CPI / PPI Plus Big Box Retail Earnings On Tap

Sunday Preview For Week Of November 13 - November 17

Next week brings us insight into consumer spending next week with a combination of the Consumer Price Index (CPI) and earnings from a couple of big box retailers. Additionally, the Producer Price Index (PPI) and Cisco earnings round out the calendar.

Starting with the economic releases, we get CPI before the market opens on Tuesday. Inflation appears to be under control, but there are some who expect a second bout with inflation. An upside CPI may add to the concern that the Fed has not yet whipped inflation.

The average S&P 500 (SPX) reaction to CPI over the past 12 months has been a move of +/-0.95%. However, note the last big move was in November 2022, which skews the average higher.

Straddle pricing in front of CPI has come down a bit in line with the price reactions. Options have been cheap going into CPI over the past few months and the lower premiums have mostly overpriced the subsequent move.

The Nasdaq-100 (NDX) has averaged +/-1.42% around CPI, but like SPX this number gets a boost from a huge rally in November 2022. Note the last three reactions have been less than 0.5% and the last reaction (-0.37%) was less than the SPX reaction of -0.62%.

The last three straddles have been overpriced relative to the subsequent move and option sellers have not really been run over by the NDX move since last November.

PPI follows CPI with the release on Wednesday before the market opens. SPX reactions to PPI have been a bit more volatile lately, even though the average move is less than CPI at +/-0.75%.

Straddle premiums have been mixed with the SPX price change exceeding the straddle pricing as recently as September.

The average move by NDX in reaction to PPI is at +/-1.06%, a figure that has not been exceeded since July.

Unlike SPX, the last three straddles have been in line with the reaction to PPI.

Earnings next week has three retailers plus Cisco (CSCO) reporting. The consumer has been cited as the savior of the economy, results from Wal-Mart (WMT), Target (TGT), and Macys (M) will offer some insight into recent consumer spending, but also expectations for the rapidly approaching holiday season.

