Earnings Season Winds Down, Stocks Threatening A Run To New Highs

Weekend Review For Week of May 12, 2025 - May 16, 2025

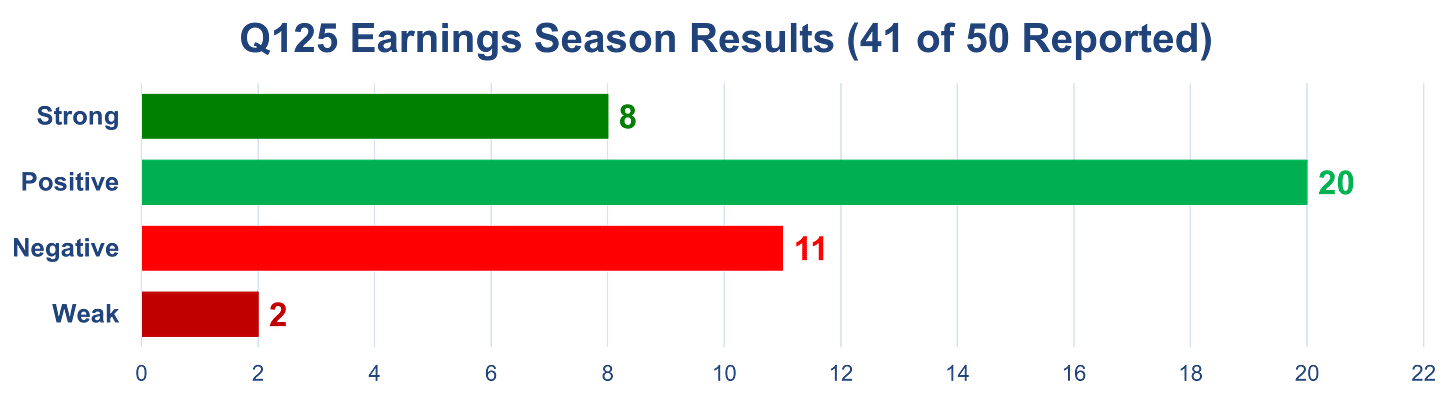

Only two of the fifty stocks we follow reported earnings last week. Cisco (CSCO) shares rose by 4.85% in response to earnings, just a tad below the average move of +/-5.02%. This classifies CSCO’s report as positive. The other firm reporting earnings was Wal-Mart (WMT) and shares were down 0.50%, a negative report based on our methodology. We now have 41 firms reporting with 8 strong, 20 positive, 11 negative, and only 2 weak reports.

