Earnings History For NFLX, TSLA, And Several More Active Stocks Reporting This Week

Sunday Preview For Week Of October 16 - October 20

Next week is the first big week of earnings season with eight of the firms we track reporting earnings. The table below is a summary of this week’s reporters followed by a bit more in-depth information for each company.

Bank of America Corp (BAC)

BAC reports Tuesday before the open and follows three big banks that reported last Friday. All three (C, JPM, WFC) experienced price reactions that were lower than the three year history so it will be interesting to see if BAC follows suit.

Note the last straddle slightly underpriced the price move, this may result in elevated premiums and an option selling opportunity in BAC.

United Airlines Holdings (UAL)

The average price change for UAL is just under 5.50% and last quarter the stock moved up by only 3.23%.

Note the most recent quarter saw the ATM straddle elevated relative to the price change. If traders with short memories expect that to repeat it may create a buying opportunity.

Las Vegas Sands (LVS)

On four of the last five reporting days LVS moved more than the average +/-4.43%. Watch for expensive options going into earnings.

The short straddle underpricing the move last quarter may also result in higher premiums.

Netflix (NFLX)

NFLX earnings are always a crapshoot. The stock is overdue for a +/-10% or greater move.

In the futures market Natural Gas is referred to as ‘the widow maker’ due to huge earnings moves in the past that moniker may work for NFLX option sellers into earnings. Refer back to the table above to see the performance of selling straddles into earnings over the last 3 years (if you don’t want to scroll back it’s a loss of 151.16).

Tesla Inc (TSLA)

TSLA and NFLX reporting on the same day guarantees the talking heads will have something to talk about. Note the last three moves for TSLA have been outside the three-year average.

Straddle sellers have been losers for the last three TSLA earnings announcements, high enough premiums will help end that streak.

American Airlines Group (AAL)

UAL reports earlier in the week so options may take a cue from that reaction.

Note, despite the outlier move last quarter, the straddle pricing was elevated resulting in a small loss.

Freeport-McMoran (FCX)

FCX has not had an outlier move since Q1 2022. They may be due for a big move and the option market may be sleeping on this one.

Note the last quarter’s move was much less than the average move, but the straddle pricing was also lower resulting in only a small profit for any sellers.

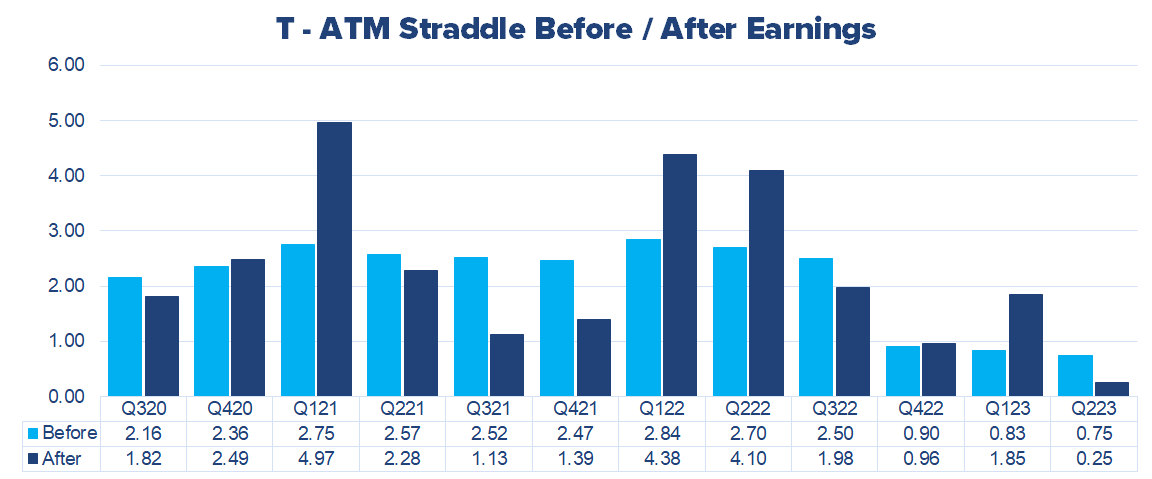

AT&T (T)

T hardly budged last quarter off earnings, after four consecutive outlier moves.

Note the low premiums around the last three announcements, cheap options may present a buying opportunity here.