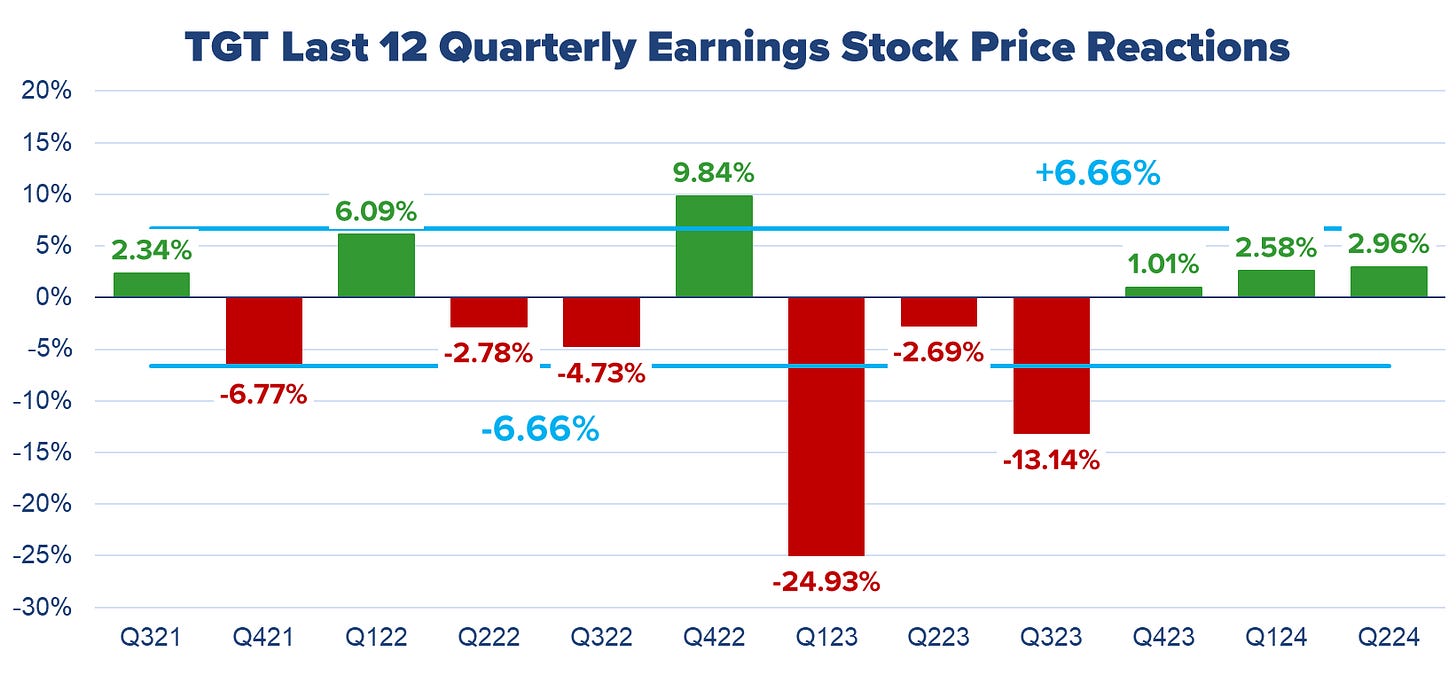

Target (TGT) Wednesday Before The Open

Cisco (CSCO) Wednesday After The Close

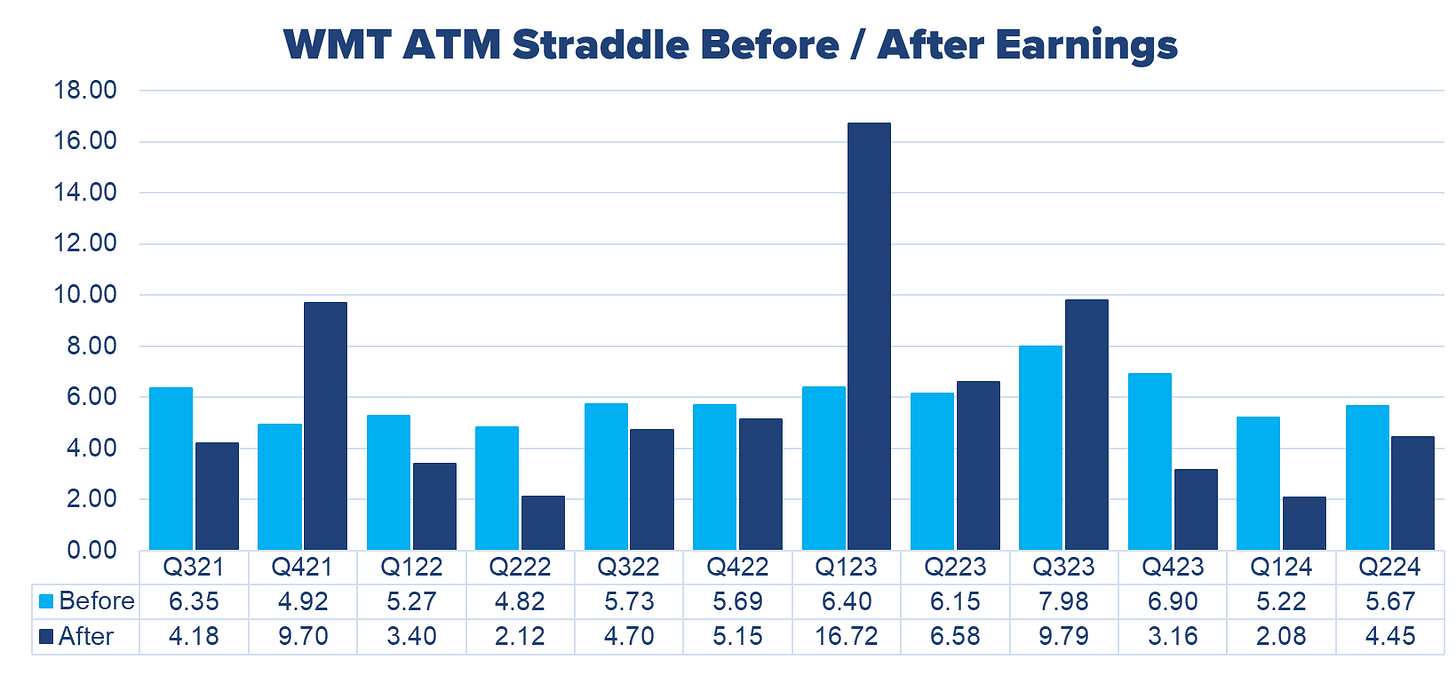

Wal-Mart (WMT) Thursday Before The Open

Macy’s (M) Thursday Before The Open