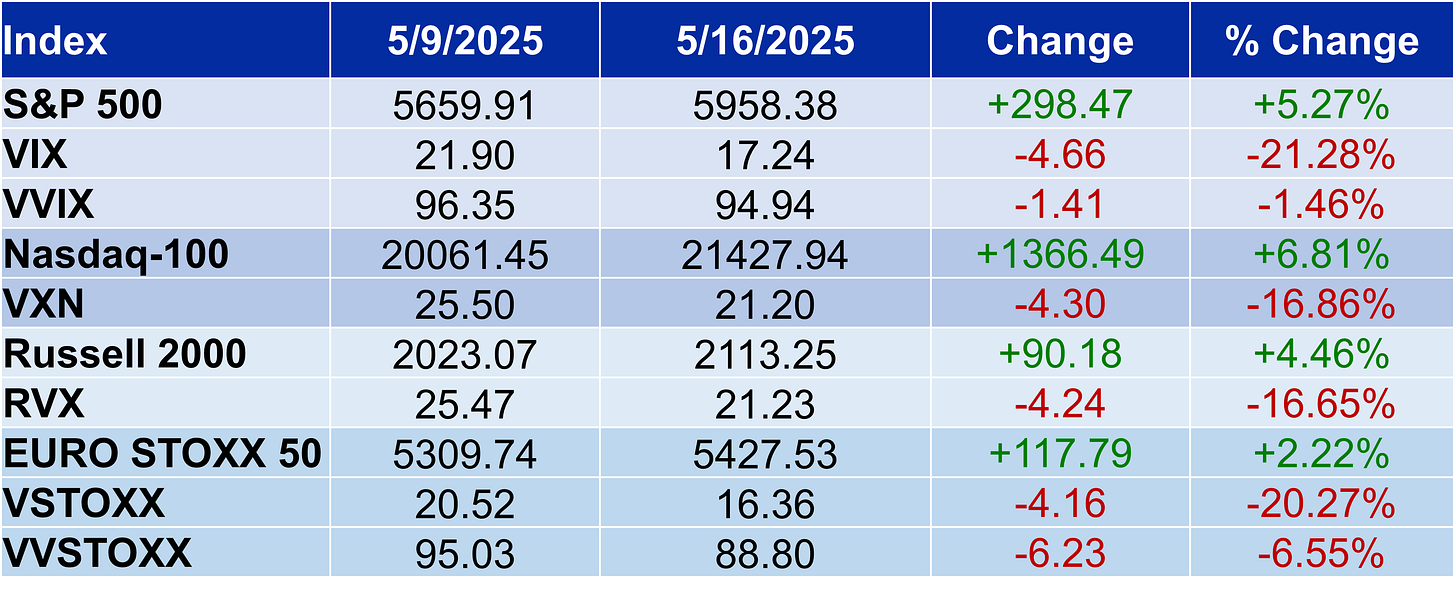

The Nasdaq-100 (NDX) was the big winner last week, rising 6.81% followed by the S&P 500 (SPX) at 5.27%, and the small cap focused Russell 2000 (RUT) up by 4.46%. VIX lost over 21.28%, which may sound like a lot, but is the 46th worst week on record for VIX. Stocks had a solid week in Europe as well, with the Euro Stoxx 50 (SX5E) gaining 2.22% resulting in a 20.27% drop for VSTOXX.

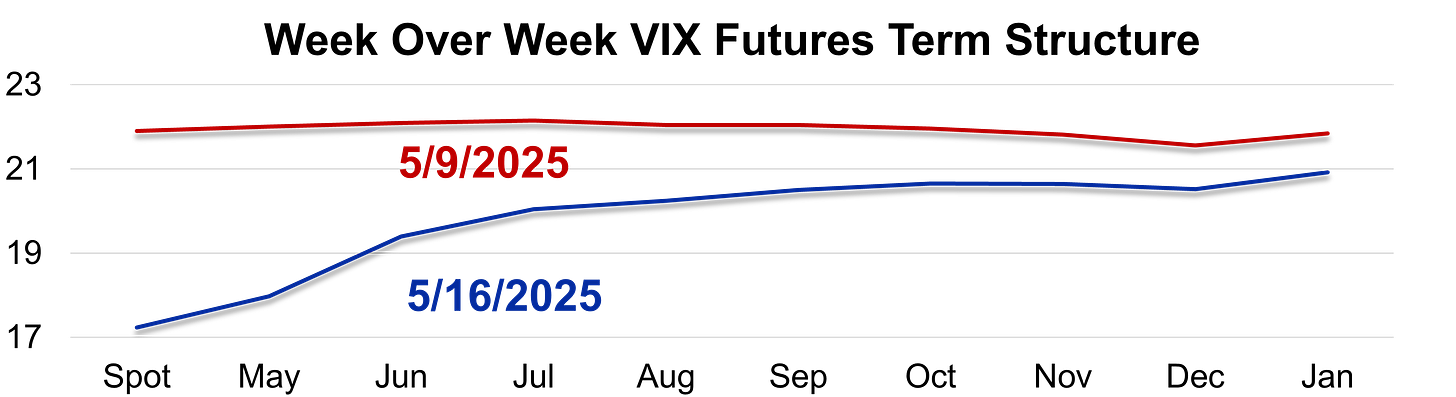

The VIX term structure moved to contango for the first time in weeks, something that is not surprising with then bullish move in stocks over the past few weeks. May VIX did finish at a premium to spot the Friday before May expires.

