Bullish And Interesting VIX 2 x 1 Spread From Last Week

Weekend Review For Week Of January 27, 2025 - January 31, 2025

Part of my weekly duties involve being on Vol Views, which is one of about a dozen weekly programs put out by Mark Longo through The Option Insider network (www.theoptioninsider.com). My regular segment covers interesting VIX option trades that use non-standard or weekly expirations. This past week, there was a trade I found using VIX calls expiring on February 26 that I found particularly interesting.

On Wednesday, with spot VIX at 15.20, a trader purchased 200 Feb 26th 16 calls at 1.80 and sold 100 Feb 26th 17 Calls for 1.50 each. The net result was a cost of 2.10 per 2 x 1 spread and the payout on February 26 VIX expiration appearing below.

The net result of this spread is the cost and maximum loss of 2.10 and breakeven of 17.10. Beyond 17.00 the trade profit increases in line with the level of VIX. The question that popped into my mind was why structure the trade like this instead of just purchasing the 16 calls. The diagram below shows the payoff for buying one VIX Feb 26th 16 Call at 1.80, the price paid in the spread above.

Buying a call is cheaper than the ratio spread, but the breakeven is higher at 17.80. This is a logical reason behind using the ratio spread to be bullish on VIX as opposed to just purchasing the 16 calls. Another thought, and something I have done in the past, is if there is a move higher in volatility, exit the long part of the spread (sell the 2 16 calls) and possibly buy a farther out of the money call to combine with the short 17 call resulting in a bear call spread. This approach is common for VIX, due to the mean reverting nature of the volatility.

US equities started the week under pressure, tried to claw back some of those returns, coming close until the announcement of tariffs going live on February 1. That announcement provided quite a boost to volatility expectations with VIX jumping about 2 points as the news hit the tape.

As noted, VIX moved up on Friday and was higher on the week. Despite the Friday move being news driven, the term structure remains in contango. This may be a hint that higher VIX and lower stock prices are on the horizon.

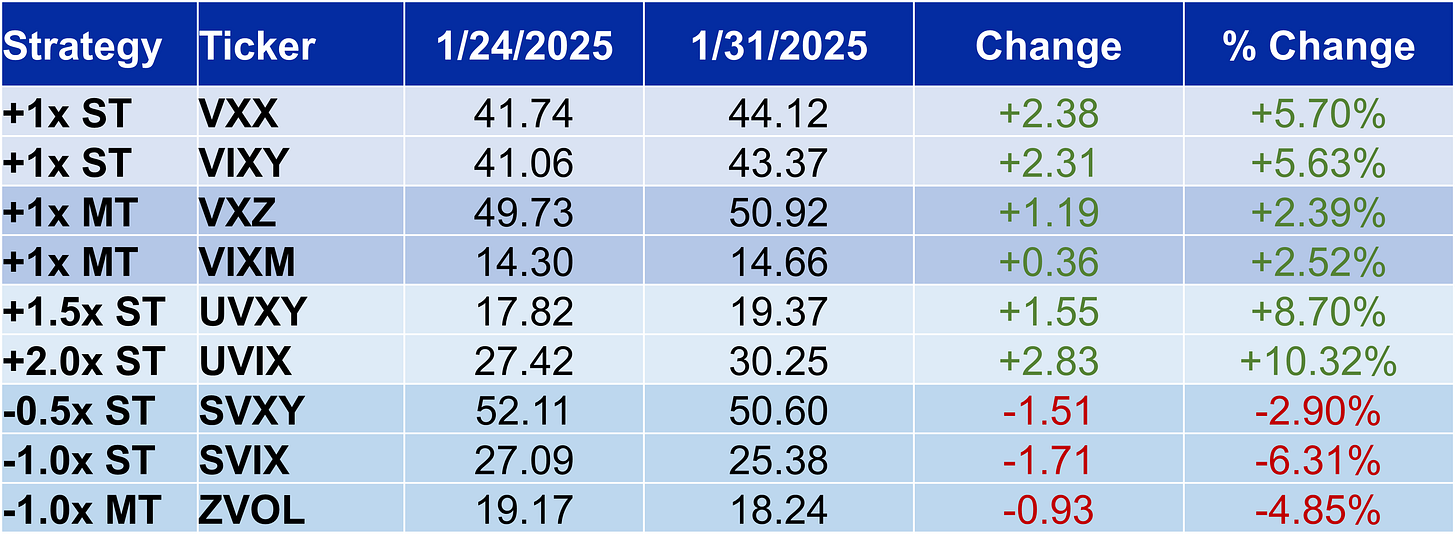

VIX ETPs behaved as expected with UVIX leading the way higher, up over 10%.

