Earnings Numbers For Options Traders: BA, TSLA, AMZN And Several More Reporting This Coming Week

Earnings Preview For Week Of October 21, 2024 - October 25, 2024

This coming week is the first of two big earnings weeks for our universe of stocks. As a reminder, we only track the stocks with the highest option volume in 2023 and have at least three years of earnings history to work with. The figures on the table below cover the last twelve reports for each. Each stock’s last twelve reactions and at-the-money (ATM) straddle pricing before and after earnings.

The idea behind sharing these numbers is for trader’s to have more information if they are considering trading options around earnings. I have been asked what stands out in these numbers, so this week I’ll add a note as to what I’m looking for.

FCX - Tuesday Before The Open

I would watch for underpricing of the straddle after two consecutive price changes in reaction to earnings that are half the long term average.

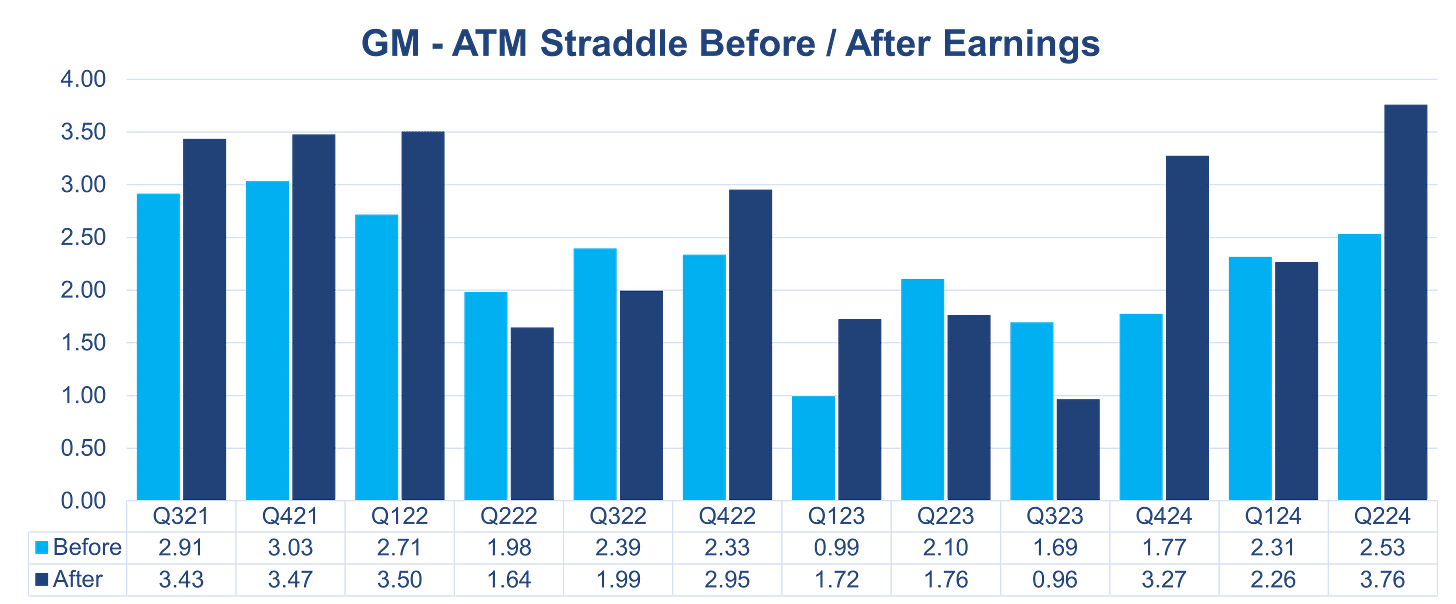

GM- Tuesday Before The Open

This is one of a few of our stocks that buying straddles around earnings has actually made money. As short straddles have a win percent of 41.67%. I would be cautious as two of the last three moves have been outlier moves (my term for price change greater than the long term average) so option premiums could be elevated making a long straddle too expensive.

VZ - Tuesday Before The Open

VZ is another stock that option buyers have made money around earnings lately. The last four reports were large moves, but despite this, premiums have remained low. This may be a better long volatility opportunity than GM as long as the cheap options trend remains.

ENPH - Tuesday After The Close

This is another stock that option buyers have done well with, however, just about all the profits for longs have come from three earnings annoucements. I honestly do not have a good opinion around this one. If the ATM straddle prices below 10%, I may consider a long trade, but that set up is doubtful.

BA - Wednesday Before The Open

BA has more issues to deal with than earnings, specifically quality issues and a recently resolved strike. I’m sure they will put a positive sping on things going forward so if forced to trade I would lean toward BA moving higher, maybe selling a 1% OTM put as the first leg of a bull put spread and choosing the long leg based on premiums, but I am not forced to trade.