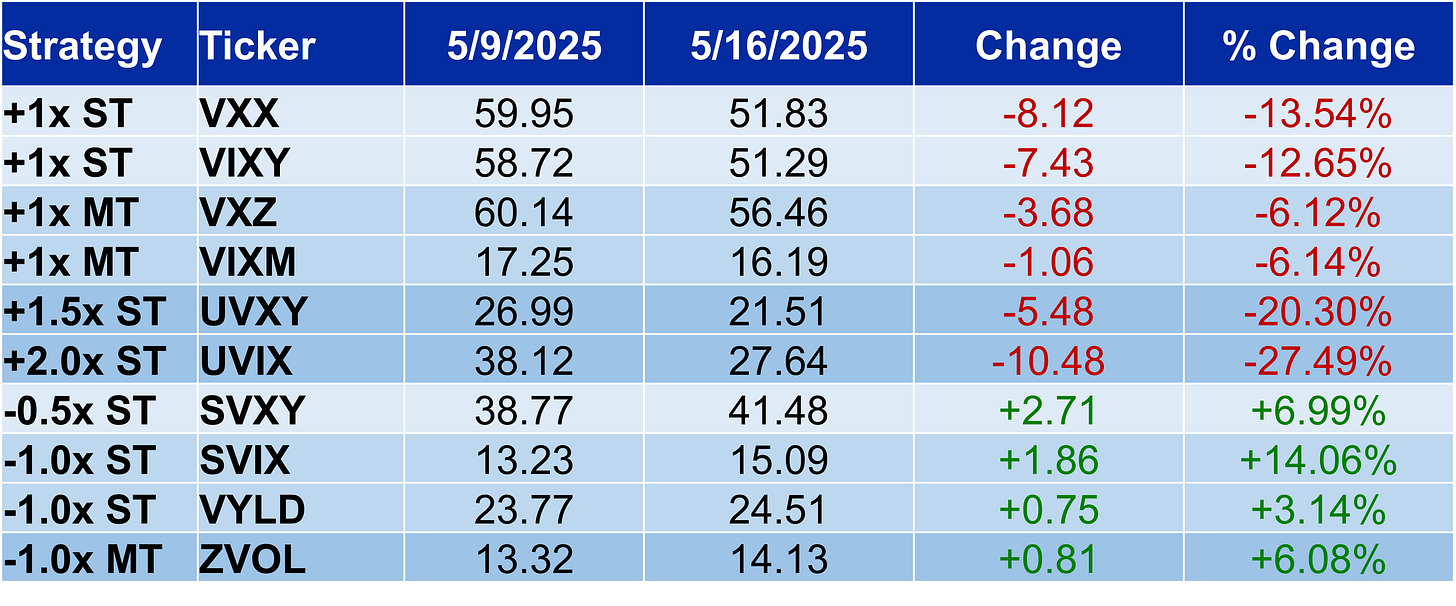

The move lower in VIX and the term structure damaged the long volatility funds with both leveraged funds giving up more than 20%. SVIX led the way on the upside, rising 14.06%.