VSTOXX and VSTOXX futures were little changed last week. The difference between VIX and VSTOXX last week is that VSTOXX was closed when the tariff announcement hit. It will likely catch up with VIX when the markets open on Monday.

S&P 500 (SPX) option sellers had a tough start to the week with the market sell-off. Tuesday’s rebound did not do sellers any favors, but the balance of the week was tame enough for straddle sellers to salvage some profits.

The Nasdaq-100 (NDX) followed SPX’s lead with a loss for the first two days and profits the last three days of the week for straddle sellers.

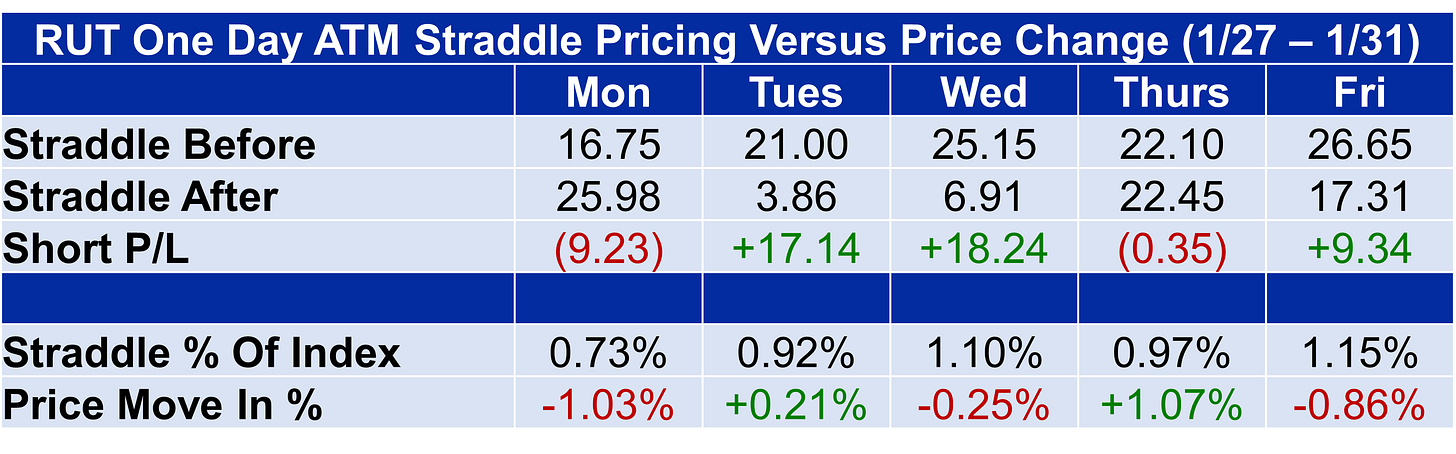

Russell 2000 (RUT) sellers did well on three days last week. The contrast with SPX and NDX is that RUT sellers would realize a net profit last week.

Euro Stoxx 50 straddle pricing resulted in a net gain of about 50 points for straddle sellers.

Finally, the best market for sellers was the final one discussed here with DAX straddles overpricing the subsequent move four of five days last week.

Mr. Rhoads, thank you for detailing the ratio call trade in this write up. I am curious about your second rationale for the viability of the trade (turning it into a BCS on spike). I am thinking that having just a long call (albeit with a higher B/E point than ration spread) would still be better than the ratio since one can roll up the long call and then sell a DITM call with a much higher IV and thus with more premium. What am I missing in that logic? Thank you sir.