KO - Wednesday Before The Open

I get made fun of when I post about KO, but this is one of the most consistent short option trades in our earnings universe. Option sellers have profitted ten of the last twelve reports. The issue may be too many people recognizing this and the options pricing a small move. If the straddle prices 0.75 or lower, note that is much lower than normal pricing, I may consider a long volatiltiy trade.

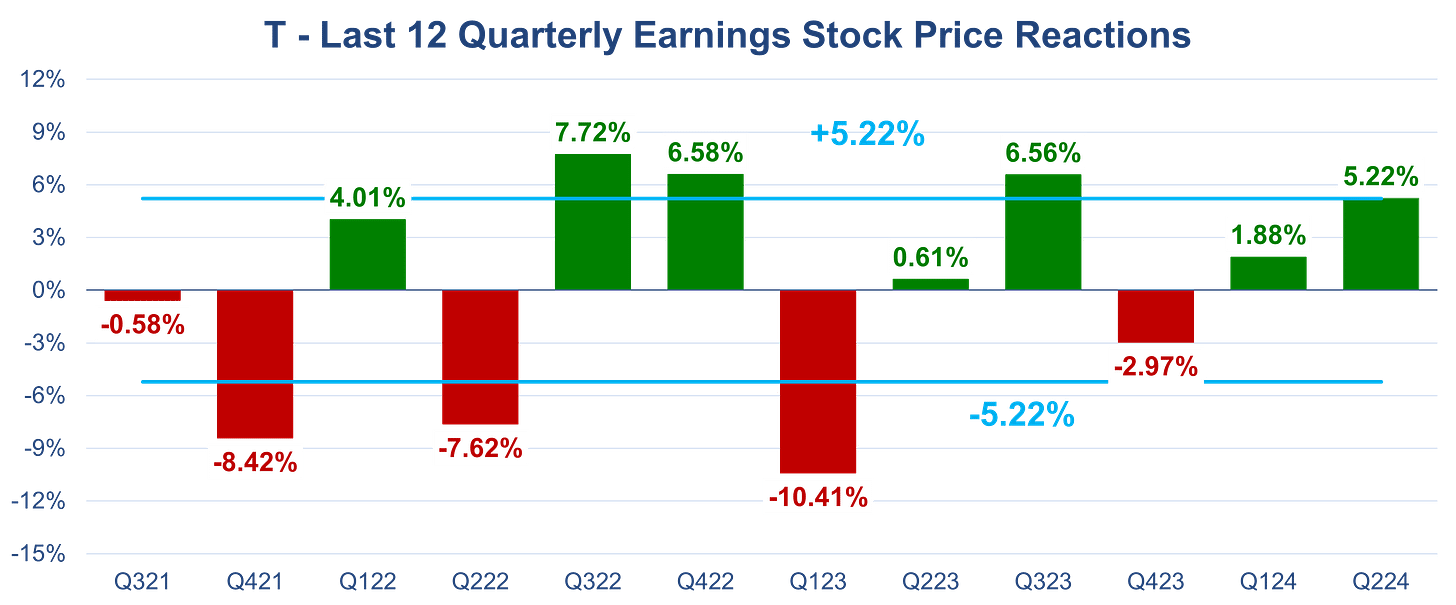

T - Wednesday Before The Open

T is very much of a coin toss related to earnigns. Any trade would be very dependent on the cost of the straddle, but like BA, I can be picky about whether to do anything here.

TSLA - Wednesday After The Close

If I can put on an iron condor that makes sense with the short strikes +/-10% relative to the stock, I’ll trade TSLA into earnings.

AAL - Thursday Before The Open

UAL rose 12% this quarter so expectations will be pretty bullish going into AAL’s numbers. I tend not to trade directionally so I’m hoping the 12% move from UAL results in a short volatility opportunity in AAL. AAL is also another market where the win percent for option sellers has been high, with profits realized the last ten reports.

AMZN - Thursday After The Close

AMZN is another crapshoot. There have not been many outlier moves over the past could of years. A chance to make money based on a move less than 9% may get us to pull the trigger on a short trade.

Mid-Day Monday -

FCX ATM straddle priced like last two reports

GM ATM straddle in line with history too

VZ ATM straddle priced slightly higher than historical average move - with stock at 43.80 put on a 40.50 / 42.00 / 45.50 / 47.00 Iron Condor expiring Friday for a credit of 0.37, risk up to 1.13.

Great content, R. Combining it with historical research I do on a symbol's post-EA IV crush & projecting it for an upcoming EA has really enhanced decision making.

FYI- $AMZN's EA actually 10/31 ATC. Wasn't yday (10/24).