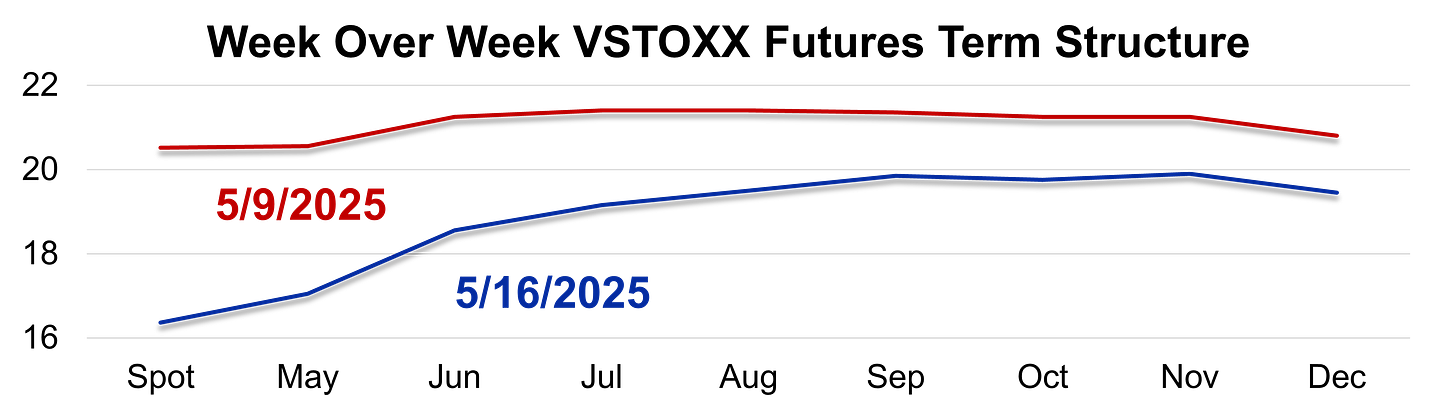

VSTOXX and the associated futures moved lower on the week and like VIX, the term structure is now in contango. One thing that is a bit different than history is VSTOXX is at a discount to VIX, this is a streak of 22 days now, the 10th longest on record. Typically, VSTOXX is at a premium to VIX, closing higher than VIX, just over 80% of the time going back to 2000.

