Call Volume Four Times Put Volume On First Day Of Option Trading For iShares Bitcoin Trust – Is It Really That Bullish?

Tuesday November 19 was the first day of trading for options on the iShares Bitcoin Trust (IBIT) ETF. Mid-day Tuesday I checked on volume and at that time over six times as many calls as puts had been traded, this figure dropped to 4.44 by the end of the day on total volume of over 353,000 contracts. At first glance, call activity is thought to be bullish. However, those that know the option market are aware a big call trade could be bearish, if it is a sale, or it may be part of a bearish call spread.

Decided to dive a bit into specific trading activity, starting with the top 20 options by volume. The table below shows the most active IBIT options on the first day of trading.

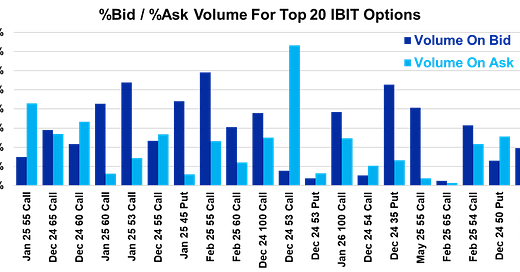

Only one of the top ten options by volume was a Put and four of the top twenty. This is not surprising since the call side of the market dominated volume. After compiling the list of most active IBIT options, we pulled volume data broken down by bid, midpoint, and ask. Typically, volume on the bid side indicates public customers selling options and volume on the ask is public customers buying. The chart below shows the percentage of total volume for each option that was traded on the bid and ask. The numbers do not add up to 100% for each contract as a good portion of the volume occurs between the bid and ask prices.

The best method of interpreting this chart is when the dark blue line is longer than the light blue that indicates more selling than buying. The Dec 24 53 Call stands out as over 70% of volume traded on the ask. Only a couple of other call options, the Jan 25 55 Call and Dec 24 60 Call had significantly more contracts trade on the ask than the bid.

Several call options had stronger bid side volume than ask volume, so many that it does not make sense to list them all here. The point is, when we see big call volume that’s not necessarily bullish. Also, we are more focused on call volume but do note that two of the four put contracts had significant volume on the bid, which could be considered bullish.

Aren’t public customers selling at the bid?3rd graph typo:

‘Typically, volume on the ask side indicates public customers selling options and volume on the ask is public customers buying.’