug 4210 Puts when the underlying index was around 4260. This trade worked out well and was never in danger of having this short put position in the money. In fact, the trade was executed just about when the EURO STOXX 50® was near the low of the day.

The risk / reward for this trade is not for everyone as the trader only pocketed 0.30 but had substantial risk. However, post trade the index needed to drop 1.17% just to reach the short strike price and as noted the index move higher post trade closing around 4294.

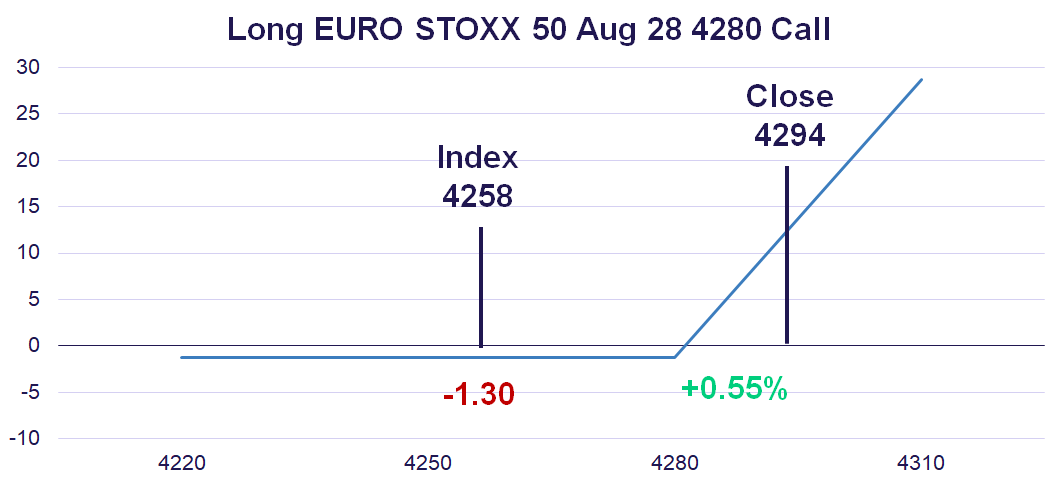

Another trade that caught our eye was a purchase of 50 of the 28 Aug 4280 Calls for 1.30. This trade was executed with the index around 4258. It appears it was held the expiration, which resulted in a nice profit.

This trade needed the index to climb by 0.55% to hit break-even and as can be seen above, this level was exceeded resulting in an option settlement price of 13.69. Not bad for what we assume is a first trade in the EURO STOXX 50 End of Day options.

Finally, we came across a purchase of 5 28 Aug 4265 Puts for 7.00 that was exited for 0.70 (a 6.30 loss) a few hours later. Instead of a payoff diagram, we have a price chart below highlighting today’s EURO STOXX 50 price action and where the trade was entered and exited.

After running up relative to Friday’s close, the index sort of settled in a tight range when the trader came in and purchased the puts. They appeared to be in good shape as the index moved below 4260 and the option’s bid price reached 12.75 with 60 contracts on the bid side so there was an opportunity to exit this trade at a profit. However, the index spent the last four hours of the day steadily working higher and the trader threw in the towel a little after 3:00 pm resulting in a loss of 6.30. Our assumption is 4280 may have been a trigger point where the trader decided they should cut their losses. Of course, not all trades are winners and we can always learn from bad trades as well as good trades.