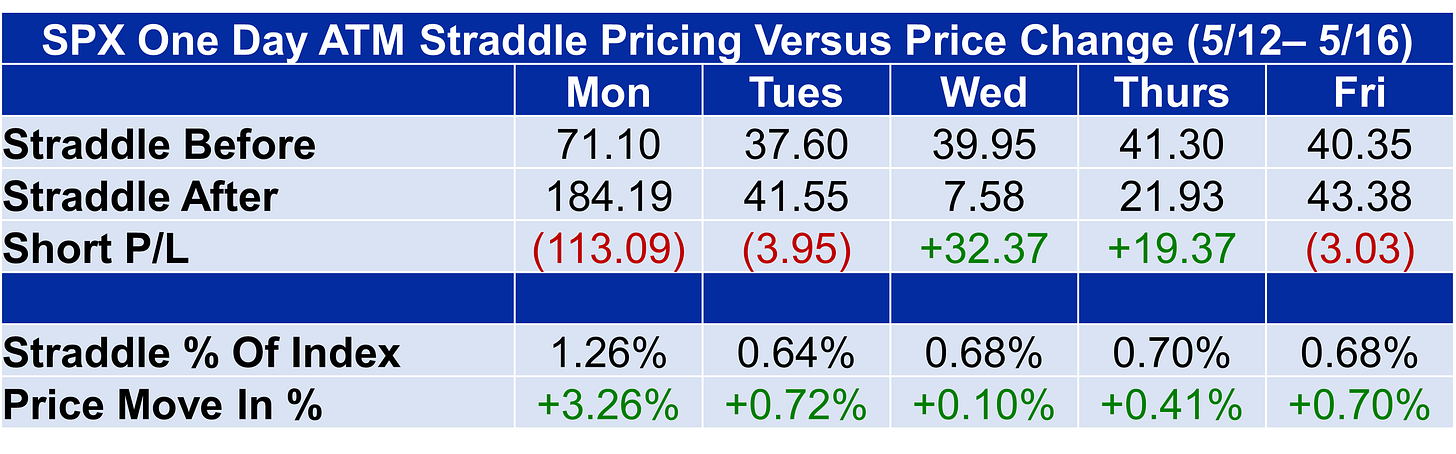

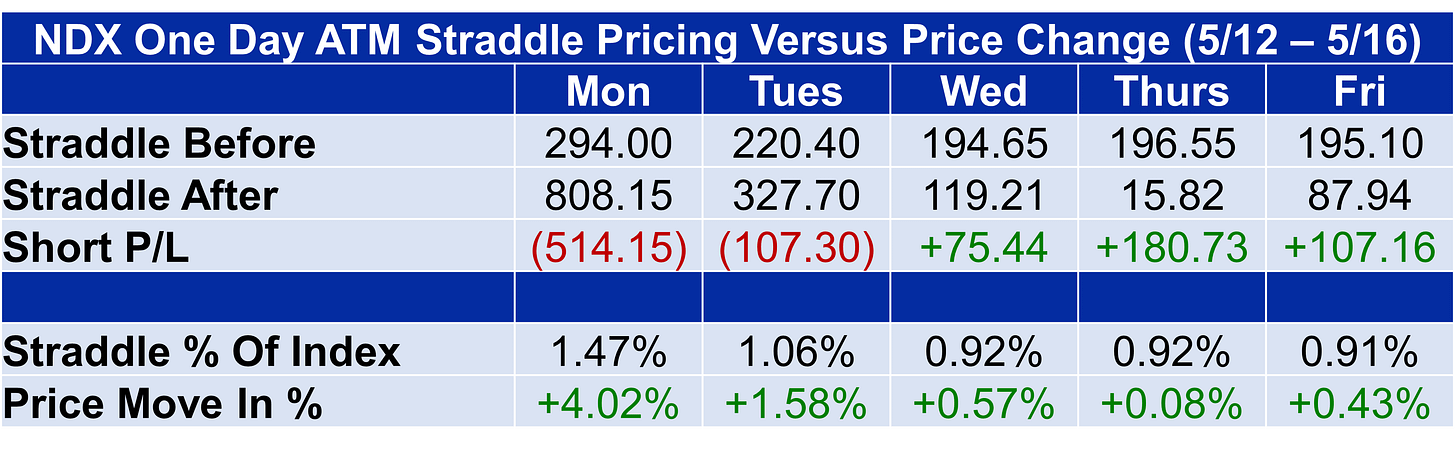

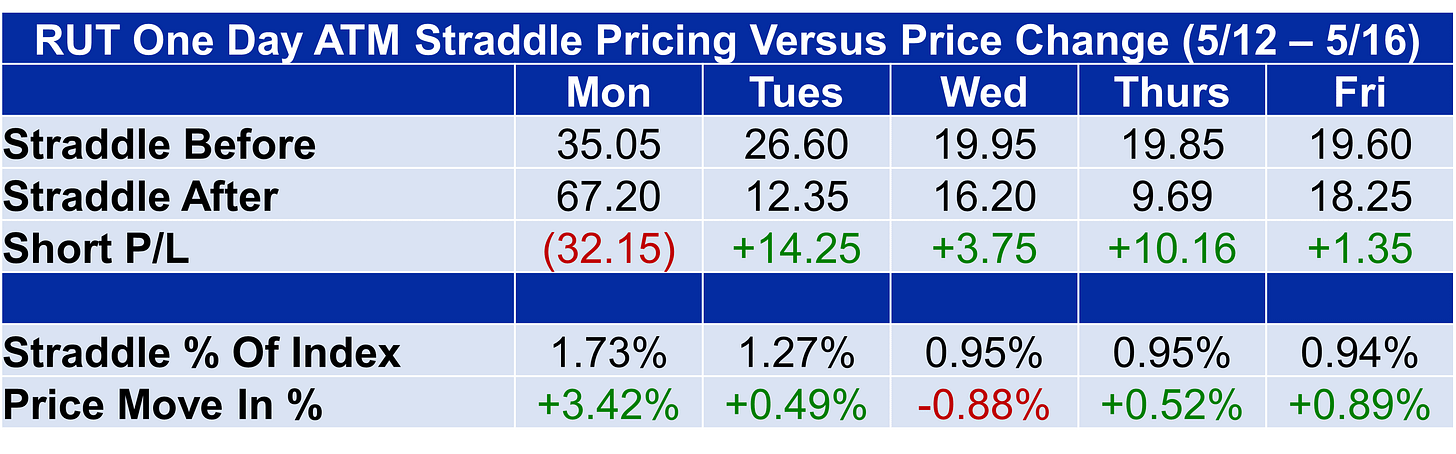

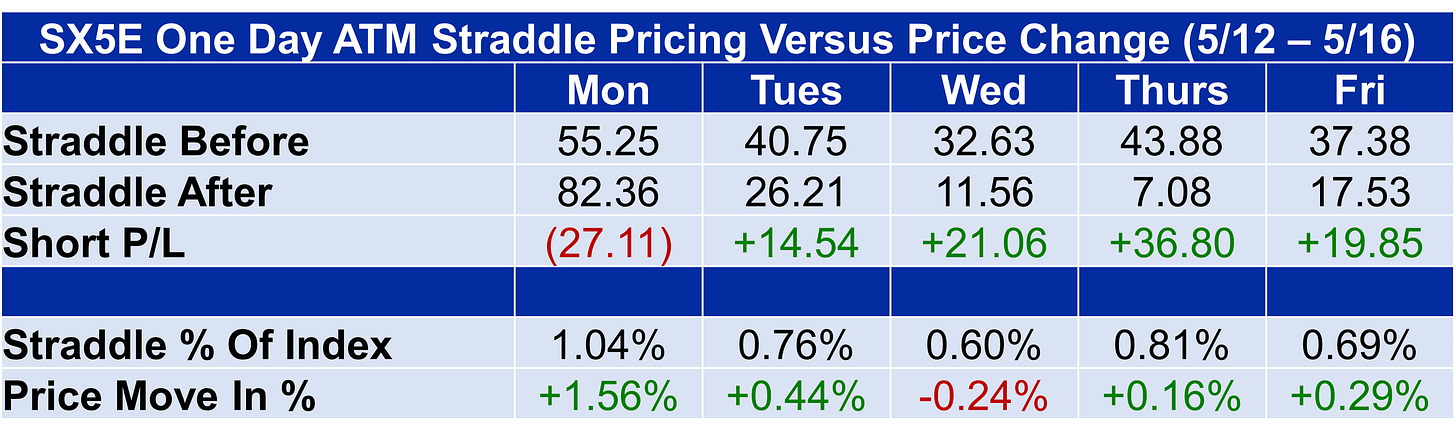

Monday’s gap higher for SPX, NDX, and RUT was a disaster for index option sellers. The balance of the week was mixed, with none of these markets making up Monday’s losses.

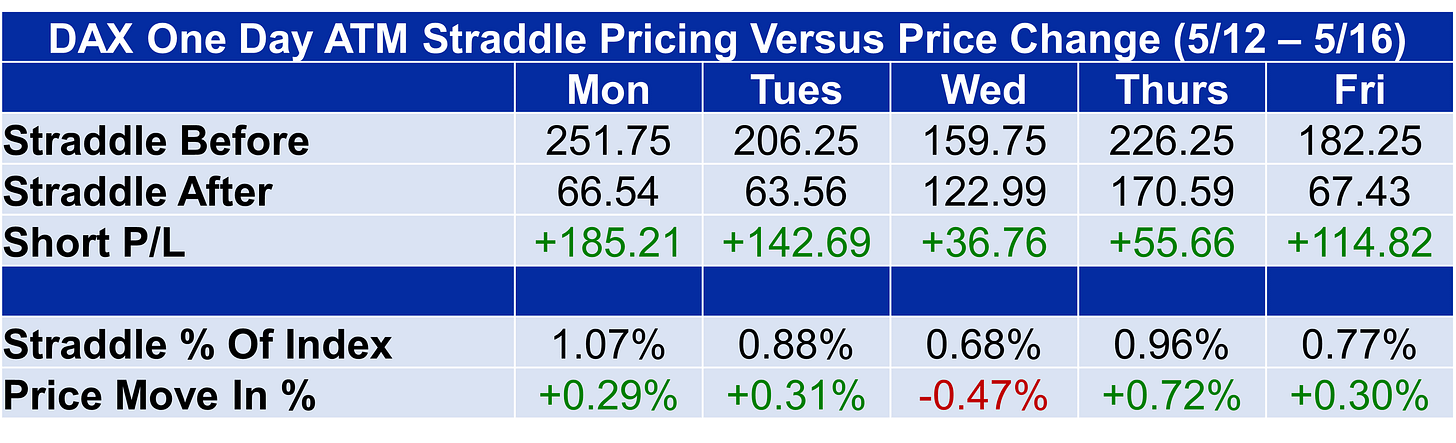

Index option sellers in Europe had a much better week than their US counterparts. The only losing day for SX5E was Monday and that loss was recovered by Wednesday. The happiest index option sellers were those using DAX, a market that was overpriced all five days last week.